- China

- /

- Metals and Mining

- /

- SZSE:001337

Exploring YAPP Automotive Systems And Two Other Promising Asian Small Caps

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China trade agreement and a cooling inflation environment, investors are increasingly looking towards small-cap stocks in Asia for potential opportunities. In this landscape, identifying promising companies like YAPP Automotive Systems requires a keen understanding of market dynamics and an eye for businesses with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 4.97% | 0.98% | 14.37% | ★★★★★★ |

| Ryoyu Systems | NA | 5.05% | 16.94% | ★★★★★★ |

| Standard Foods | 3.12% | -4.48% | -22.82% | ★★★★★★ |

| HannStar Board | 66.09% | -2.82% | -3.15% | ★★★★★★ |

| Top Union Electronics | 2.12% | 8.34% | 19.44% | ★★★★★☆ |

| Unitech Computer | 24.96% | 2.56% | 1.58% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| Dong Fang Offshore | 29.10% | 42.34% | 42.27% | ★★★★★☆ |

| Techno Smart | 10.18% | 12.81% | 17.66% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

YAPP Automotive Systems (SHSE:603013)

Simply Wall St Value Rating: ★★★★★★

Overview: YAPP Automotive Systems Co., Ltd. focuses on the research, development, manufacturing, sale, and service of energy storage and thermal management system products with a market cap of CN¥9.44 billion.

Operations: YAPP Automotive Systems generates revenue primarily from its plastic fuel tank segment, amounting to CN¥8.19 billion. The company's financial performance is reflected in its market capitalization of approximately CN¥9.44 billion.

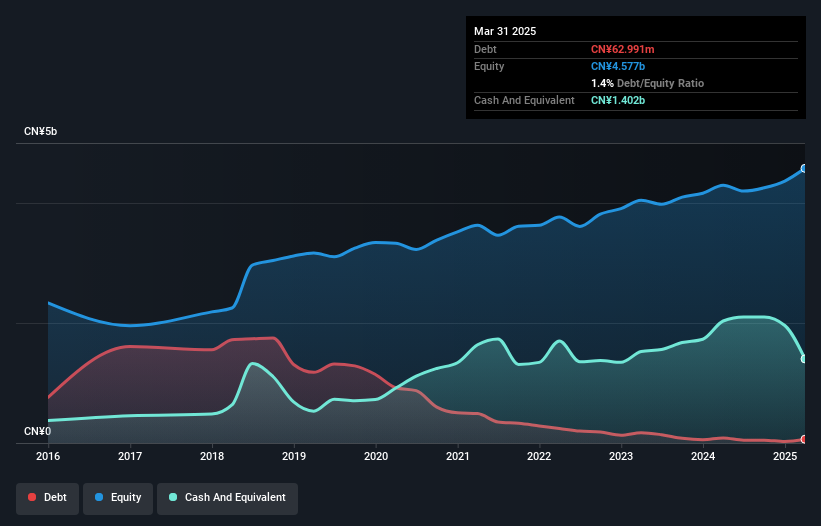

YAPP Automotive Systems showcases a promising profile with its recent earnings growth of 7.1%, surpassing the Auto Components industry's 6.4%. The company has effectively reduced its debt to equity ratio from 27.7% to 1.4% over five years, reflecting sound financial management. Despite a slight decline in earnings by 0.3% annually over five years, YAPP's net income for Q1 2025 rose to CNY 129 million from CNY 128 million the previous year, indicating resilience in operations. A share repurchase program valued at up to CNY 200 million further underscores YAPP's commitment to enhancing shareholder value and optimizing capital structure.

- Navigate through the intricacies of YAPP Automotive Systems with our comprehensive health report here.

Explore historical data to track YAPP Automotive Systems' performance over time in our Past section.

Shenzhen Tellus Holding (SZSE:000025)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Tellus Holding Co., Ltd. operates in China through its subsidiaries, focusing on property leasing and services as well as jewelry operations, with a market capitalization of CN¥7.40 billion.

Operations: Shenzhen Tellus generates revenue primarily from property leasing and services, alongside its jewelry operations. The company's net profit margin has shown variability over recent periods, reflecting changes in operating efficiency and cost management.

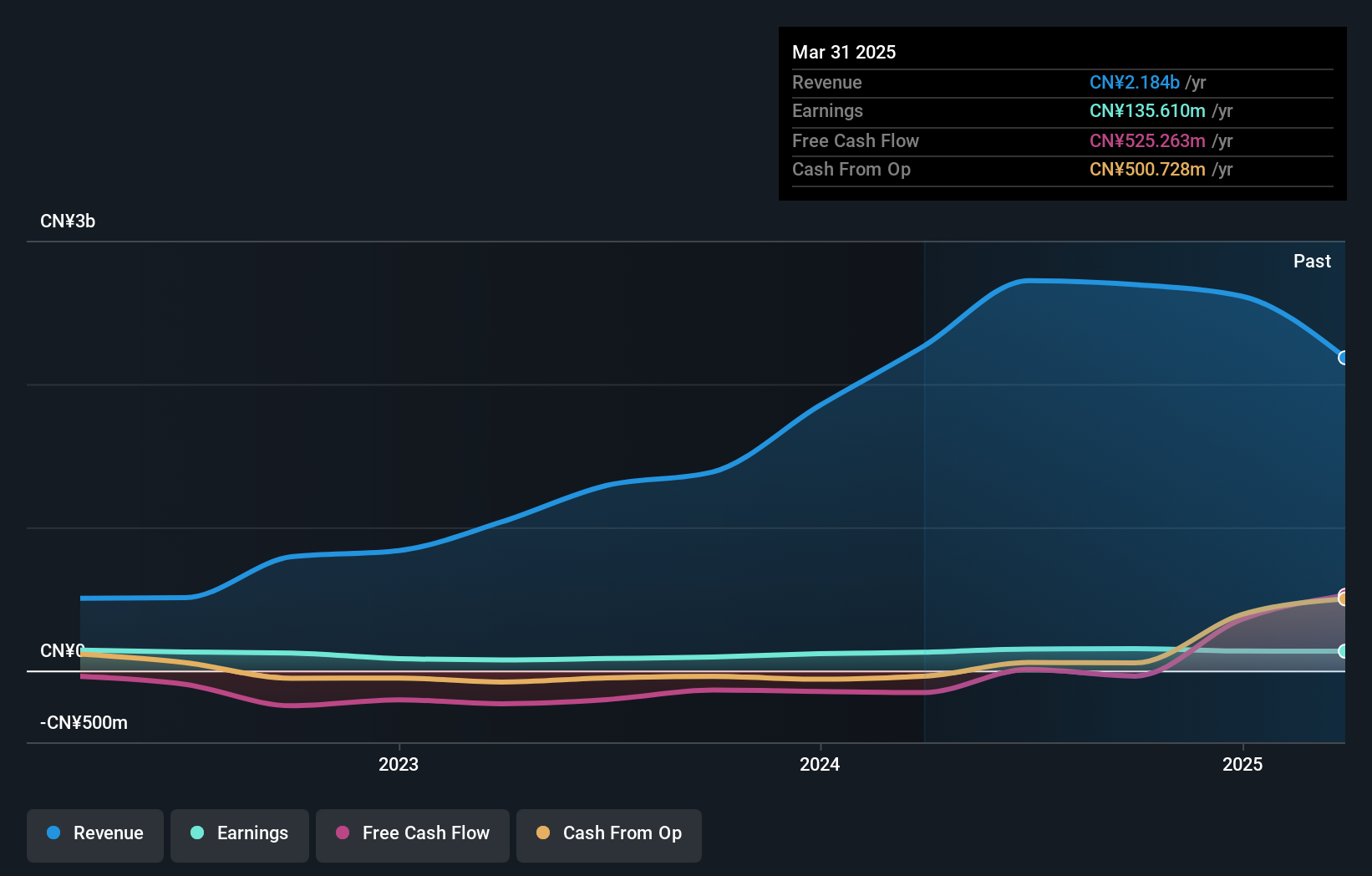

Shenzhen Tellus Holding, a small-cap player in the retail distribution sector, boasts high-quality earnings and a strong financial position. Despite its debt-to-equity ratio climbing to 4.8% over five years, the company still holds more cash than total debt. Recent figures show earnings growth of 5.8%, surpassing industry averages, yet revenue for Q1 2025 dipped to CNY 328.5 million from CNY 758.32 million year-on-year. Net income remained stable at CNY 34.23 million against last year's CNY 35.25 million, while basic EPS slightly decreased to CNY 0.0794 from CNY 0.0818 previously reported.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Tellus Holding.

Understand Shenzhen Tellus Holding's track record by examining our Past report.

Sichuan Gold (SZSE:001337)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Gold Co., Ltd. is involved in the gold mining industry and has a market capitalization of CN¥10.67 billion.

Operations: The primary revenue stream for Sichuan Gold comes from the production and sale of gold concentrate and alloy gold, generating CN¥639.83 million. The company's financial performance is highlighted by a net profit margin trend worth noting, reflecting its efficiency in converting revenue into actual profit.

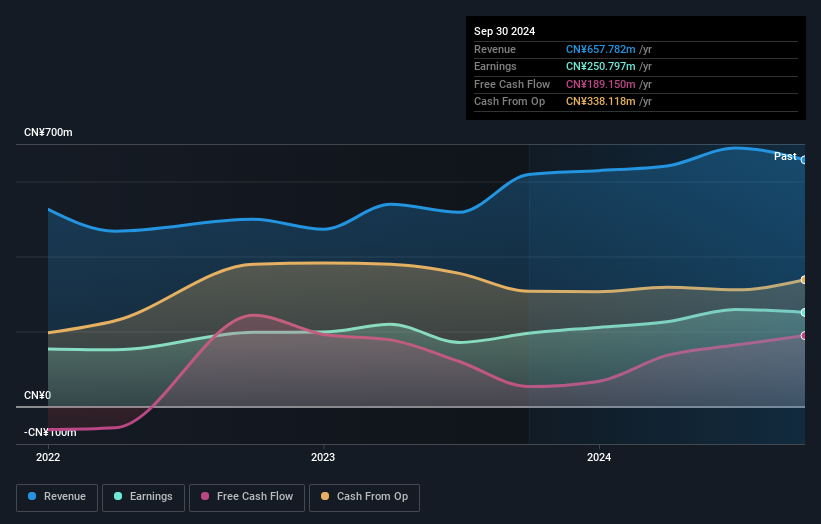

Sichuan Gold, a nimble player in the metals and mining sector, has shown impressive financial health with a 17.7% earnings growth over the past year, outpacing the industry average of -3.9%. The company is debt-free, removing concerns about interest payments and enhancing its financial stability. With high-quality earnings reported consistently, Sichuan Gold's net income rose to CNY 248 million from CNY 211 million last year. Despite recent share price volatility, it remains profitable with robust free cash flow of CNY 153 million as of May 2025. Additionally, they approved a final cash dividend of CNY 2.50 per share for 2024 at their AGM this month.

Taking Advantage

- Explore the 2608 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sichuan Gold, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001337

Flawless balance sheet with solid track record.

Market Insights

Community Narratives