- China

- /

- Semiconductors

- /

- SHSE:688591

Undiscovered Gems And 2 Other Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate mixed signals, with major indices like the S&P 500 closing out a strong year despite recent fluctuations and economic indicators such as the Chicago PMI showing contraction, investors are increasingly turning their attention to small-cap stocks for potential growth opportunities. In this environment of cautious optimism and selective profit-taking, identifying promising small-cap stocks can be a strategic move to enhance portfolio diversification and capitalize on under-the-radar opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Xiamen Leading Optics (SHSE:605118)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Leading Optics Co., Ltd. is a company that offers optical solutions globally, with a market cap of CN¥7.16 billion.

Operations: The company's primary revenue stream is derived from its optical manufacturing segment, which generated CN¥595.95 million.

Xiamen Leading Optics, a smaller player in the optics industry, showcases intriguing financial dynamics. Over the past year, its earnings grew by 13.1%, outpacing the electronic industry's 1.9% growth rate and indicating robust performance amid sector challenges. Despite a 2.9% annual decline in earnings over five years, recent figures reflect resilience with net income at CNY 115.72 million for nine months ending September 2024 compared to CNY 118.45 million previously. The company boasts a healthy debt profile with more cash than total debt and reduced its debt-to-equity ratio from 10.8% to 6.9%.

- Take a closer look at Xiamen Leading Optics' potential here in our health report.

Evaluate Xiamen Leading Optics' historical performance by accessing our past performance report.

Telink Semiconductor(Shanghai)Co.Ltd (SHSE:688591)

Simply Wall St Value Rating: ★★★★★☆

Overview: Telink Semiconductor(Shanghai)Co., Ltd. specializes in the research, development, design, and sales of low-power wireless IoT chips and has a market capitalization of CN¥7.07 billion.

Operations: Telink Semiconductor generates revenue primarily from its semiconductor segment, amounting to CN¥747.24 million.

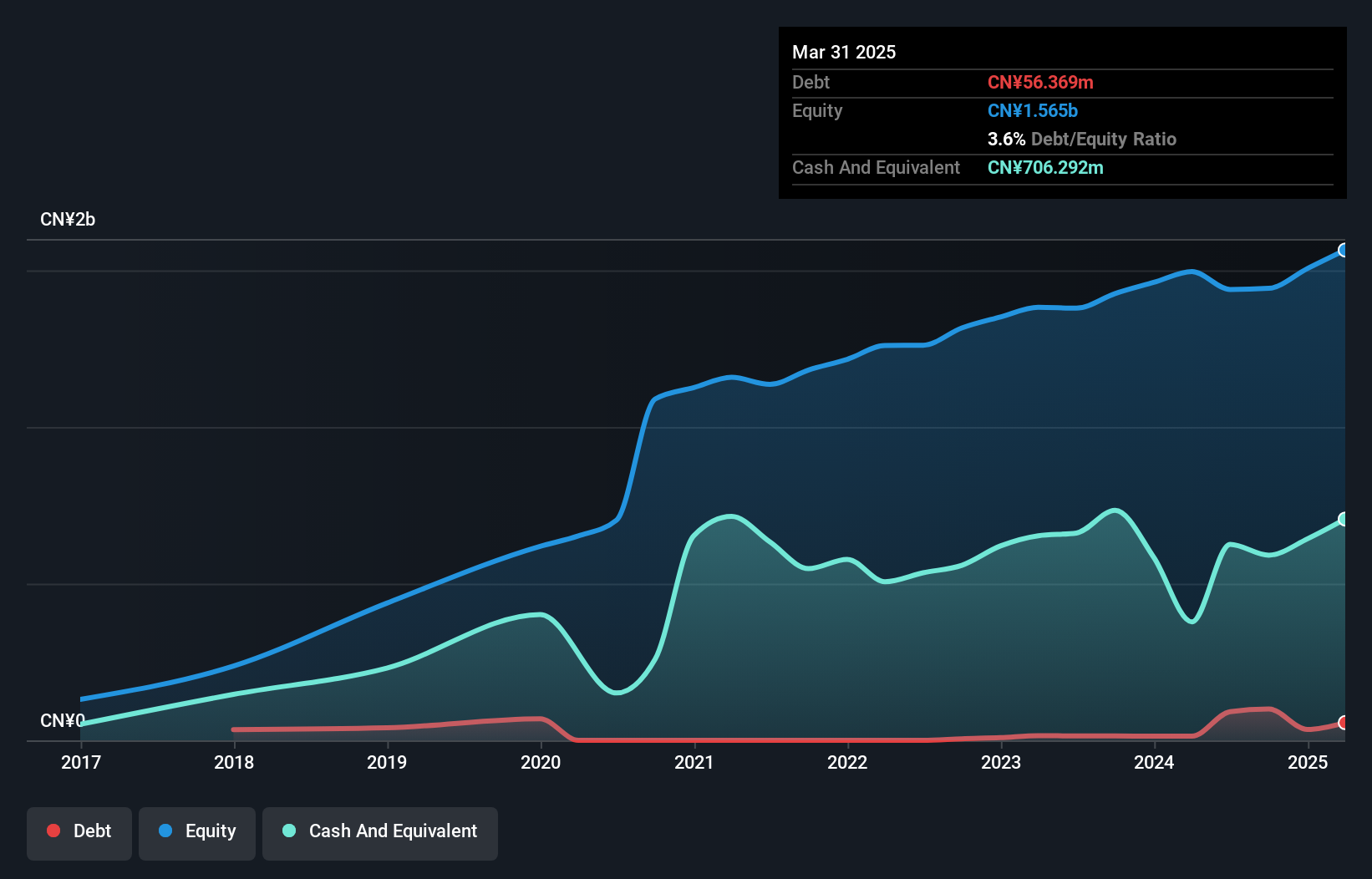

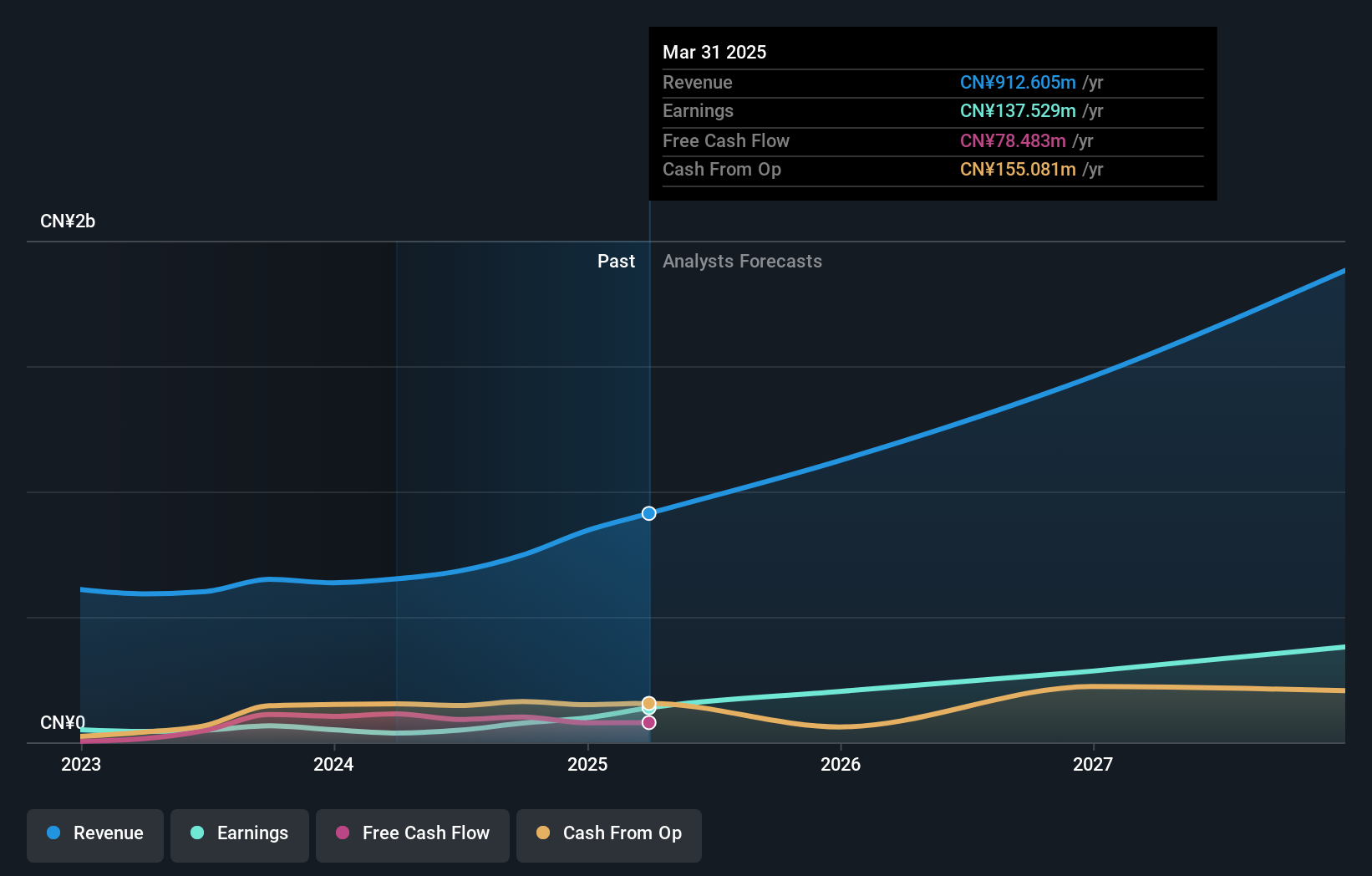

Telink Semiconductor, a nimble player in the semiconductor industry, has shown impressive growth with earnings rising 16.5% over the past year, outpacing the industry's 12.9%. The company reported sales of CN¥587 million for nine months ending September 2024, up from CN¥476 million previously. Net income also increased to CN¥64 million from CN¥38 million a year ago. Despite a significant one-off gain of CN¥24.9 million impacting results, Telink remains robust with more cash than debt and positive free cash flow. Recently, it repurchased over 4.2 million shares for approximately CN¥93 million as part of its buyback strategy initiated in early 2024.

Yuan Cheng CableLtd (SZSE:002692)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yuan Cheng Cable Co., Ltd. specializes in the design, research and development, production, and sales of wire and cable products in China with a market capitalization of CN¥2.77 billion.

Operations: Yuan Cheng Cable Co., Ltd. generates revenue primarily from its wire and cable segment, amounting to CN¥4.11 billion.

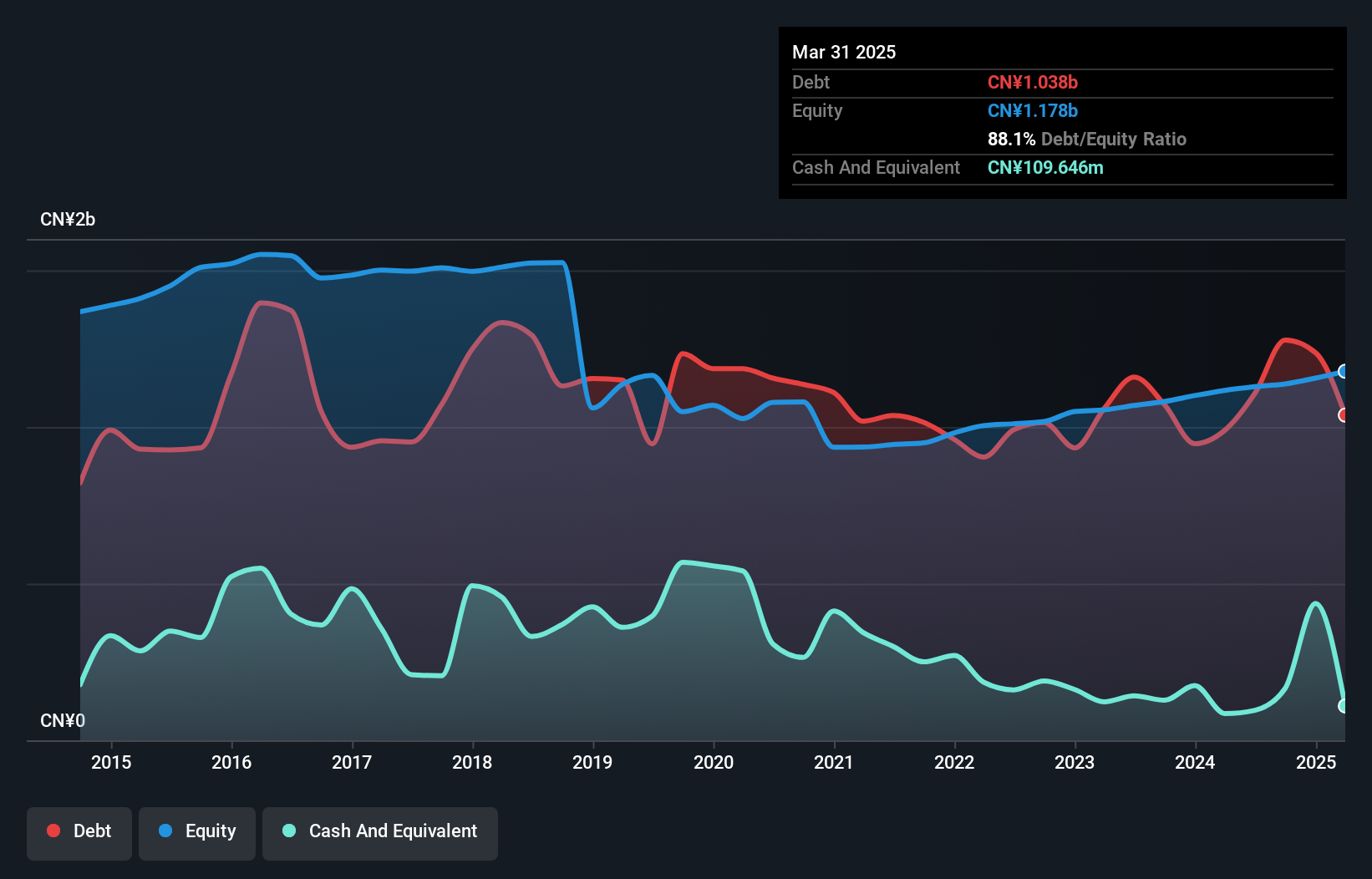

Yuan Cheng Cable, a smaller player in the electrical industry, recently showcased impressive earnings growth of 10.1%, outpacing the industry average of 1.1%. Despite a high net debt to equity ratio at 97.7%, their interest payments are well covered with an EBIT coverage of 4.4 times, indicating sound financial handling amidst challenges. Over the past year, revenue surged from CNY 2.27 billion to CNY 3.18 billion while net income climbed from CNY 32 million to CNY 51.38 million, reflecting strong operational performance and potential for further growth within its niche market segment.

- Delve into the full analysis health report here for a deeper understanding of Yuan Cheng CableLtd.

Explore historical data to track Yuan Cheng CableLtd's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 4669 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telink Semiconductor(Shanghai)Co.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688591

Telink Semiconductor(Shanghai)Co.Ltd

Engages in research, development, design, and sales of low-power wireless IoT chips.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives