- China

- /

- Auto Components

- /

- SHSE:601163

Do Triangle TyreLtd's (SHSE:601163) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Triangle TyreLtd (SHSE:601163). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Triangle TyreLtd with the means to add long-term value to shareholders.

Check out our latest analysis for Triangle TyreLtd

How Quickly Is Triangle TyreLtd Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Triangle TyreLtd grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

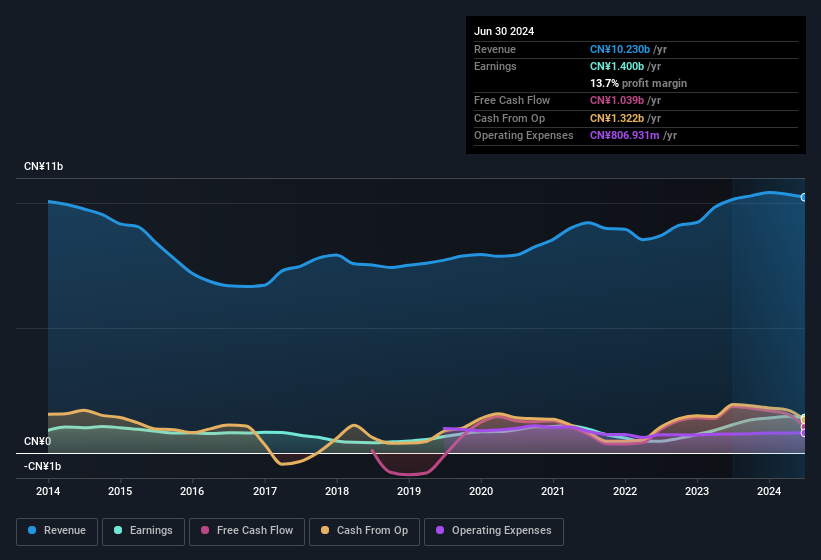

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While revenue is looking a bit flat, the good news is EBIT margins improved by 2.9 percentage points to 13%, in the last twelve months. That's something to smile about.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Triangle TyreLtd's future EPS 100% free.

Are Triangle TyreLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Triangle TyreLtd insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth CN¥979m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Triangle TyreLtd, with market caps between CN¥7.1b and CN¥23b, is around CN¥1.2m.

Triangle TyreLtd's CEO took home a total compensation package worth CN¥916k in the year leading up to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Triangle TyreLtd Deserve A Spot On Your Watchlist?

One positive for Triangle TyreLtd is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Triangle TyreLtd, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. However, before you get too excited we've discovered 1 warning sign for Triangle TyreLtd that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Triangle TyreLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601163

Triangle TyreLtd

Engages in the research and development, design, manufacture, and marketing of tire products in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.