As the Asian markets navigate a complex economic landscape, characterized by China's steady GDP growth and Japan's political uncertainties, investors are keenly observing how these factors influence small-cap stocks. With inflationary pressures easing in some regions and trade dynamics shifting, there is potential for certain under-the-radar companies to capitalize on these evolving conditions. Identifying promising stocks often involves looking for those with strong fundamentals that can effectively leverage current market trends and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 34.20% | 17.05% | 40.91% | ★★★★★★ |

| Ohashi Technica | NA | 5.69% | -10.83% | ★★★★★★ |

| AzureWave Technologies | NA | 0.15% | 17.60% | ★★★★★★ |

| Jih Lin Technology | 54.08% | 1.96% | 1.22% | ★★★★★★ |

| Miwon Chemicals | 0.12% | 10.40% | 16.52% | ★★★★★★ |

| Konishi | 0.15% | 0.46% | 12.50% | ★★★★★★ |

| Saison Technology | NA | 1.17% | -9.03% | ★★★★★★ |

| Triocean Industrial Corporation | 21.89% | 47.09% | 77.47% | ★★★★★★ |

| Kondotec | 13.45% | 7.00% | 9.12% | ★★★★★☆ |

| CHANGE HoldingsInc | 65.87% | 30.07% | 16.98% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

GUILIN FUDALtd (SHSE:603166)

Simply Wall St Value Rating: ★★★★★☆

Overview: GUILIN FUDA Co., Ltd. is engaged in the research, development, production, and sale of auto parts and components in China with a market capitalization of approximately CN¥11.52 billion.

Operations: The primary revenue stream for GUILIN FUDA Co., Ltd. comes from its Automobile and Internal Combustion Engine Parts segment, generating approximately CN¥1.80 billion.

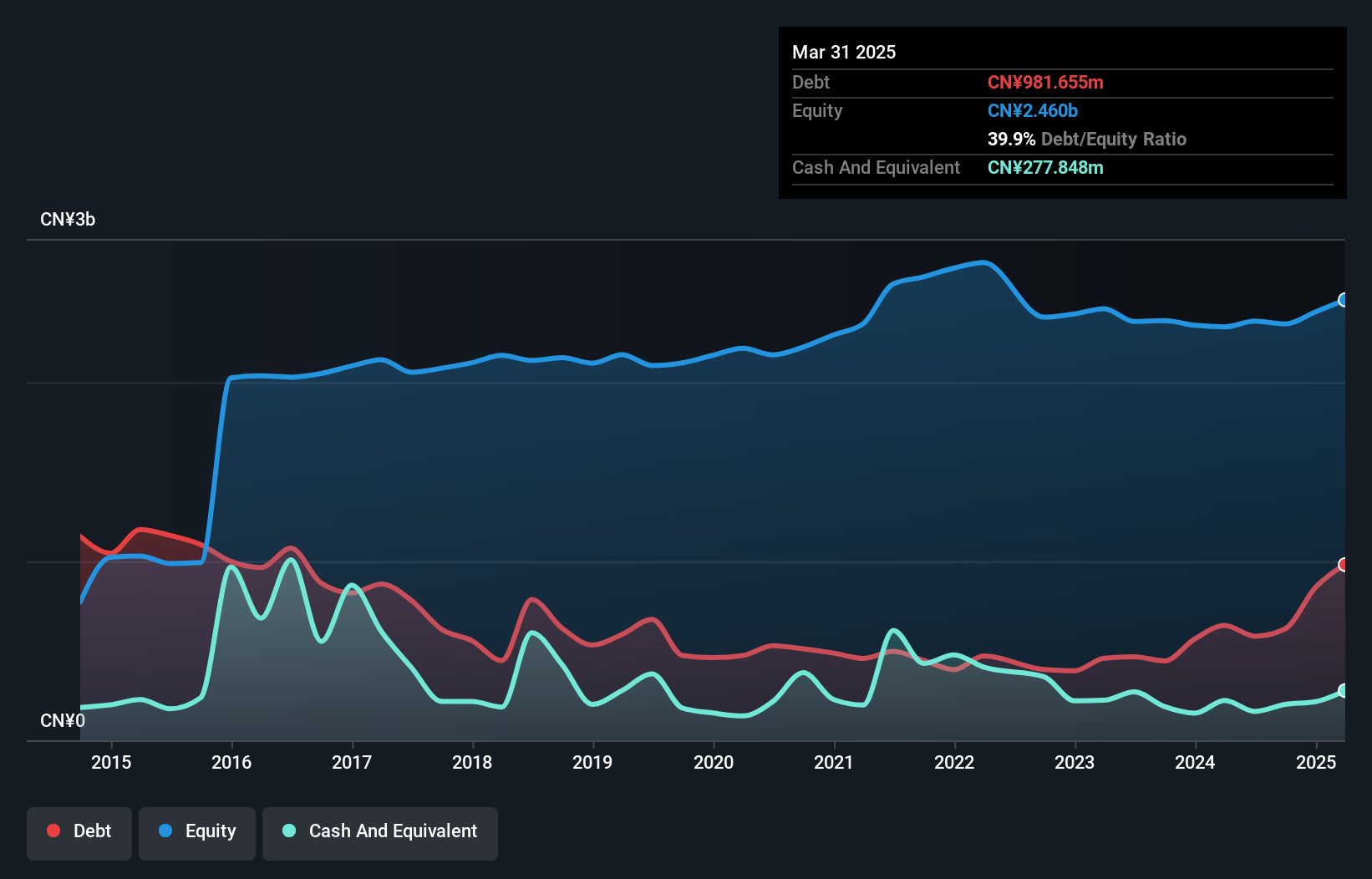

Guilin FUDA Ltd. has shown impressive earnings growth of 109% over the past year, outpacing the Auto Components industry's 4.7%. The company reported a net income of CNY 65.11 million for Q1 2025, up from CNY 31.6 million a year ago, highlighting its robust performance despite a volatile share price recently. Its debt to equity ratio rose from 21.7% to 39.9% over five years but remains satisfactory at a net level of 28.6%, with interest payments well covered by EBIT at a multiple of 15x, indicating strong financial health amidst its growth trajectory in revenue and earnings per share.

- Click here and access our complete health analysis report to understand the dynamics of GUILIN FUDALtd.

Evaluate GUILIN FUDALtd's historical performance by accessing our past performance report.

ChengDu ShengNuo BiotecLtd (SHSE:688117)

Simply Wall St Value Rating: ★★★★★☆

Overview: ChengDu ShengNuo Biotec Co., Ltd. focuses on the research, development, production, sale, and export of peptide drugs with a market capitalization of CN¥6.68 billion.

Operations: ShengNuo Biotec generates revenue primarily from the sale and export of peptide drugs. The company's financial performance is characterized by a focus on these core activities, with significant investment in research and development to support its product offerings.

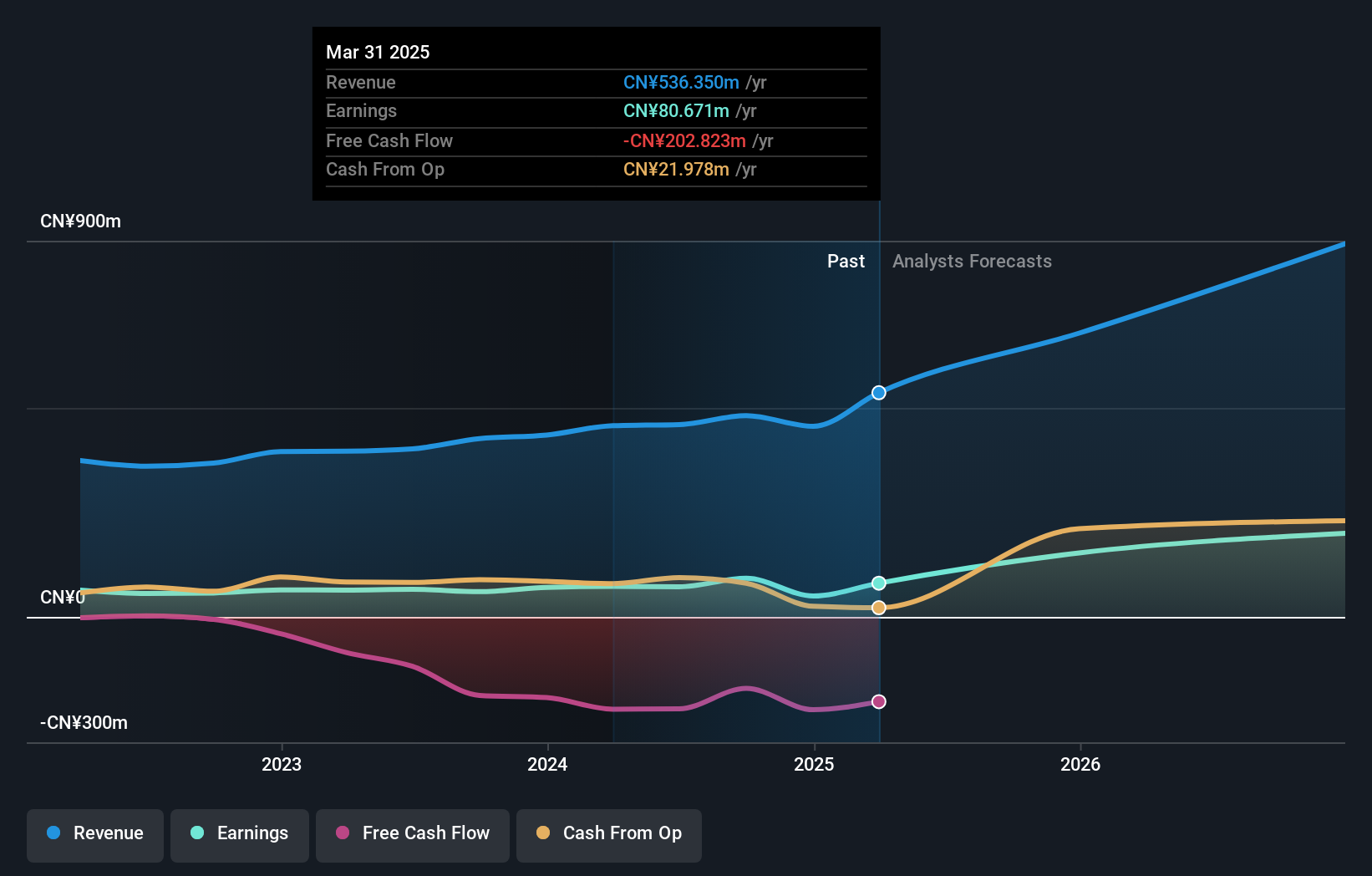

ChengDu ShengNuo Biotec, a smaller player in the biotech space, has shown impressive growth with its recent quarterly sales reaching CNY 184.34 million, up from CNY 104.06 million last year. Net income also saw a boost to CNY 47.12 million from CNY 16.47 million previously, indicating strong operational performance. The company's net debt to equity ratio stands at a satisfactory 28.1%, suggesting prudent financial management amidst its expansion efforts. Earnings per share climbed significantly to CNY 0.42 from CNY 0.15, reflecting robust profitability improvements and positioning it well for future growth within the industry landscape.

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ruentex Engineering & Construction Co., Ltd. is a company engaged in construction and engineering services, with a market capitalization of NT$48.94 billion.

Operations: Ruentex Engineering & Construction generates revenue primarily from its Construction Division, which contributes NT$20.65 billion, followed by the Construction Materials Business Segment at NT$4.70 billion and the Interior Decoration Design Segment at NT$2.16 billion.

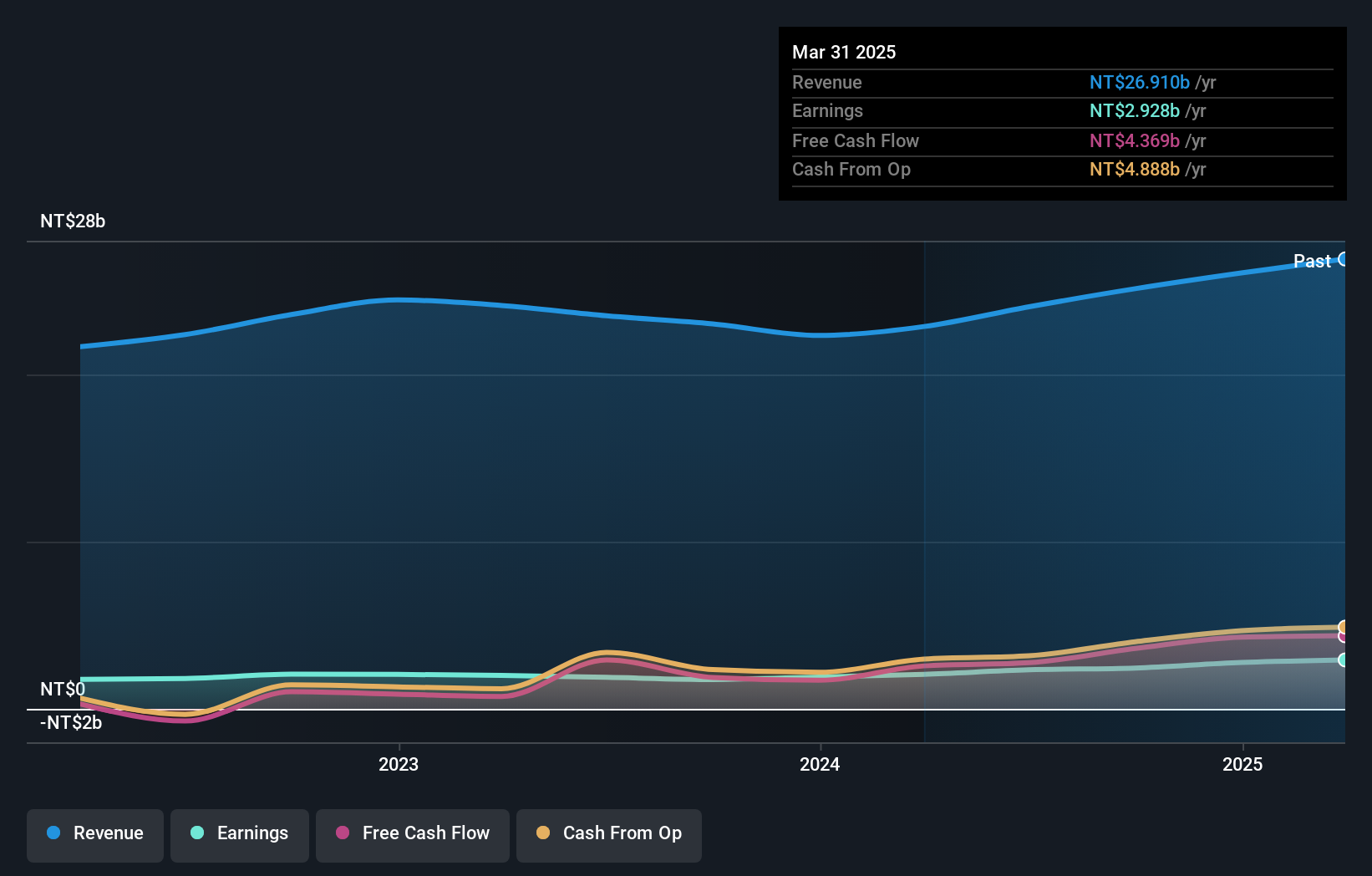

Ruentex Engineering & Construction, a notable player in the construction sector, is showing promising growth. Over the past year, its earnings surged by 41.7%, outpacing the industry average of 0.1%. The company reported Q1 2025 sales of TWD 6.19 billion and net income of TWD 549 million, both up from last year's figures. Trading at a significant discount to its estimated fair value by 73.4%, it offers potential upside for investors seeking undervalued opportunities. With a satisfactory net debt to equity ratio of 15.2% and positive free cash flow, Ruentex seems well-positioned financially for future endeavors.

Turning Ideas Into Actions

- Dive into all 2610 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688117

ChengDu ShengNuo BiotecLtd

Engages in the research and development, production, sale, and export of peptide drugs.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives