- China

- /

- Auto Components

- /

- SHSE:603786

Shareholders in KEBODA TECHNOLOGY (SHSE:603786) are in the red if they invested three years ago

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term KEBODA TECHNOLOGY Co., Ltd. (SHSE:603786) shareholders, since the share price is down 22% in the last three years, falling well short of the market decline of around 10%.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for KEBODA TECHNOLOGY

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, KEBODA TECHNOLOGY actually managed to grow EPS by 18% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

With a rather small yield of just 1.0% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 26% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching KEBODA TECHNOLOGY more closely, as sometimes stocks fall unfairly. This could present an opportunity.

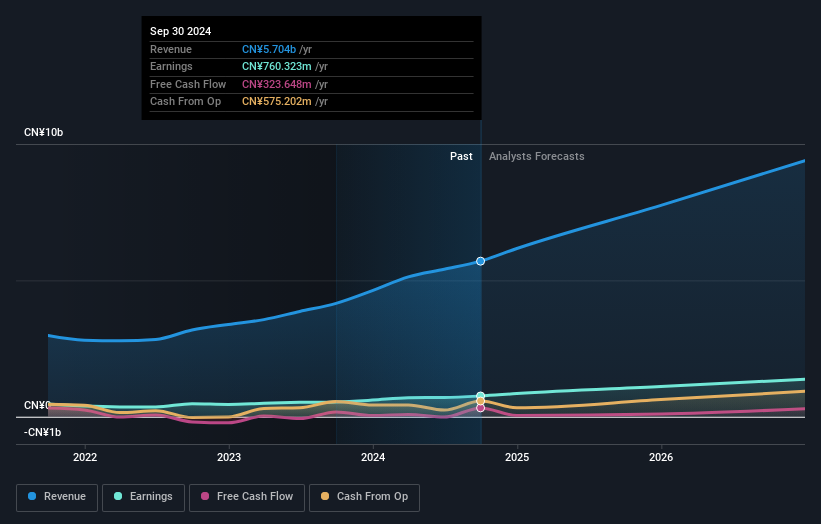

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

KEBODA TECHNOLOGY is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for KEBODA TECHNOLOGY in this interactive graph of future profit estimates.

A Different Perspective

KEBODA TECHNOLOGY provided a TSR of 15% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.8% endured over half a decade. It could well be that the business is stabilizing. Before forming an opinion on KEBODA TECHNOLOGY you might want to consider these 3 valuation metrics.

Of course KEBODA TECHNOLOGY may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KEBODA TECHNOLOGY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603786

KEBODA TECHNOLOGY

Engages in the manufacture and sale of automotive electronics and related products for automotive industry in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives