- China

- /

- Auto Components

- /

- SHSE:603596

Discover 3 Leading Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are keenly observing how these factors influence stock performance, particularly in the U.S., where large-cap and growth stocks have shown resilience. In this environment, companies with significant insider ownership often attract attention due to the potential alignment of interests between management and shareholders, which can be a compelling factor for those seeking stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. operates in the biotechnology sector, focusing on the development and manufacturing of diagnostic reagents and vaccines, with a market cap of CN¥92.92 billion.

Operations: The company's revenue is primarily derived from its biotechnology operations, specifically in the development and production of diagnostic reagents and vaccines.

Insider Ownership: 24.2%

Earnings Growth Forecast: 113.8% p.a.

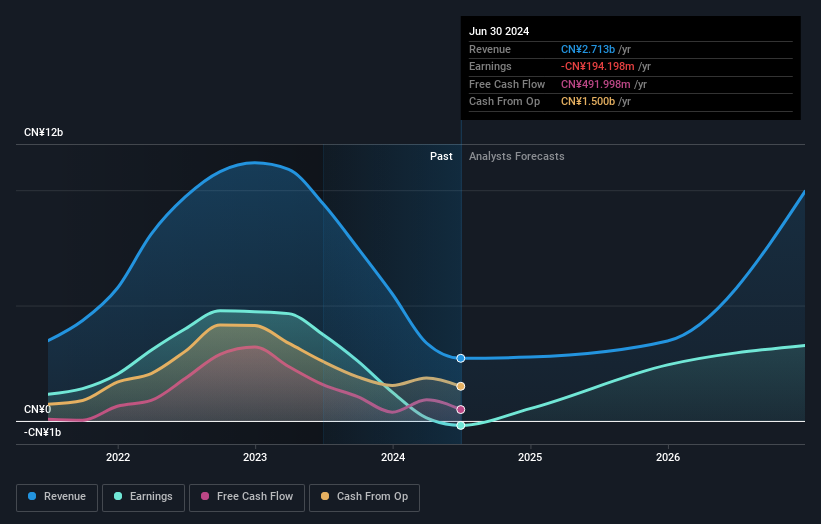

Beijing Wantai Biological Pharmacy Enterprise has seen a significant drop in revenue and net income for the first nine months of 2024, with sales at CNY 1.95 billion compared to CNY 4.97 billion a year ago. Despite this, the company is forecasted to achieve substantial annual profit growth over the next three years, outpacing market averages. Recent share buybacks worth CNY 200 million indicate confidence from within, though insider trading activity remains minimal over the past three months.

- Navigate through the intricacies of Beijing Wantai Biological Pharmacy Enterprise with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Beijing Wantai Biological Pharmacy Enterprise shares in the market.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bethel Automotive Safety Systems Co., Ltd develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China, with a market cap of CN¥30.15 billion.

Operations: The company generates revenue of CN¥8.35 billion from the manufacturing and selling of automobile and related accessories.

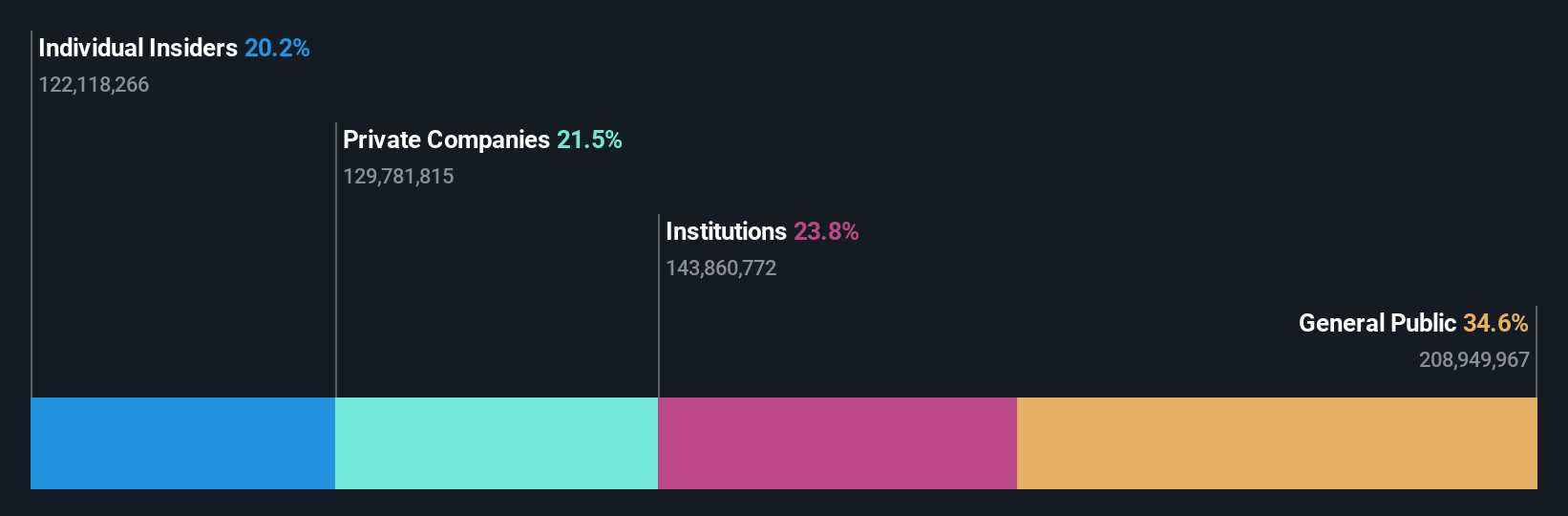

Insider Ownership: 20.1%

Earnings Growth Forecast: 25.3% p.a.

Bethel Automotive Safety Systems is poised for significant growth, with earnings expected to rise 25.3% annually over the next three years, surpassing market averages. Recent earnings reports show sales of CNY 6.58 billion and net income of CNY 778.03 million for the first nine months of 2024, reflecting strong year-over-year growth. Despite past shareholder dilution, the company trades well below its fair value estimate and has completed a share buyback program worth CNY 14.49 million, signaling internal confidence.

- Get an in-depth perspective on Bethel Automotive Safety Systems' performance by reading our analyst estimates report here.

- Our valuation report here indicates Bethel Automotive Safety Systems may be undervalued.

Southchip Semiconductor Technology(Shanghai) (SHSE:688484)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Southchip Semiconductor Technology(Shanghai) Co., Ltd. is a semiconductor design company specializing in power and battery management solutions in China, with a market cap of CN¥15.52 billion.

Operations: The company generates revenue of CN¥2.37 billion from its semiconductor segment, focusing on power and battery management solutions in China.

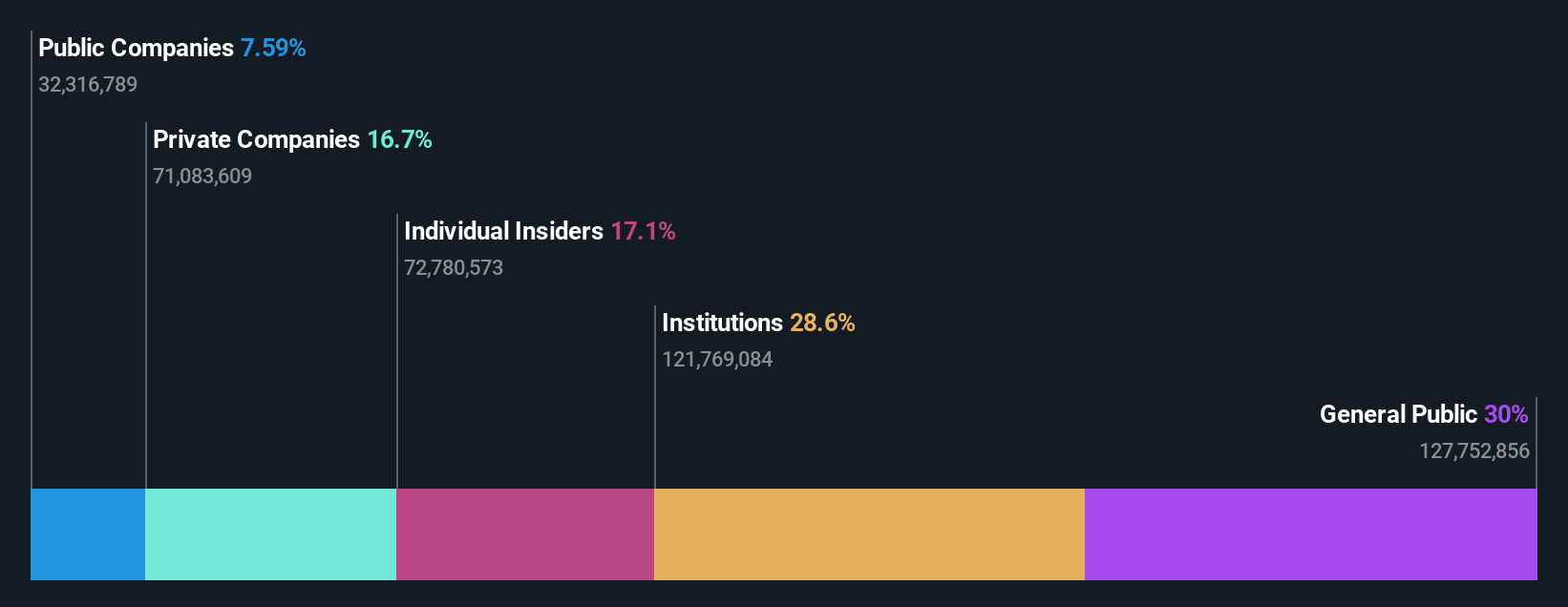

Insider Ownership: 17.1%

Earnings Growth Forecast: 24.2% p.a.

Southchip Semiconductor Technology is positioned for growth, with revenue expected to increase by 21.3% annually, outpacing the broader Chinese market. The company reported significant earnings growth of 153.7% over the past year and completed a share buyback worth CNY 50.01 million, reflecting internal confidence. Despite high volatility in its share price and a low forecasted return on equity of 12.8%, its P/E ratio remains attractive compared to industry averages.

- Take a closer look at Southchip Semiconductor Technology(Shanghai)'s potential here in our earnings growth report.

- Our expertly prepared valuation report Southchip Semiconductor Technology(Shanghai) implies its share price may be too high.

Key Takeaways

- Discover the full array of 1508 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bethel Automotive Safety Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603596

Bethel Automotive Safety Systems

Develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China.

Flawless balance sheet with high growth potential.