- China

- /

- Auto Components

- /

- SHSE:603239

Discovering Undiscovered Gems in January 2025

Reviewed by Simply Wall St

As 2025 begins, global markets are navigating a mixed landscape with the S&P 500 and Nasdaq Composite closing out strong years despite recent volatility, while economic indicators like the Chicago PMI highlight ongoing challenges for manufacturing. Amidst these dynamics, small-cap stocks present intriguing opportunities for investors seeking potential growth in an environment marked by cautious optimism and strategic adjustments in monetary policy. In this context, identifying undiscovered gems involves looking for companies that demonstrate resilience and adaptability to capitalize on shifting market conditions and emerging economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Zhejiang Xiantong Rubber&PlasticLtd (SHSE:603239)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Xiantong Rubber&Plastic Co., Ltd specializes in the research, development, design, production, and sale of automobile parts in China with a market capitalization of CN¥3.69 billion.

Operations: Xiantong Rubber&Plastic generates revenue primarily from the sale of automotive parts, amounting to CN¥1.17 billion. The company's financial performance can be analyzed through its net profit margin, which provides insight into its profitability relative to total revenue.

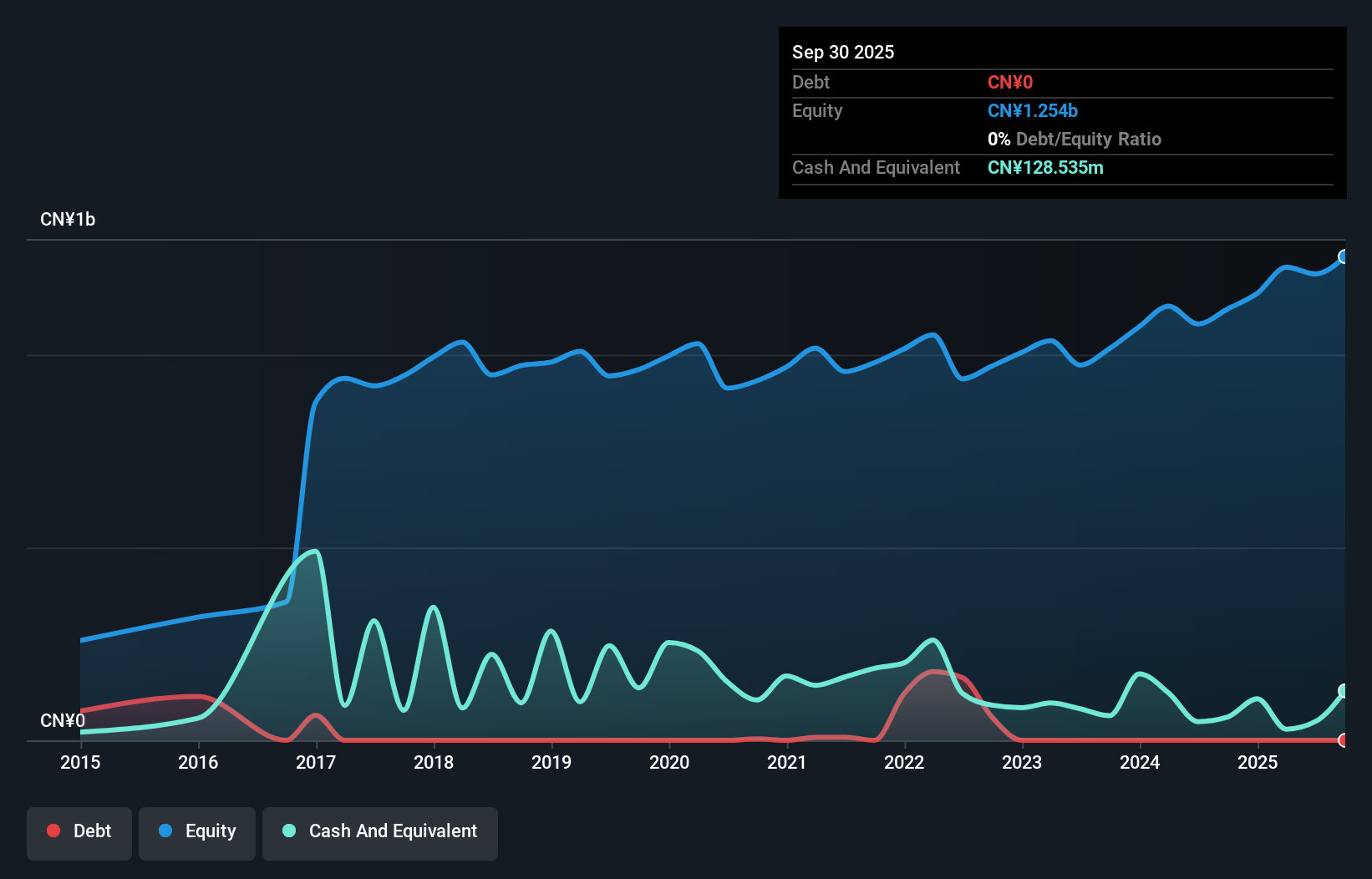

Zhejiang Xiantong, a dynamic player in the auto components sector, showcases impressive growth with earnings surging 38.7% over the past year, outpacing industry averages. The company is debt-free and offers good value with a price-to-earnings ratio of 20.1x compared to the CN market's 32.7x. Recent reports highlight robust performance for the first nine months of 2024, with sales reaching CNY 841 million from CNY 734 million last year and net income climbing to CNY 129 million from CNY 97 million previously. This financial health positions Zhejiang Xiantong well for future expansion opportunities in its industry space.

Taiwan FamilyMart (TPEX:5903)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taiwan FamilyMart Co., Ltd. operates and manages convenience stores in Taiwan and internationally, with a market cap of NT$41.74 billion.

Operations: FamilyMart generates revenue primarily from its Retail Segment, contributing NT$98.20 billion, and its Logistics Department with NT$56.53 billion.

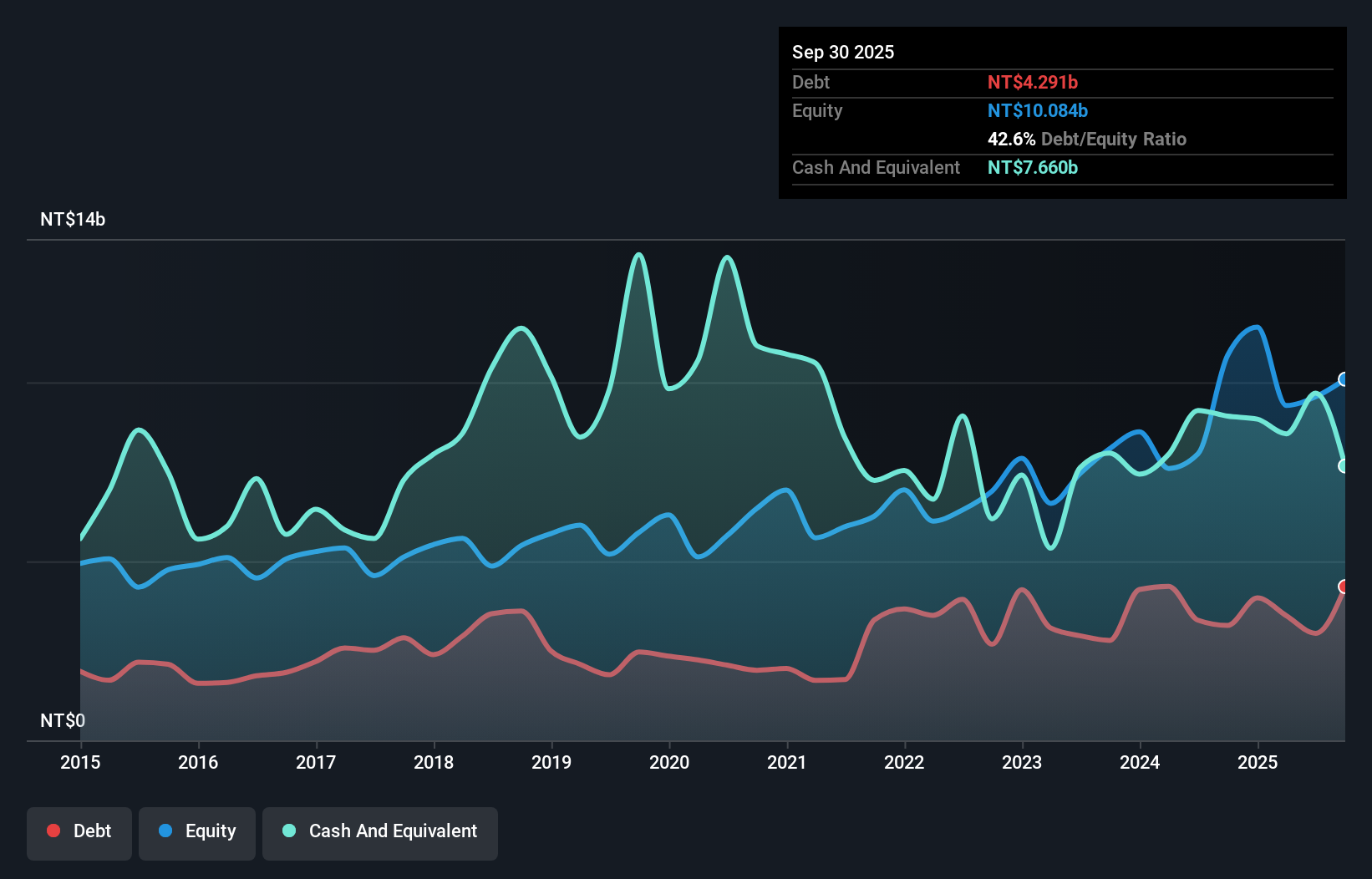

Taiwan FamilyMart is making waves with its recent financial performance. The company's earnings surged by 83.9% last year, outpacing the Consumer Retailing industry's 11.2% growth rate, and it trades at a value that's 41.7% below estimated fair value, suggesting potential upside for investors. Despite a significant one-off gain of NT$2.7 billion impacting results, net income for Q3 2024 jumped to TWD 2,649 million from TWD 527 million the previous year. Basic earnings per share rose dramatically to TWD 11.87 from TWD 2.36 in the same period last year, highlighting robust operational improvements despite forecasts of declining earnings in the coming years.

- Click to explore a detailed breakdown of our findings in Taiwan FamilyMart's health report.

Assess Taiwan FamilyMart's past performance with our detailed historical performance reports.

Base (TSE:4481)

Simply Wall St Value Rating: ★★★★★★

Overview: BASE CO., LTD. is a Japanese company involved in computer software development and related services with a market capitalization of ¥54.54 billion.

Operations: The company generates revenue primarily from its Contracted Software Development Business, which reported ¥19.65 billion.

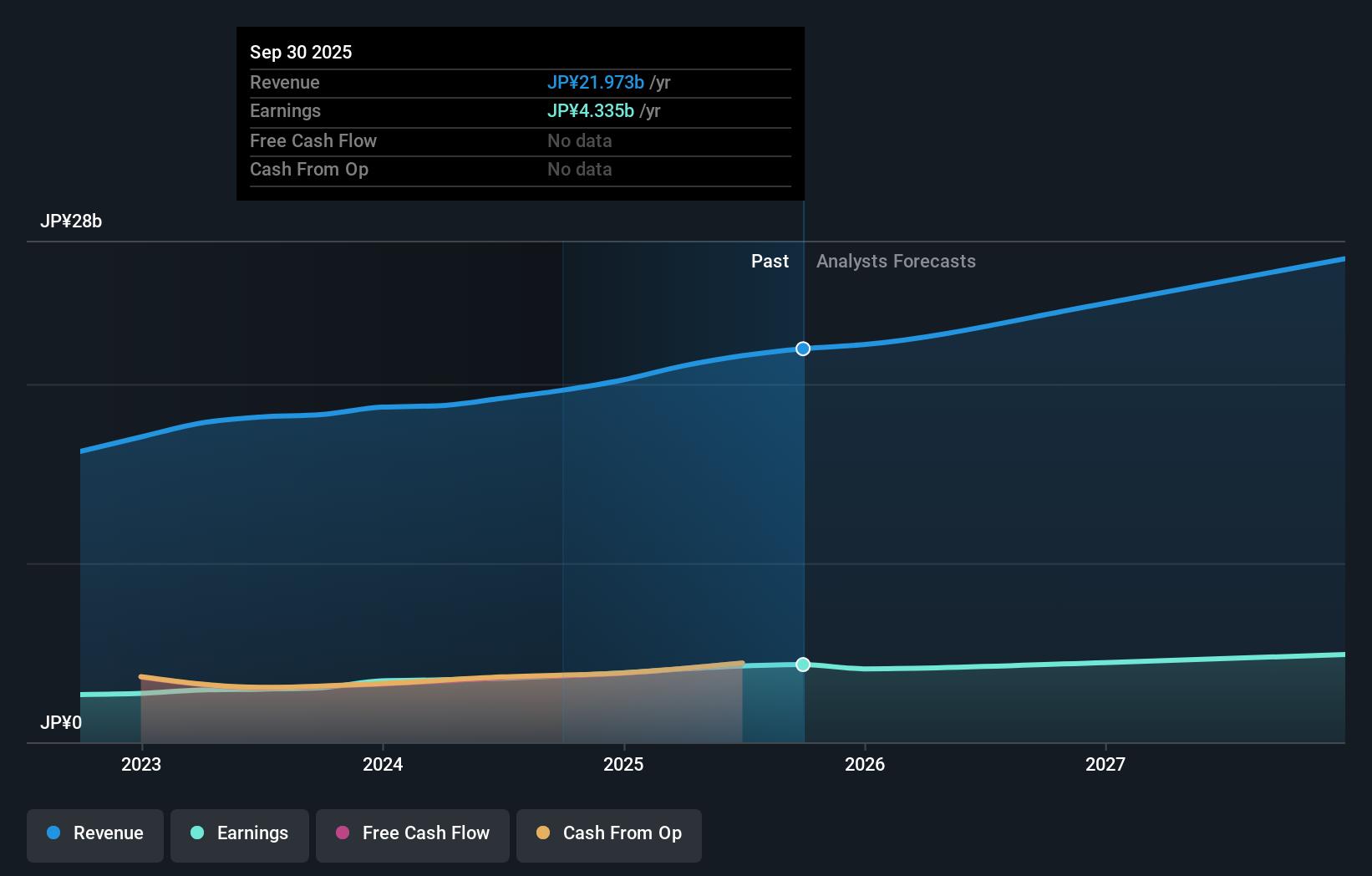

Base stands out with its impressive financial health and growth potential. Over the past year, earnings have surged by 22%, surpassing the IT industry's average of 10%. The company is entirely debt-free, a significant improvement from five years ago when the debt to equity ratio was 32.7%. Trading at nearly 55% below its estimated fair value, Base offers an attractive proposition for investors seeking undervalued opportunities. Recent share repurchases totaling ¥999 million further indicate confidence in its future prospects. With high-quality earnings and positive free cash flow, Base seems poised for continued growth in a competitive sector.

- Click here and access our complete health analysis report to understand the dynamics of Base.

Gain insights into Base's past trends and performance with our Past report.

Next Steps

- Click through to start exploring the rest of the 4664 Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Xiantong Rubber&PlasticLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603239

Zhejiang Xiantong Rubber&PlasticLtd

Engages in the research and development, design, production, and sale of automobile sealing strips and other automobile parts in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)