- China

- /

- Auto Components

- /

- SHSE:603305

Here's Why Ningbo Xusheng Group (SHSE:603305) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Ningbo Xusheng Group Co., Ltd. (SHSE:603305) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ningbo Xusheng Group

What Is Ningbo Xusheng Group's Debt?

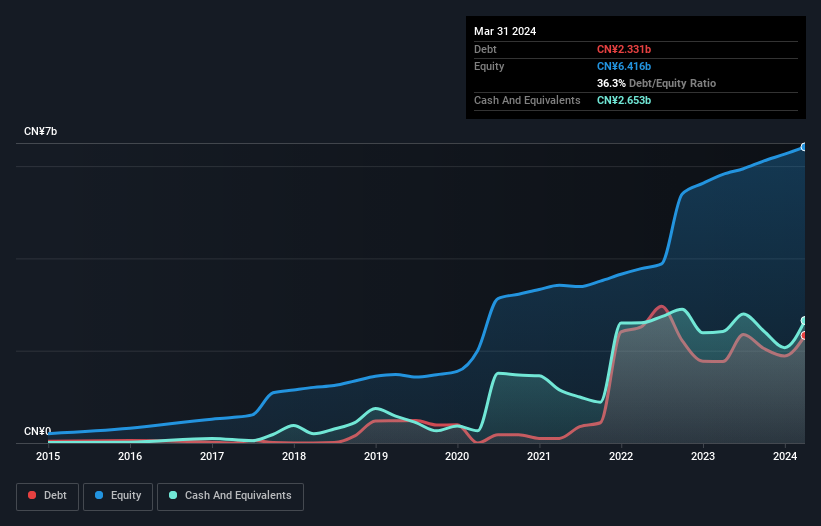

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Ningbo Xusheng Group had CN¥2.33b of debt, an increase on CN¥1.76b, over one year. But on the other hand it also has CN¥2.65b in cash, leading to a CN¥322.5m net cash position.

How Healthy Is Ningbo Xusheng Group's Balance Sheet?

We can see from the most recent balance sheet that Ningbo Xusheng Group had liabilities of CN¥2.94b falling due within a year, and liabilities of CN¥1.39b due beyond that. Offsetting this, it had CN¥2.65b in cash and CN¥1.32b in receivables that were due within 12 months. So it has liabilities totalling CN¥353.3m more than its cash and near-term receivables, combined.

Since publicly traded Ningbo Xusheng Group shares are worth a total of CN¥12.5b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Ningbo Xusheng Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

But the bad news is that Ningbo Xusheng Group has seen its EBIT plunge 17% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ningbo Xusheng Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Ningbo Xusheng Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Ningbo Xusheng Group saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

We could understand if investors are concerned about Ningbo Xusheng Group's liabilities, but we can be reassured by the fact it has has net cash of CN¥322.5m. So although we see some areas for improvement, we're not too worried about Ningbo Xusheng Group's balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Ningbo Xusheng Group that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Xusheng Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603305

Ningbo Xusheng Group

Engages in the research and development, production, and sales of precision aluminum alloy parts in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.