- China

- /

- Capital Markets

- /

- SHSE:603093

Discovering None's Hidden Gems With These 3 Promising Small Caps

Reviewed by Simply Wall St

In a week marked by volatile earnings and economic data, small-cap stocks have shown resilience in the face of broader market declines, as evidenced by the Russell 2000's slight uptick. Amidst this backdrop of cautious optimism for smaller companies, identifying promising small-cap stocks can be particularly rewarding when they demonstrate strong fundamentals and potential for growth despite challenging macroeconomic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 10.19% | 19.02% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Kinergy Advancement Berhad | 60.88% | 6.26% | 33.33% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Xiamen Bank (SHSE:601187)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Bank Co., Ltd. offers a range of banking products and services to individuals, corporate clients, and small and microfinance businesses with a market cap of CN¥13.96 billion.

Operations: The bank generates revenue primarily through interest income from loans and advances, as well as fees and commissions from various banking services. It incurs costs related to interest expenses on deposits and borrowings, alongside operational expenses. The net profit margin demonstrates fluctuations over recent periods, influenced by changes in these revenue streams and cost structures.

Xiamen Bank, with assets totaling CN¥403.3 billion and equity of CN¥31.8 billion, presents a compelling profile in the banking sector. Its total deposits stand at CN¥223.3 billion against loans of CN¥222 billion, indicating a robust lending capacity. The bank's allowance for bad loans is sufficient at 0.7% of total loans, reflecting prudent risk management practices. Despite recent challenges with an earnings growth dip of 8.9%, future forecasts suggest a promising annual growth rate of 26%. Trading significantly below its estimated fair value by 52%, Xiamen Bank seems well-positioned for potential appreciation amidst industry dynamics.

- Unlock comprehensive insights into our analysis of Xiamen Bank stock in this health report.

Gain insights into Xiamen Bank's historical performance by reviewing our past performance report.

Nanhua Futures (SHSE:603093)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanhua Futures Co., Ltd. is a company that provides financial services with a focus on derivatives business and has a market cap of CN¥7.74 billion.

Operations: The company's revenue streams are primarily derived from its derivatives-focused financial services. The gross profit margin is 35%, reflecting the efficiency of its operations in generating profit from its revenues.

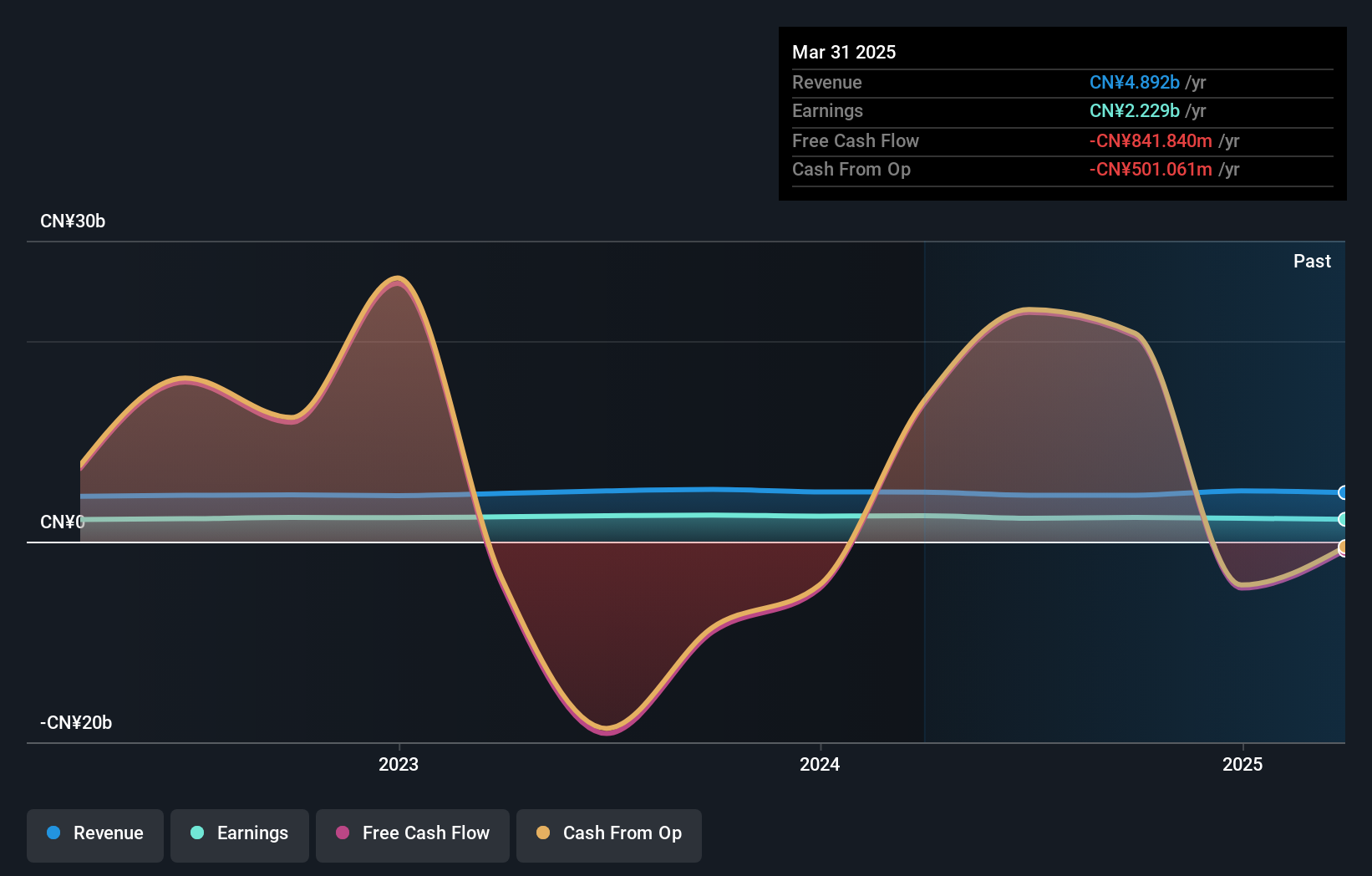

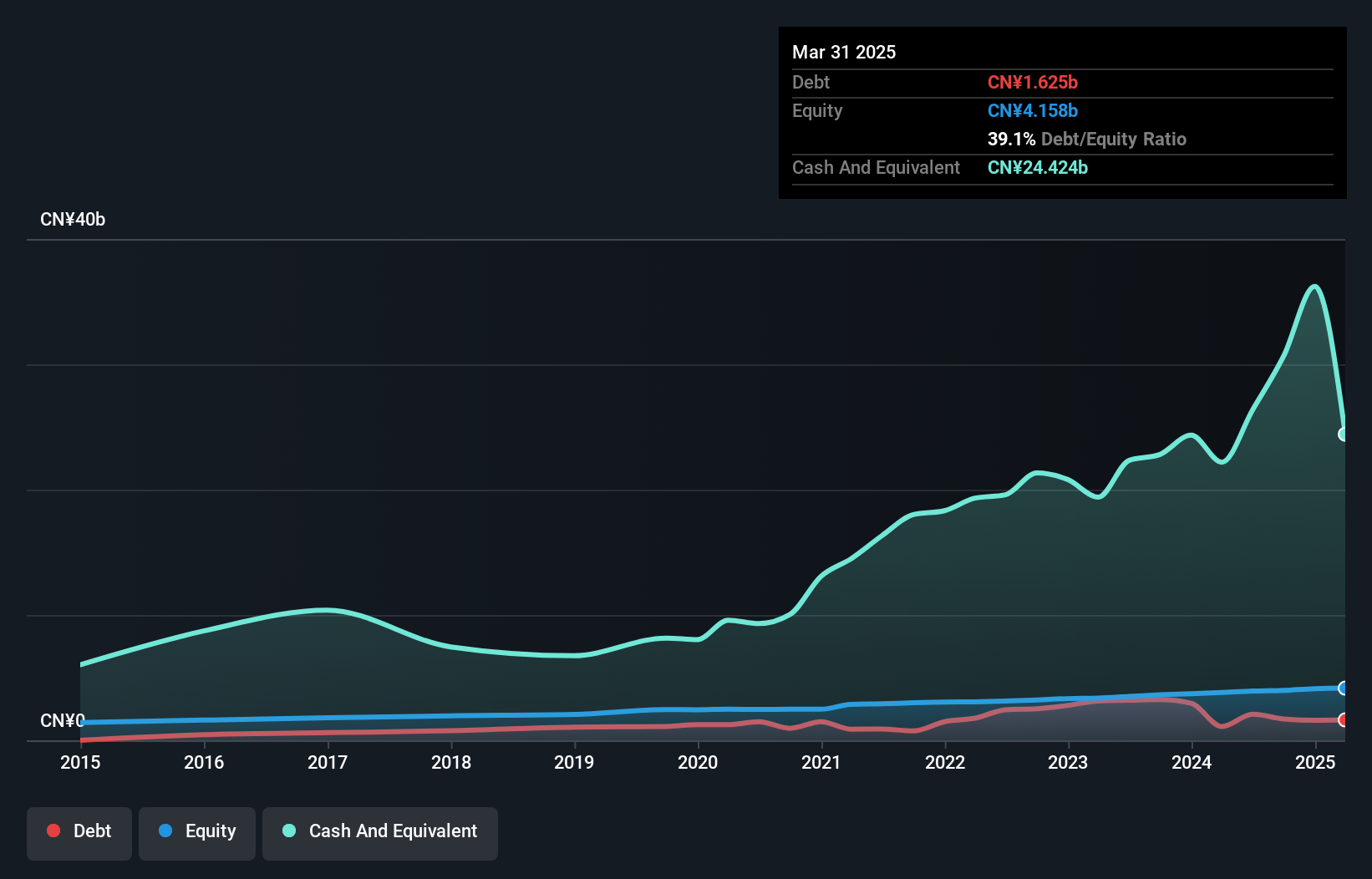

Nanhua Futures, a smaller player in the financial sector, has shown notable resilience and growth. Its earnings increased by 11.9% over the past year, outpacing the industry’s -12.6%. The company’s debt-to-equity ratio improved from 45.2% to 42.8% over five years, indicating prudent financial management with more cash than total debt on hand. Recent earnings for nine months ending September 2024 revealed net income of CNY 358 million compared to CNY 298 million last year, reflecting solid profitability with basic EPS rising from CNY 0.49 to CNY 0.59 alongside a strategic share repurchase of nearly one percent worth CNY 50 million.

GUILIN FUDALtd (SHSE:603166)

Simply Wall St Value Rating: ★★★★★☆

Overview: GUILIN FUDA Co., Ltd. is engaged in the research, development, production, and sale of auto parts and components in China with a market capitalization of approximately CN¥4.01 billion.

Operations: GUILIN FUDA generates revenue primarily from its Automobile and Internal Combustion Engine Parts segment, amounting to CN¥1.51 billion. The company's market capitalization is approximately CN¥4.01 billion.

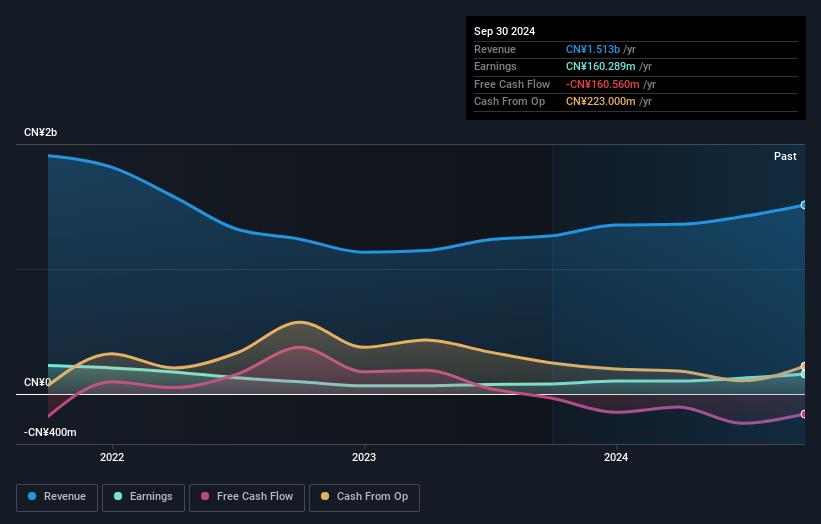

GUILIN FUDA Ltd. has shown impressive growth, with earnings jumping 97.9% over the past year, outpacing the Auto Components industry's 10.1%. Despite a rise in its debt to equity ratio from 22.5% to 26.8% over five years, its net debt to equity remains satisfactory at 18.2%, and interest payments are well covered by EBIT at a multiple of 13x. Recent financials highlight sales reaching CNY1.11 billion for nine months ending September 2024, up from CNY949 million year-on-year, while net income climbed to CNY120 million compared to CNY64 million previously, reflecting strong operational performance amidst industry challenges.

- Navigate through the intricacies of GUILIN FUDALtd with our comprehensive health report here.

Explore historical data to track GUILIN FUDALtd's performance over time in our Past section.

Make It Happen

- Click here to access our complete index of 4738 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanhua Futures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603093

Nanhua Futures

Provides financial services focused on derivatives business.

Excellent balance sheet with proven track record.