- China

- /

- Semiconductors

- /

- SHSE:688147

3 Asian Growth Companies With High Insider Ownership And 25% Revenue Growth

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and regulatory challenges, Asian markets are navigating a complex landscape where growth opportunities continue to emerge. In this environment, companies with robust insider ownership and strong revenue growth can offer unique insights into potential resilience and strategic alignment.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| NEXTIN (KOSDAQ:A348210) | 12.2% | 27% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 77% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Schooinc (TSE:264A) | 21.6% | 68.9% |

| BIWIN Storage Technology (SHSE:688525) | 18.9% | 57.6% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 131% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

We'll examine a selection from our screener results.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bethel Automotive Safety Systems Co., Ltd, with a market cap of CN¥38.06 billion, develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China.

Operations: The company's revenue primarily comes from the manufacturing and selling of automobile and related accessories, amounting to CN¥8.95 billion.

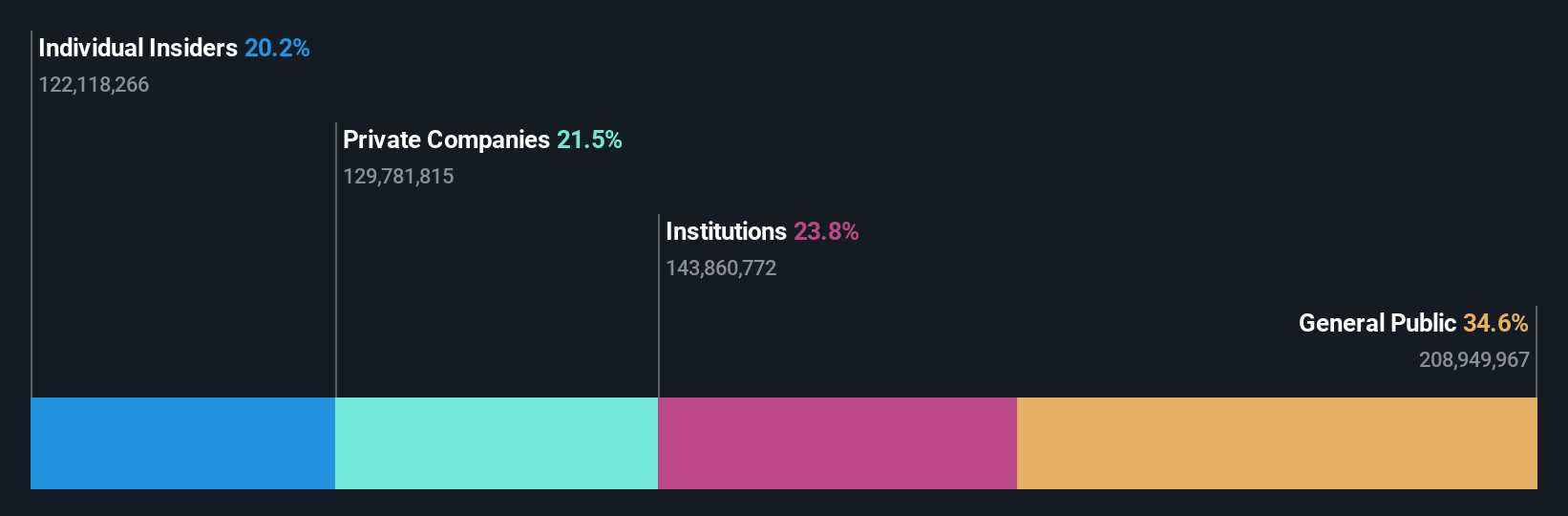

Insider Ownership: 20.1%

Revenue Growth Forecast: 23.4% p.a.

Bethel Automotive Safety Systems is trading at 56.5% below its estimated fair value, with earnings expected to grow significantly at 25.26% annually over the next three years. Revenue growth is forecasted to outpace the market at 23.4% per year, despite a lower projected return on equity of 19.4%. Recent activities include completing a share buyback worth CNY 78.1 million, although the company was recently removed from major indices like SSE 180 and Shanghai Stock Exchange Value Index.

- Get an in-depth perspective on Bethel Automotive Safety Systems' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Bethel Automotive Safety Systems implies its share price may be lower than expected.

Suzhou Novosense Microelectronics (SHSE:688052)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Novosense Microelectronics Co., Ltd. is a company that specializes in the design and production of semiconductor products, with a market cap of CN¥25.25 billion.

Operations: Revenue segments for Suzhou Novosense Microelectronics Co., Ltd. are not provided in the given text.

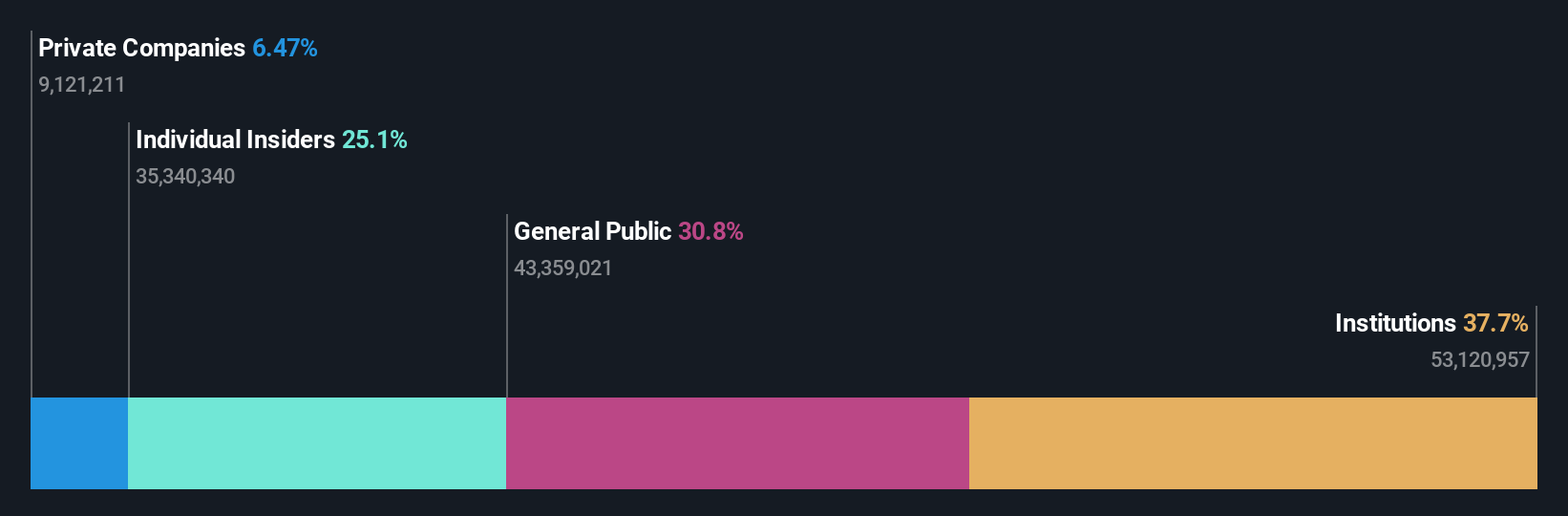

Insider Ownership: 25.1%

Revenue Growth Forecast: 25.9% p.a.

Suzhou Novosense Microelectronics is experiencing rapid revenue growth, with a 25.9% annual increase forecasted to surpass the Chinese market average. Despite this, it reported a net loss of CNY 402.95 million for 2024, up from CNY 305.33 million the previous year, and its return on equity is expected to remain low at 3.7%. The company is projected to achieve profitability within three years amidst high share price volatility and no significant recent insider trading activity.

- Navigate through the intricacies of Suzhou Novosense Microelectronics with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Suzhou Novosense Microelectronics is priced higher than what may be justified by its financials.

Jiangsu Leadmicro Nano-Equipment Technology (SHSE:688147)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Leadmicro Nano-Equipment Technology Ltd designs, manufactures, and services film deposition and etching equipment with a market cap of CN¥14.62 billion.

Operations: The company's revenue primarily comes from its Equipment Manufacturing segment, which generated CN¥2.70 billion.

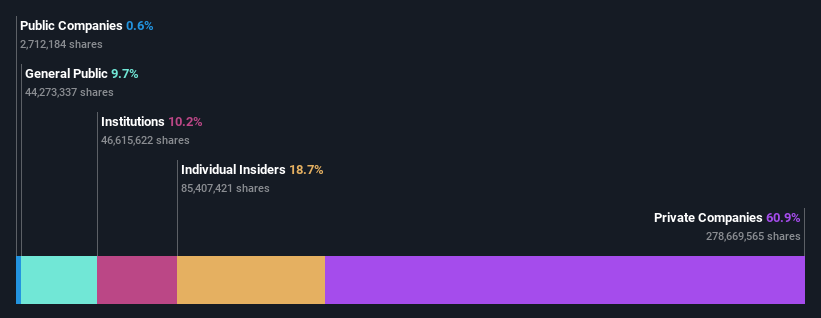

Insider Ownership: 18.7%

Revenue Growth Forecast: 21.7% p.a.

Jiangsu Leadmicro Nano-Equipment Technology has demonstrated robust revenue growth, with a 60.75% increase in 2024 to CNY 2.70 billion, although net income declined to CNY 214.38 million. Despite this dip in profit margins from 16.1% to 7.9%, earnings are expected to grow significantly at an annual rate of over 46%, outpacing the Chinese market average. The company's price-to-earnings ratio is competitive within the semiconductor industry, and no substantial insider trading activity has been reported recently.

- Click to explore a detailed breakdown of our findings in Jiangsu Leadmicro Nano-Equipment Technology's earnings growth report.

- Our expertly prepared valuation report Jiangsu Leadmicro Nano-Equipment Technology implies its share price may be too high.

Summing It All Up

- Dive into all 643 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Jiangsu Leadmicro Nano-Equipment Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688147

Jiangsu Leadmicro Nano-Equipment Technology

Designs, manufactures, and services film deposition and etching equipment.

High growth potential with adequate balance sheet.