- China

- /

- Auto Components

- /

- SHSE:603655

Changzhou Langbo Sealing Technologies Co.,Ltd.'s (SHSE:603655) 39% Share Price Surge Not Quite Adding Up

Changzhou Langbo Sealing Technologies Co.,Ltd. (SHSE:603655) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

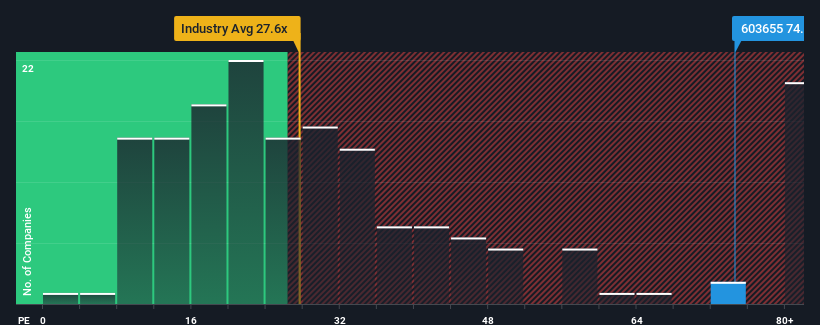

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may consider Changzhou Langbo Sealing TechnologiesLtd as a stock to avoid entirely with its 74.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Changzhou Langbo Sealing TechnologiesLtd has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Changzhou Langbo Sealing TechnologiesLtd

Is There Enough Growth For Changzhou Langbo Sealing TechnologiesLtd?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Changzhou Langbo Sealing TechnologiesLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 46% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 6.2% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's an unpleasant look.

In light of this, it's alarming that Changzhou Langbo Sealing TechnologiesLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Changzhou Langbo Sealing TechnologiesLtd's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Changzhou Langbo Sealing TechnologiesLtd currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Changzhou Langbo Sealing TechnologiesLtd that you should be aware of.

If these risks are making you reconsider your opinion on Changzhou Langbo Sealing TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603655

Changzhou Langbo Sealing TechnologiesLtd

Changzhou Langbo Sealing Technologies Co.,Ltd.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion