- China

- /

- Auto Components

- /

- SHSE:603390

Guangzhou Tongda Auto Electric (SHSE:603390) sheds CN¥766m, company earnings and investor returns have been trending downwards for past five years

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Guangzhou Tongda Auto Electric Co., Ltd (SHSE:603390) share price dropped 53% over five years. That is extremely sub-optimal, to say the least. On top of that, the share price is down 20% in the last week.

Since Guangzhou Tongda Auto Electric has shed CN¥766m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Guangzhou Tongda Auto Electric

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Guangzhou Tongda Auto Electric became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

The modest 0.7% dividend yield is unlikely to be guiding the market view of the stock. It could be that the revenue decline of 6.9% per year is viewed as evidence that Guangzhou Tongda Auto Electric is shrinking. This has probably encouraged some shareholders to sell down the stock.

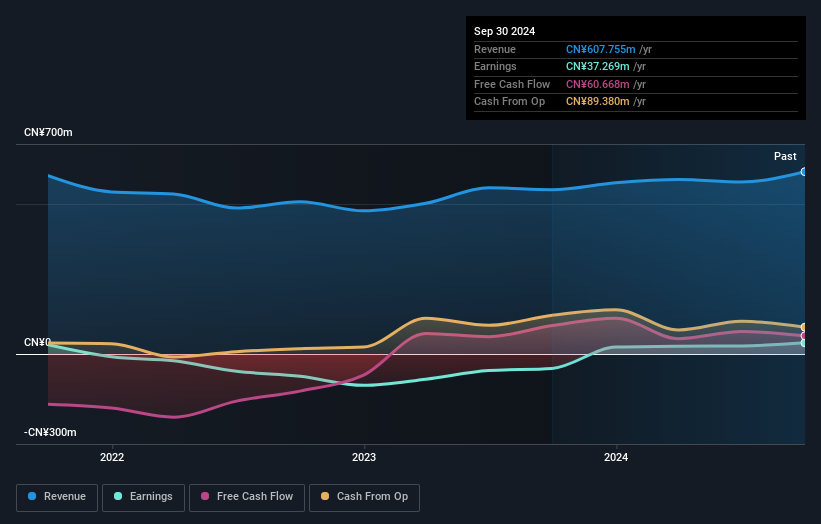

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Guangzhou Tongda Auto Electric's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 6.5% in the last year, Guangzhou Tongda Auto Electric shareholders lost 14% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Guangzhou Tongda Auto Electric better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Guangzhou Tongda Auto Electric (including 1 which is a bit unpleasant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603390

Guangzhou Tongda Auto Electric

Manufactures and supplies electrical products for bus and coach manufacturers in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives