- China

- /

- Auto Components

- /

- SHSE:603009

Exploring Three Undiscovered Gems with Strong Financial Foundations

Reviewed by Simply Wall St

In recent weeks, U.S. small-cap stocks have surged to record highs, joining their larger counterparts in a rally fueled by positive economic indicators and geopolitical developments. Amidst this buoyant market environment, identifying stocks with robust financial foundations becomes essential for investors seeking stability and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Shanghai Beite Technology (SHSE:603009)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Beite Technology Co., Ltd. operates in China, supplying chassis parts, automotive air-conditioning compressors, high-precision parts, and aluminum forging lightweight components, with a market capitalization of CN¥14.17 billion.

Operations: Shanghai Beite Technology generates revenue primarily from its supply of chassis parts, automotive air-conditioning compressors, high-precision parts, and aluminum forging lightweight components. The company has a market capitalization of CN¥14.17 billion.

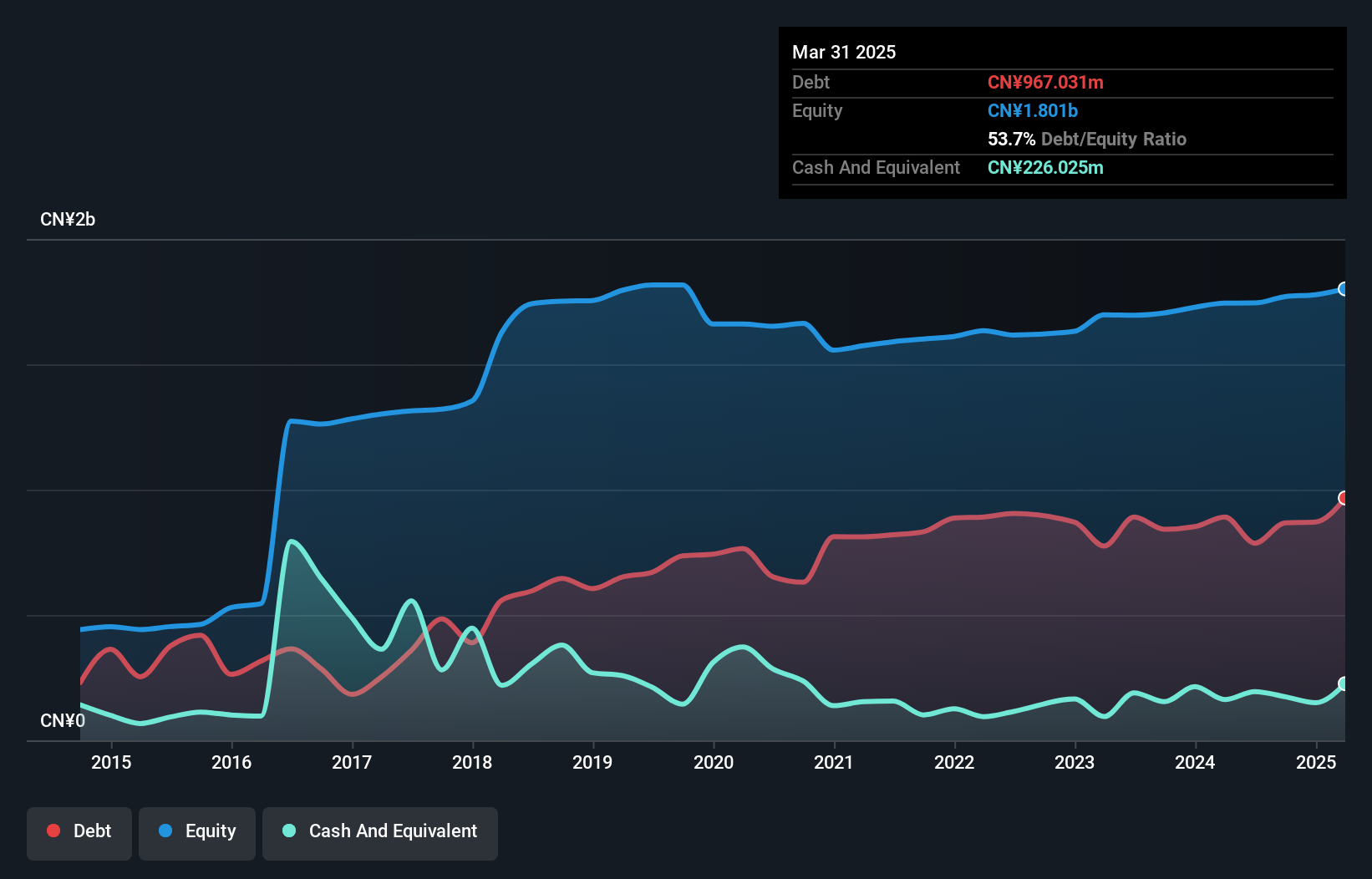

Shanghai Beite Technology, a promising player in the auto components sector, has shown impressive growth with earnings skyrocketing by 122.6% over the past year, outpacing the industry average of 10.5%. The company's net income for the first nine months of 2024 reached CNY 60.81 million, up from CNY 28.82 million last year, reflecting its strong performance and high-quality earnings. With a satisfactory net debt to equity ratio at 39.2% and well-covered interest payments by EBIT (3.2x), Shanghai Beite seems well-positioned financially as it continues to be profitable with positive free cash flow and no immediate cash runway concerns.

Macrolink Culturaltainment Development (SZSE:000620)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Macrolink Culturaltainment Development Co., Ltd. operates in the cultural and entertainment sectors with a market cap of CN¥12.80 billion.

Operations: The company generates revenue primarily from its cultural and entertainment operations. Its net profit margin has shown fluctuations, indicating variability in profitability over recent periods.

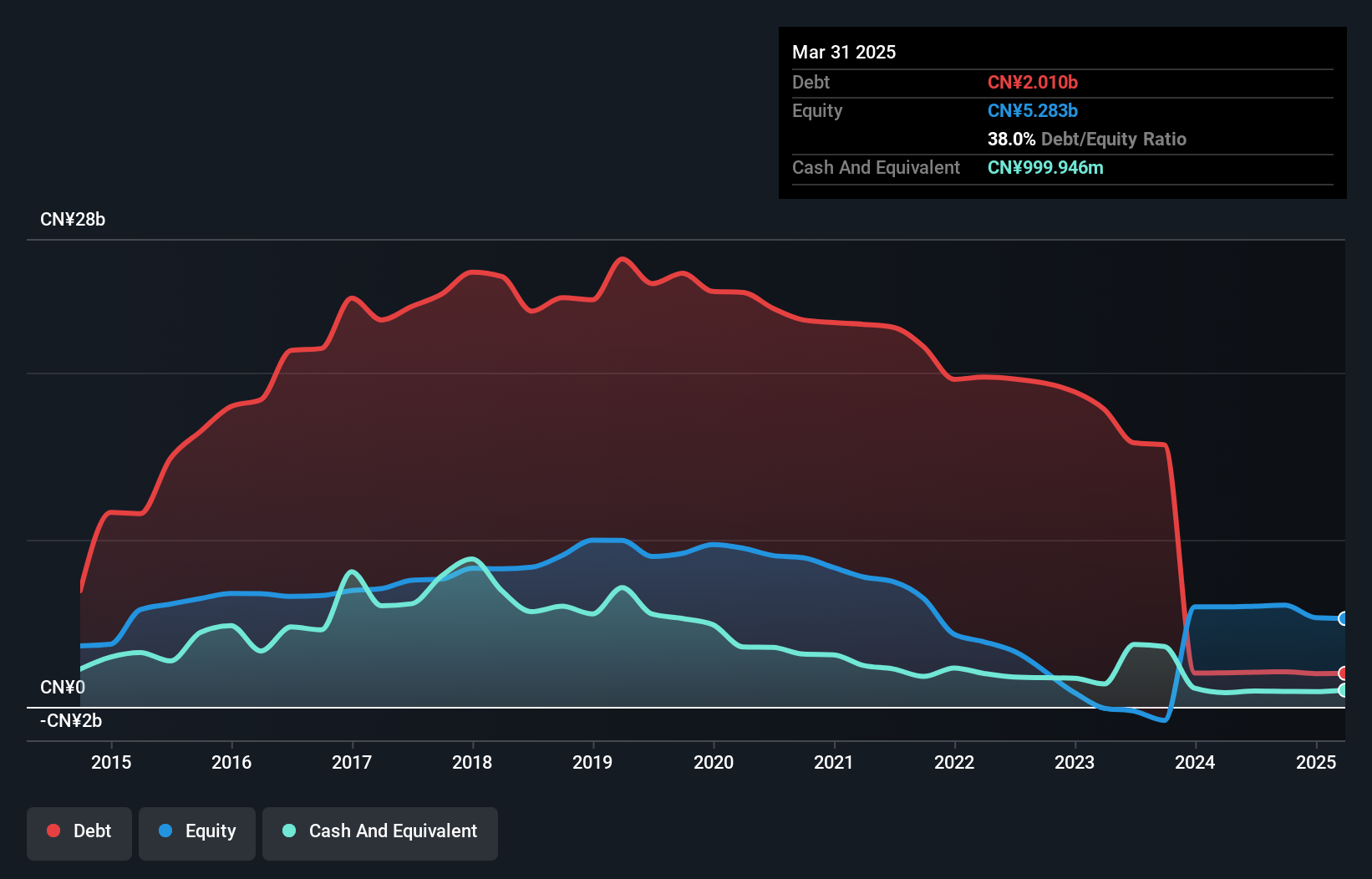

Macrolink Culturaltainment Development, a company with a knack for turning things around, recently reported net income of CNY 83.5 million after facing a hefty net loss of CNY 1.76 billion the previous year. Its price-to-earnings ratio stands at an attractive 5.8x, significantly below the market average of 36.7x in China, suggesting potential undervaluation. Over five years, its debt to equity ratio impressively dropped from 282% to just over 34%, indicating improved financial health and management's focus on stability. Despite substantial shareholder dilution last year, Macrolink's profitability this year marks a notable shift in its financial trajectory.

LuxNet (TPEX:4979)

Simply Wall St Value Rating: ★★★★★★

Overview: LuxNet Corporation, along with its subsidiaries, is involved in the manufacturing, processing, and sale of electric and optical communication components in Taiwan, with a market capitalization of approximately NT$29.86 billion.

Operations: LuxNet generates revenue primarily from its Optical Communication System Active Components segment, contributing NT$3.41 billion. The company's market capitalization stands at approximately NT$29.86 billion.

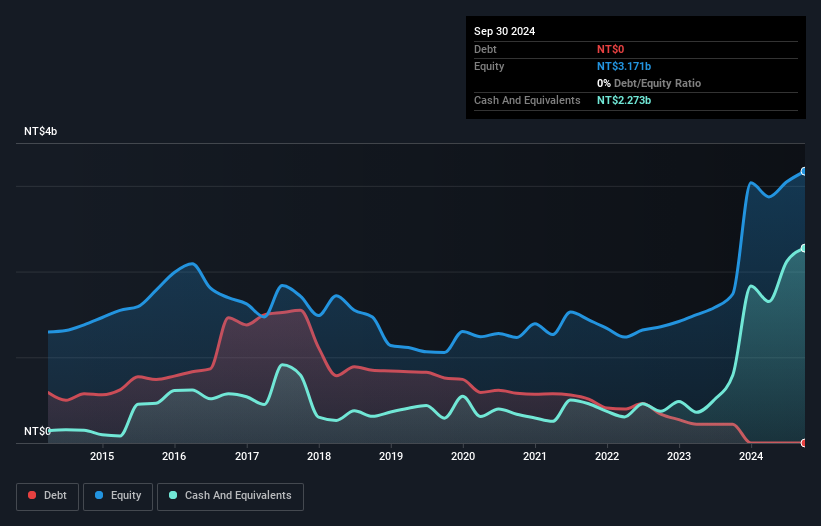

LuxNet, a nimble player in the tech industry, showcases robust earnings growth with a 41.9% rise over the past year, outpacing its sector's -9.2%. Despite recent shareholder dilution, LuxNet remains debt-free and boasts high-quality earnings. The latest quarter saw sales reach TWD 945.63 million, up from TWD 879.88 million last year; however, net income dipped to TWD 137.87 million from TWD 164.9 million previously. Over nine months, sales climbed to TWD 2,402.93 million compared to last year's TWD 1,944.72 million while net income improved to TWD 381.37 million from TWD 287.14 million priorly.

- Click here and access our complete health analysis report to understand the dynamics of LuxNet.

Gain insights into LuxNet's past trends and performance with our Past report.

Make It Happen

- Reveal the 4641 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603009

Shanghai Beite Technology

Engages in the chassis parts, lightweight aluminum alloy, and air-conditioning compressor businesses in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives