- China

- /

- Electronic Equipment and Components

- /

- SZSE:300790

January 2025's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

As global markets navigate a mixed start to 2025, with the S&P 500 and Nasdaq Composite reflecting strong annual gains despite recent economic challenges, investors are keenly observing the performance of growth companies. In this context, insider ownership can serve as a compelling indicator of confidence in a company's potential, aligning management's interests with those of shareholders and potentially enhancing long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Medley (TSE:4480) | 34% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

KEBODA TECHNOLOGY (SHSE:603786)

Simply Wall St Growth Rating: ★★★★★☆

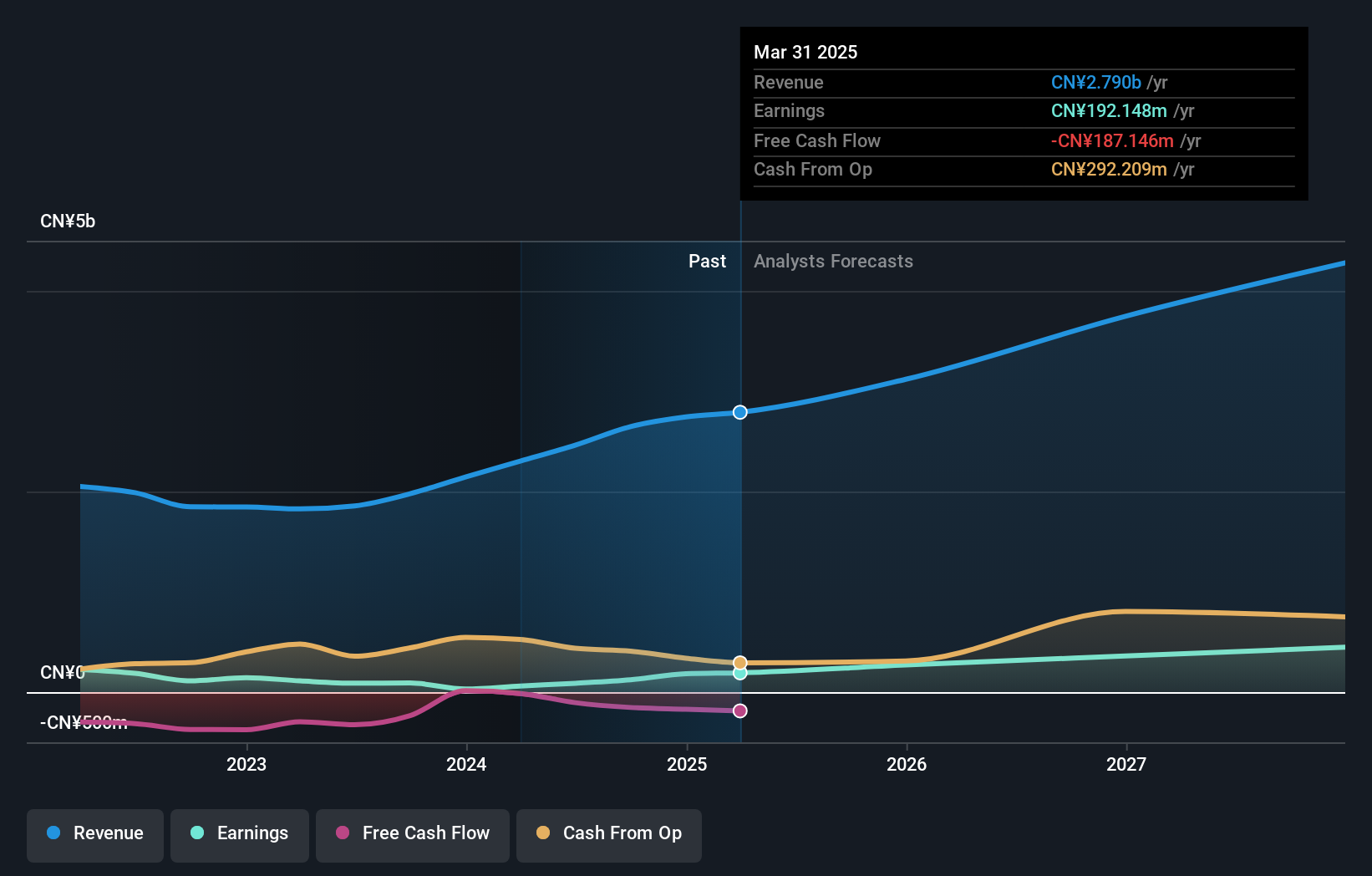

Overview: KEBODA TECHNOLOGY Co., Ltd. manufactures and sells automotive electronics and related products for the automotive industry in China, with a market cap of CN¥23.83 billion.

Operations: KEBODA TECHNOLOGY Co., Ltd.'s revenue is primarily derived from the production and distribution of automotive electronics and associated products within China's automotive sector.

Insider Ownership: 12.8%

Revenue Growth Forecast: 22.4% p.a.

KEBODA TECHNOLOGY demonstrates strong growth potential with expected annual earnings and revenue growth rates of 26.31% and 22.4%, respectively, both outpacing the Chinese market averages. The company reported significant sales and net income increases for the first nine months of 2024, reaching CNY 4.27 billion in sales and CNY 606.57 million in net income, reflecting robust operational performance. Despite a lower forecasted return on equity, analysts anticipate a stock price rise of over 30%.

- Navigate through the intricacies of KEBODA TECHNOLOGY with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report KEBODA TECHNOLOGY implies its share price may be too high.

DongGuan YuTong Optical TechnologyLtd (SZSE:300790)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DongGuan YuTong Optical Technology Co., Ltd. (ticker: SZSE:300790) specializes in the manufacturing and sale of optical components, with a market cap of CN¥6.77 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for DongGuan YuTong Optical Technology Co., Ltd.

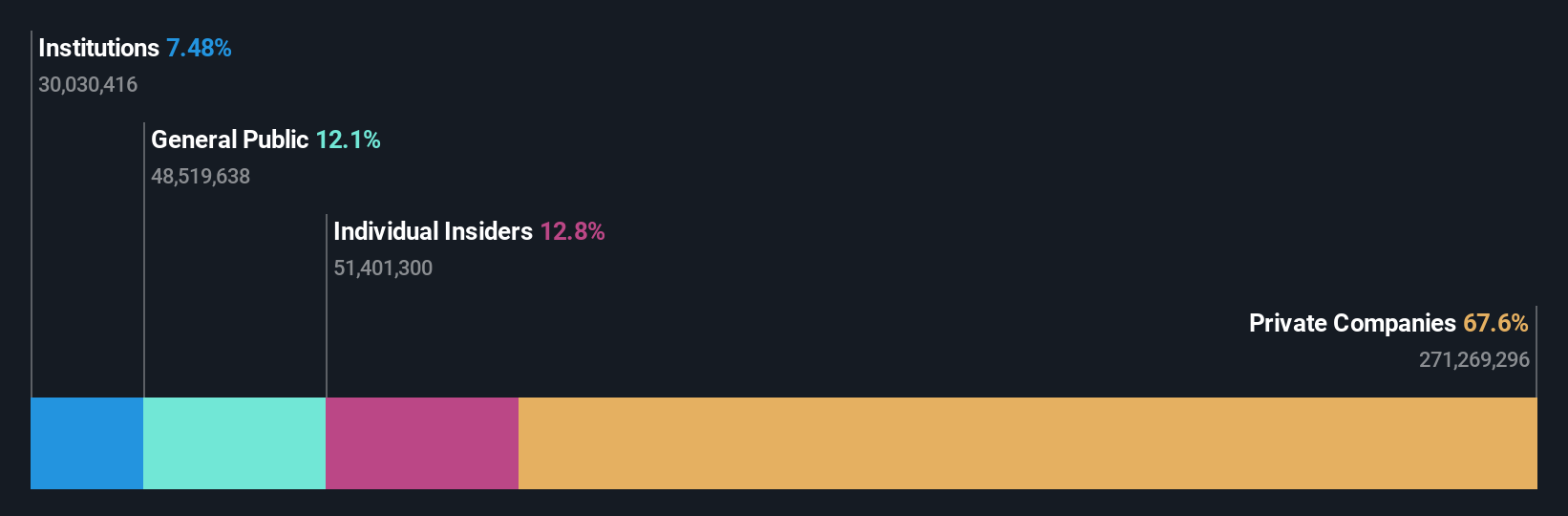

Insider Ownership: 33.4%

Revenue Growth Forecast: 14.4% p.a.

DongGuan YuTong Optical Technology is experiencing significant earnings growth, with forecasts predicting a 32.36% annual increase, outpacing the Chinese market's 25.2%. Despite recent shareholder dilution and low future return on equity projections, the company reported strong financial results for the first nine months of 2024. Sales reached CNY 1.99 billion, up from CNY 1.49 billion year-on-year, while net income increased to CNY 133.31 million from CNY 41.48 million.

- Delve into the full analysis future growth report here for a deeper understanding of DongGuan YuTong Optical TechnologyLtd.

- Our valuation report here indicates DongGuan YuTong Optical TechnologyLtd may be overvalued.

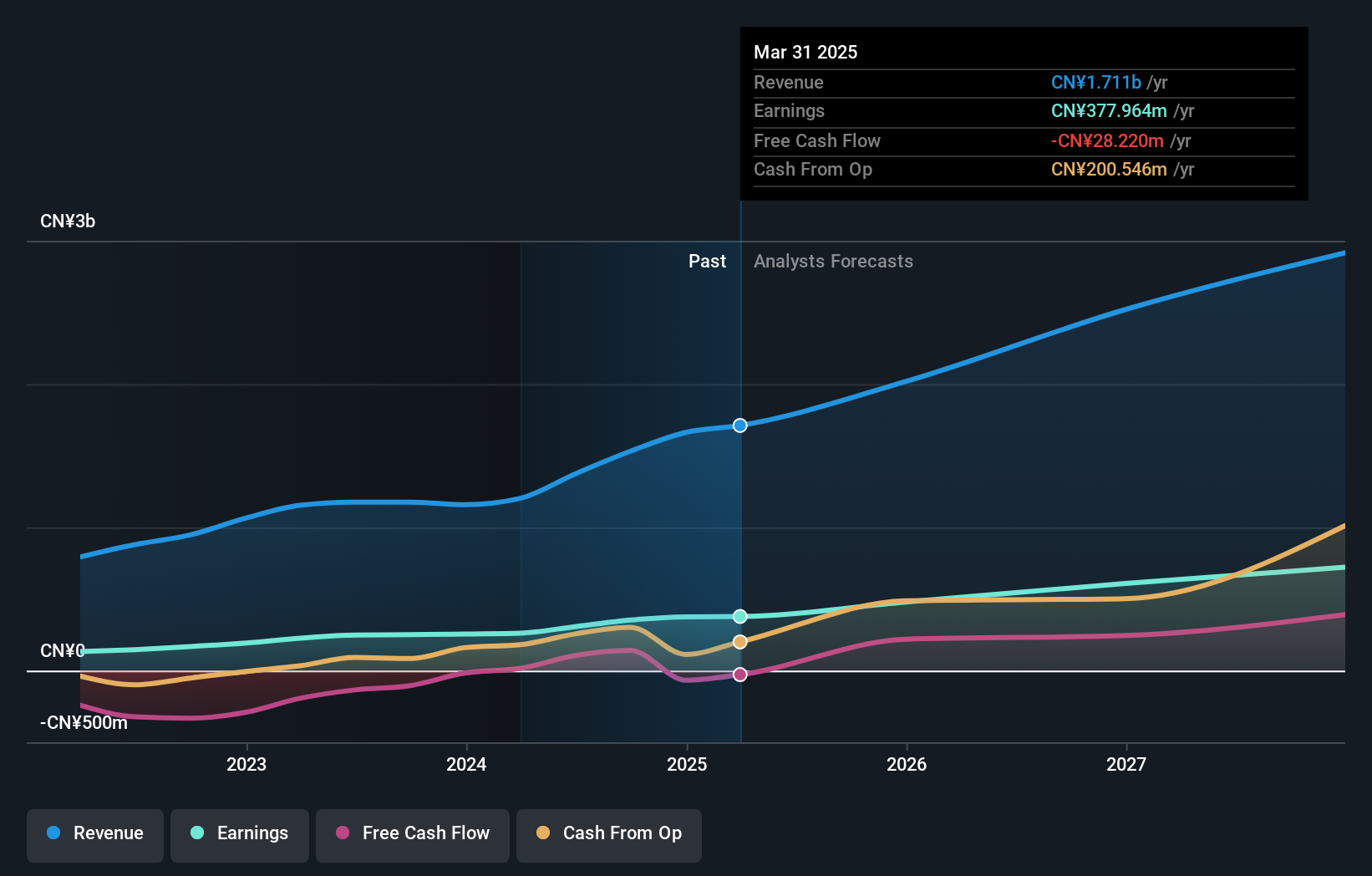

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. focuses on developing, producing, and selling alloy soft magnetic powder and related components for electronic equipment, with a market cap of CN¥14.76 billion.

Operations: The revenue segments for POCO Holding Co., Ltd. include the development, production, and sale of alloy soft magnetic powder and alloy soft magnetic core along with related inductance components for users in the electronic equipment sector.

Insider Ownership: 24.8%

Revenue Growth Forecast: 25.6% p.a.

POCO Holding has shown robust financial performance with a 41% earnings increase over the past year and reported sales of CNY 1.23 billion for the first nine months of 2024, up from CNY 854.13 million last year. Earnings are expected to grow significantly at 26.59% annually, surpassing both industry and market averages. Despite a lower future return on equity forecast at 19.7%, its price-to-earnings ratio remains competitive within the electronic sector.

- Take a closer look at POCO Holding's potential here in our earnings growth report.

- Our valuation report unveils the possibility POCO Holding's shares may be trading at a premium.

Summing It All Up

- Gain an insight into the universe of 1483 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300790

DongGuan YuTong Optical TechnologyLtd

DongGuan YuTong Optical Technology Co.,Ltd.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives