- China

- /

- Electrical

- /

- SZSE:003021

Insiders Favor Darbond Technology Among 2 Other Leading Growth Stocks

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors continue to seek opportunities in growth stocks with strong insider ownership, a factor often seen as a sign of confidence in the company's future prospects. In this context, companies like Darbond Technology stand out as they align with current market trends by demonstrating resilience and potential for long-term growth amidst fluctuating indices and economic indicators.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Darbond Technology (SHSE:688035)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Darbond Technology Co., Ltd focuses on the research, development, production, and sale of polymer engineering and interface materials in China, with a market cap of CN¥4.81 billion.

Operations: Darbond Technology Co., Ltd generates its revenue from the research, development, production, and sale of polymer engineering and interface materials in China.

Insider Ownership: 29.6%

Darbond Technology shows promising growth potential with earnings forecasted to increase by 38.1% annually, outpacing the Chinese market's average. However, recent financials reveal a decline in net income and profit margins compared to last year. The company completed a share buyback plan worth CNY 54.06 million, indicating confidence in its prospects despite volatile share prices. Revenue is expected to grow at 16.9% annually, slower than the desired high growth threshold of 20%.

- Navigate through the intricacies of Darbond Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Darbond Technology implies its share price may be too high.

Shenzhen VMAX New Energy (SHSE:688612)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen VMAX New Energy Co., Ltd. focuses on the research, development, production, and sale of power electronics and power transmission products both in China and internationally, with a market cap of CN¥9.37 billion.

Operations: The company's revenue is primarily derived from its electric equipment segment, which generated CN¥6.29 billion.

Insider Ownership: 38.4%

Shenzhen VMAX New Energy's earnings are forecast to grow significantly at 25.34% annually, surpassing the Chinese market average. Despite a modest net income increase recently, the company trades at a favorable price-to-earnings ratio of 20.1x compared to its peers. Revenue growth is projected at 21.9% per year, supported by high insider ownership and strategic share repurchase plans worth up to CNY 100 million, reflecting management's confidence in future performance.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen VMAX New Energy.

- The analysis detailed in our Shenzhen VMAX New Energy valuation report hints at an deflated share price compared to its estimated value.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. operates in the machinery and electronics sector with a market cap of CN¥17.10 billion.

Operations: I'm sorry, but it seems that the revenue segment information for Shenzhen Zhaowei Machinery & Electronics Co., Ltd. is missing from the provided text. Please provide the specific details of the revenue segments so I can assist you with summarizing them accurately.

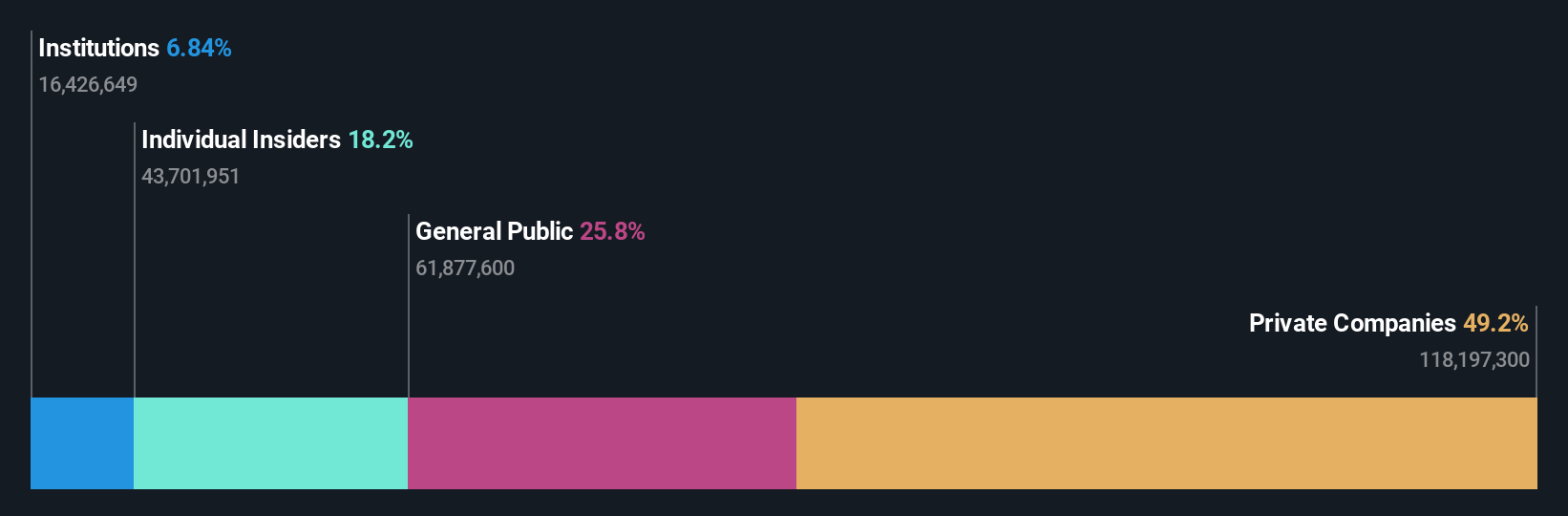

Insider Ownership: 18.2%

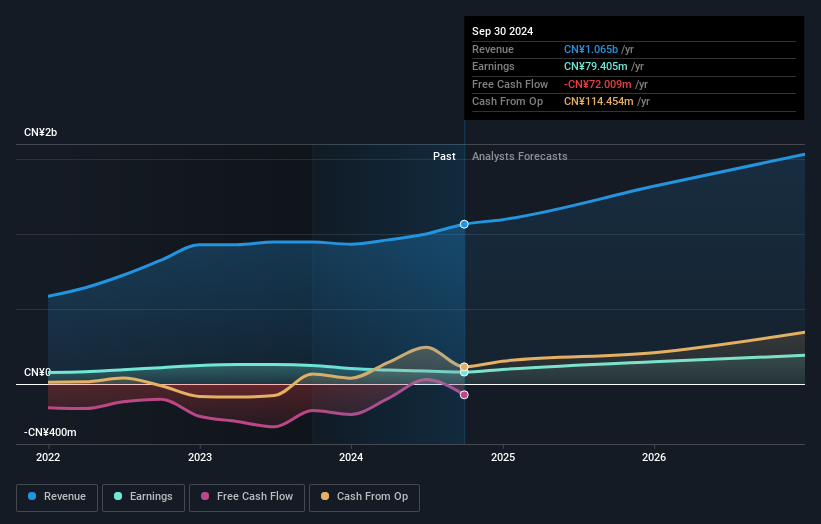

Shenzhen Zhaowei Machinery & Electronics is poised for significant growth, with earnings projected to increase by 25.01% annually. Revenue is expected to grow at 20.9% per year, outpacing the broader Chinese market, despite recent share price volatility. The company reported a revenue increase to CNY 1.06 billion for the first nine months of 2024, up from CNY 813.47 million in the previous year, reflecting its robust performance and high insider ownership's potential impact on strategic decisions.

- Dive into the specifics of Shenzhen Zhaowei Machinery & Electronics here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Shenzhen Zhaowei Machinery & Electronics' share price might be too optimistic.

Taking Advantage

- Dive into all 1492 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003021

Shenzhen Zhaowei Machinery & Electronics

Shenzhen Zhaowei Machinery & Electronics Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives