- China

- /

- Auto Components

- /

- SHSE:603596

Ningbo Sanxing Medical ElectricLtd And 2 More High Growth Companies Insiders Are Buying

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite finishing strong despite recent slumps, investors are keenly observing insider activities as a potential indicator of confidence in future growth. In this context, stocks with high insider ownership often draw attention for their potential alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Simply Wall St Growth Rating: ★★★★★☆

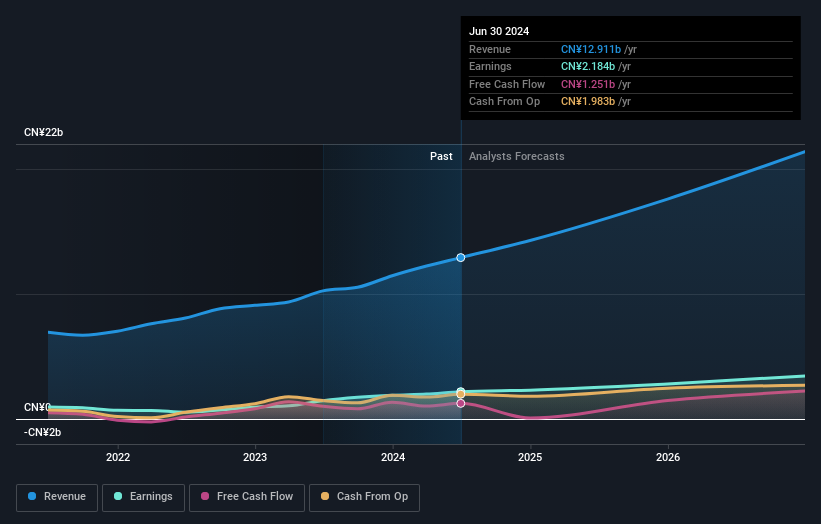

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥42.30 billion.

Operations: I'm sorry, but it appears that the revenue segment information is missing from the provided text. If you can provide the specific revenue segment data, I would be happy to help summarize it for you.

Insider Ownership: 23.8%

Earnings Growth Forecast: 21.3% p.a.

Ningbo Sanxing Medical Electric Ltd. demonstrates robust growth potential, with earnings and revenue projected to grow significantly at over 20% annually, outpacing the Chinese market in revenue growth. Despite trading at a substantial discount to estimated fair value, its dividend track record is unstable. Recent earnings reports show strong performance with sales reaching CNY 10.43 billion for the first nine months of 2024, reflecting solid year-over-year growth in both revenue and net income.

- Navigate through the intricacies of Ningbo Sanxing Medical ElectricLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Ningbo Sanxing Medical ElectricLtd's shares may be trading at a discount.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bethel Automotive Safety Systems Co., Ltd develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China with a market cap of CN¥26.12 billion.

Operations: The company's revenue is primarily derived from the manufacturing and selling of automobile and related accessories, amounting to CN¥8.95 billion.

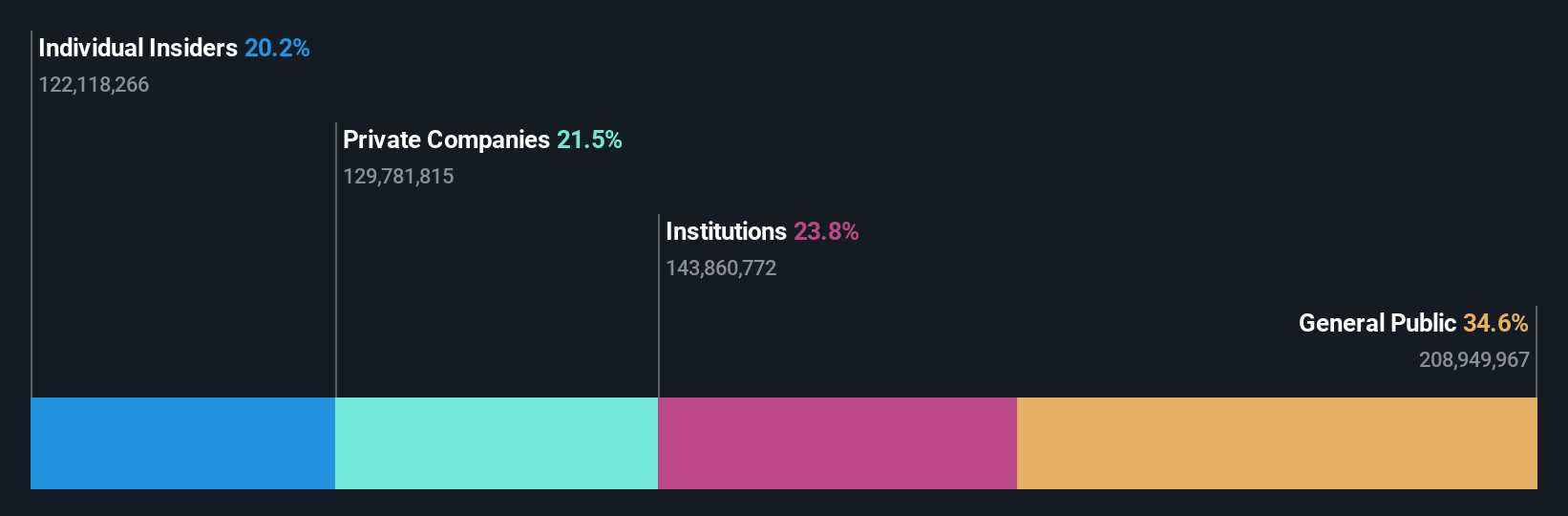

Insider Ownership: 20.1%

Earnings Growth Forecast: 25.3% p.a.

Bethel Automotive Safety Systems is poised for growth, with earnings forecasted to rise significantly at 25.3% annually, surpassing the Chinese market's average. The company trades at a substantial discount to its estimated fair value and has shown strong year-over-year revenue and net income growth in recent reports. However, it was recently removed from key indices like the SSE 180 Index. A completed share buyback indicates strategic financial management amidst these developments.

- Dive into the specifics of Bethel Automotive Safety Systems here with our thorough growth forecast report.

- The analysis detailed in our Bethel Automotive Safety Systems valuation report hints at an deflated share price compared to its estimated value.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★★☆

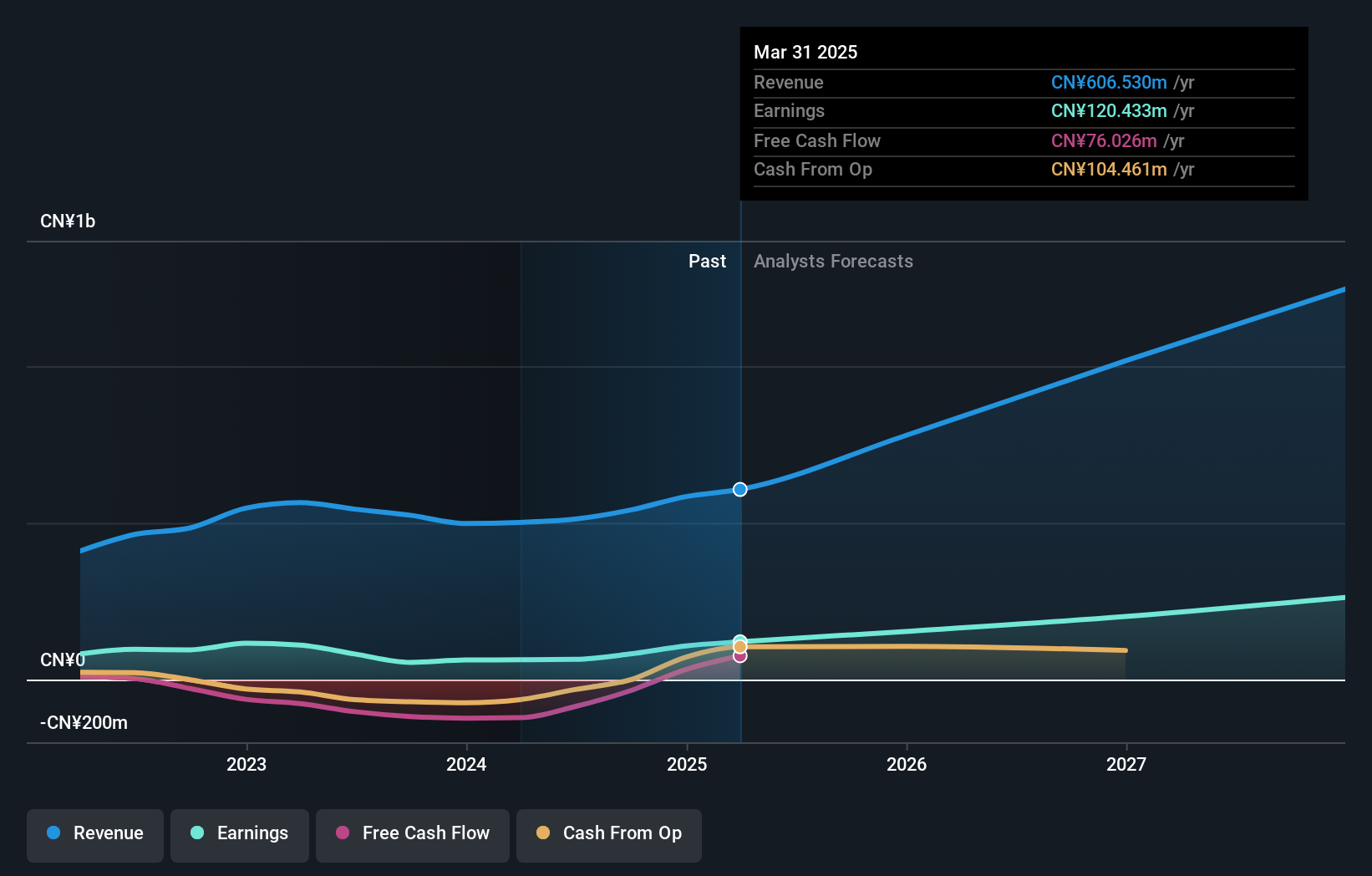

Overview: Anhui Ronds Science & Technology Incorporated Company offers machinery condition monitoring solutions for predictive maintenance in China, with a market cap of CN¥3.03 billion.

Operations: Anhui Ronds generates its revenue through providing machinery condition monitoring solutions within the predictive maintenance sector in China.

Insider Ownership: 27.6%

Earnings Growth Forecast: 30.8% p.a.

Anhui Ronds Science & Technology demonstrates promising growth potential, with earnings projected to increase significantly at 30.8% annually, outpacing the broader Chinese market. Recent financials reveal a turnaround from losses to a net income of CNY 2.72 million over nine months, supported by revenue growth of CNY 342.74 million. Despite past shareholder dilution, the company's private placement raised substantial capital, suggesting strategic positioning for continued expansion in its sector.

- Click here to discover the nuances of Anhui Ronds Science & Technology with our detailed analytical future growth report.

- Our valuation report here indicates Anhui Ronds Science & Technology may be overvalued.

Next Steps

- Click this link to deep-dive into the 1492 companies within our Fast Growing Companies With High Insider Ownership screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bethel Automotive Safety Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603596

Bethel Automotive Safety Systems

Develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China.

Flawless balance sheet with high growth potential.