In a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience despite some downward pressures, with the S&P 500 Index experiencing only a slight decline. As investors navigate these turbulent waters, companies with strong insider ownership often stand out as promising opportunities because insiders' stakes can signal confidence in the company's long-term growth potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Brightstar Resources (ASX:BTR) | 10.1% | 86% |

Let's review some notable picks from our screened stocks.

Jiangsu Xinquan Automotive TrimLtd (SHSE:603179)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jiangsu Xinquan Automotive Trim Co., Ltd. designs, develops, manufactures, sells, and supplies auto parts in China with a market cap of CN¥25.33 billion.

Operations: The company generates revenue from its Auto Parts & Accessories segment, totaling CN¥12.86 billion.

Insider Ownership: 39.4%

Revenue Growth Forecast: 22.4% p.a.

Jiangsu Xinquan Automotive Trim Ltd. demonstrates strong growth potential with earnings expected to rise significantly by 28.09% annually, surpassing the CN market's forecast. Revenue growth is also projected at 22.4% per year, outpacing the market average of 13.5%. The company's Price-To-Earnings ratio of 27.2x suggests it is undervalued compared to the broader CN market at 36.3x, despite a low dividend coverage by free cash flows and high non-cash earnings levels.

- Click to explore a detailed breakdown of our findings in Jiangsu Xinquan Automotive TrimLtd's earnings growth report.

- In light of our recent valuation report, it seems possible that Jiangsu Xinquan Automotive TrimLtd is trading behind its estimated value.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥249.87 billion.

Operations: The company's revenue segments include core chips for cloud servers, edge computing, and terminal equipment in China.

Insider Ownership: 28.7%

Revenue Growth Forecast: 45.3% p.a.

Cambricon Technologies is poised for substantial growth, with revenue projected to expand by 45.3% annually, outpacing the broader CN market. The company is expected to achieve profitability within three years, though its Return on Equity forecast remains low at 5.5%. Despite recent share price volatility and no significant insider trading activity in the past three months, a successful private placement raised RMB 1.65 billion, indicating strong investor interest and financial backing.

- Take a closer look at Cambricon Technologies' potential here in our earnings growth report.

- Our valuation report unveils the possibility Cambricon Technologies' shares may be trading at a premium.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

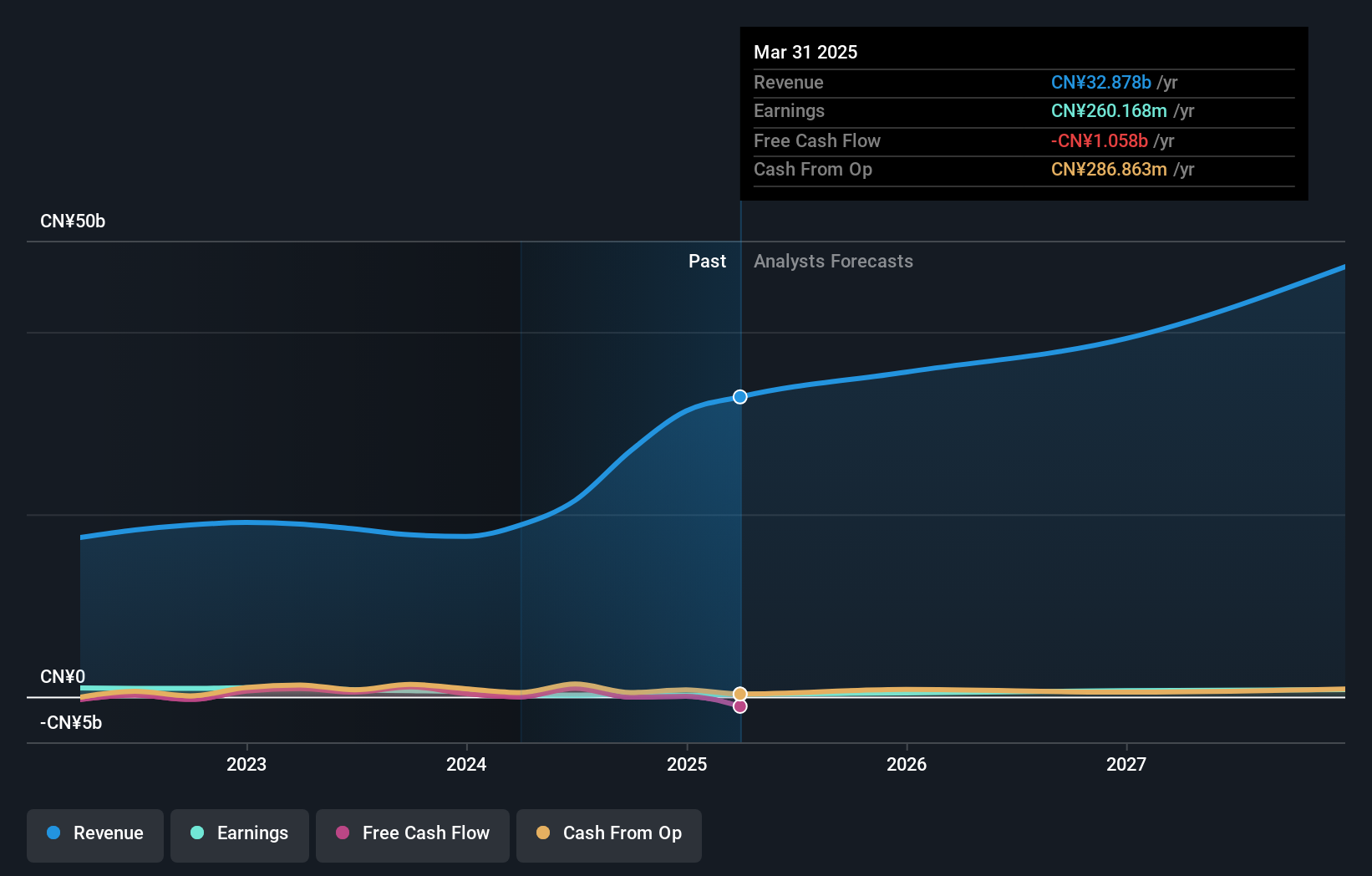

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a technology services provider, offering IT consulting and solutions, with a market cap of CN¥68.27 billion.

Operations: iSoftStone generates revenue through its IT consulting and solutions services.

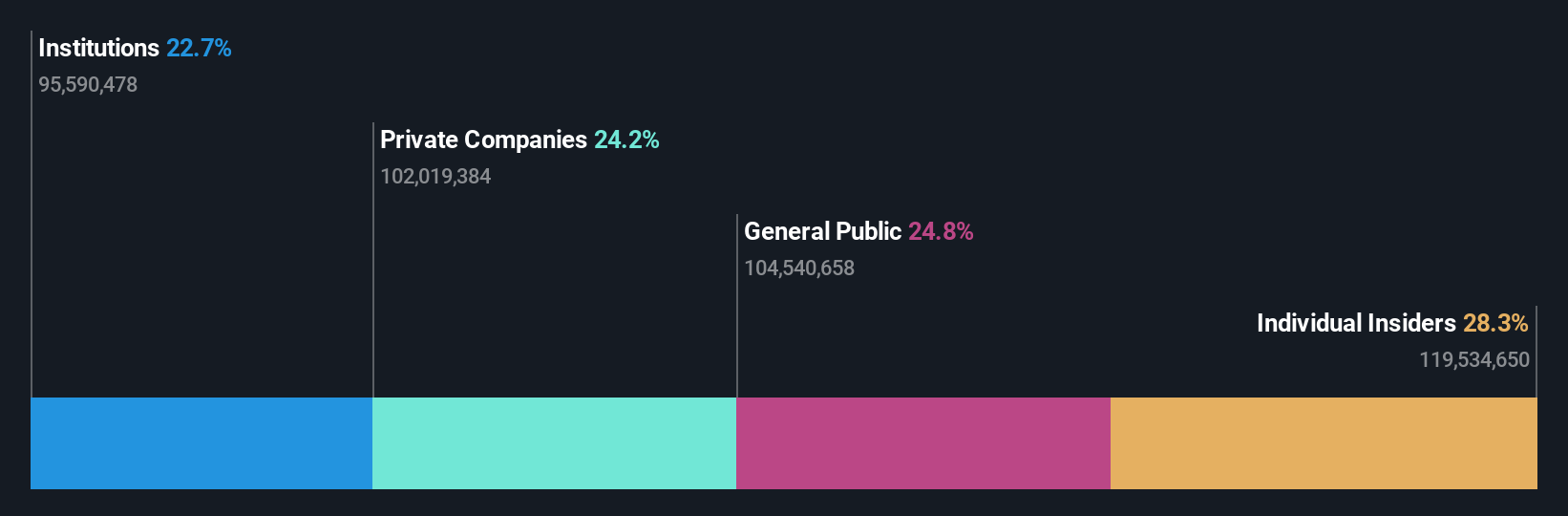

Insider Ownership: 23.8%

Revenue Growth Forecast: 16.9% p.a.

iSoftStone Information Technology (Group) is navigating a period of growth, with earnings anticipated to rise by 31.42% annually, surpassing the broader CN market's growth rate. Although revenue growth is slower than desired at 16.9% per year, it still exceeds the market average. Despite recent share price volatility and no significant insider trading activity, a forthcoming shareholders meeting aims to address credit guarantees and hedging strategies, potentially influencing future financial stability and strategic direction.

- Click here and access our complete growth analysis report to understand the dynamics of iSoftStone Information Technology (Group).

- Our valuation report here indicates iSoftStone Information Technology (Group) may be undervalued.

Taking Advantage

- Reveal the 1438 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if iSoftStone Information Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301236

iSoftStone Information Technology (Group)

iSoftStone Information Technology (Group) Co., Ltd.

Reasonable growth potential and fair value.

Market Insights

Community Narratives