- China

- /

- Auto Components

- /

- SHSE:605255

Ningbo TIP Rubber Technology Co.,Ltd (SHSE:605255) CEO Jianyi You's holdings dropped 15% in value as a result of the recent pullback

Key Insights

- Insiders appear to have a vested interest in Ningbo TIP Rubber TechnologyLtd's growth, as seen by their sizeable ownership

- 65% of the company is held by a single shareholder (Jianyi You)

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

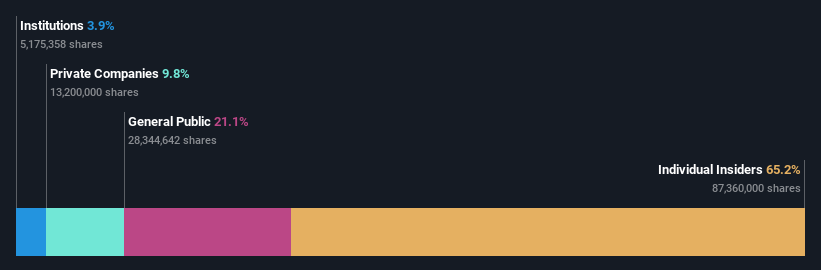

If you want to know who really controls Ningbo TIP Rubber Technology Co.,Ltd (SHSE:605255), then you'll have to look at the makeup of its share registry. We can see that individual insiders own the lion's share in the company with 65% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And last week, insiders endured the biggest losses as the stock fell by 15%.

Let's take a closer look to see what the different types of shareholders can tell us about Ningbo TIP Rubber TechnologyLtd.

View our latest analysis for Ningbo TIP Rubber TechnologyLtd

What Does The Institutional Ownership Tell Us About Ningbo TIP Rubber TechnologyLtd?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

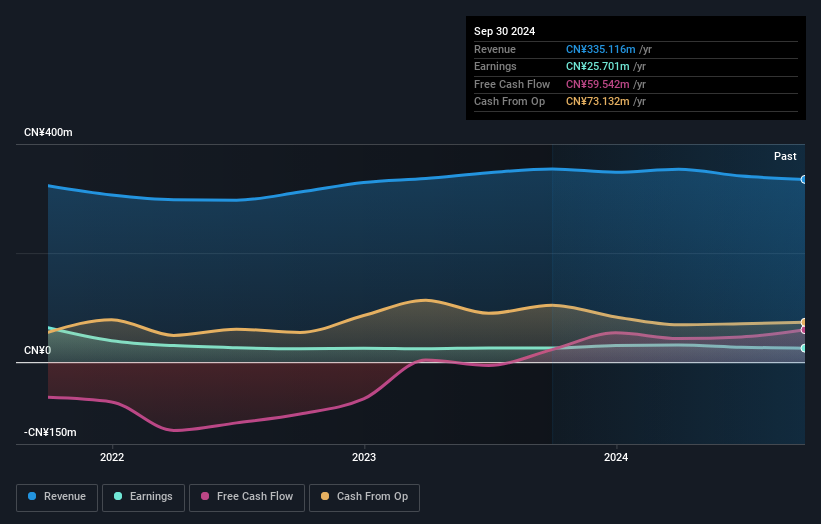

Since institutions own only a small portion of Ningbo TIP Rubber TechnologyLtd, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Hedge funds don't have many shares in Ningbo TIP Rubber TechnologyLtd. The company's CEO Jianyi You is the largest shareholder with 65% of shares outstanding. This essentially means that they have significant control over the outcome or future of the company, which is why insider ownership is usually looked upon favourably by prospective buyers. Meanwhile, the second and third largest shareholders, hold 6.4% and 3.4%, of the shares outstanding, respectively.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Ningbo TIP Rubber TechnologyLtd

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own the majority of Ningbo TIP Rubber Technology Co.,Ltd. This means they can collectively make decisions for the company. That means they own CN¥1.1b worth of shares in the CN¥1.7b company. That's quite meaningful. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 21% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 9.8%, of the Ningbo TIP Rubber TechnologyLtd stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Ningbo TIP Rubber TechnologyLtd better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Ningbo TIP Rubber TechnologyLtd (including 1 which shouldn't be ignored) .

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo TIP Rubber TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605255

Ningbo TIP Rubber TechnologyLtd

Focuses on the research and development, production, and sale of automotive polymers fluid piping systems, and sealing system parts and assemblies.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives