Investors push BAIC BluePark New Energy TechnologyLtd (SHSE:600733) 5.7% lower this week, company's increasing losses might be to blame

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. For example, the BAIC BluePark New Energy Technology Co.,Ltd. (SHSE:600733) share price is up 38% in the last 1 year, clearly besting the market return of around 9.8% (not including dividends). So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 23% in three years.

Although BAIC BluePark New Energy TechnologyLtd has shed CN¥2.7b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for BAIC BluePark New Energy TechnologyLtd

BAIC BluePark New Energy TechnologyLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

BAIC BluePark New Energy TechnologyLtd grew its revenue by 13% last year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 38%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

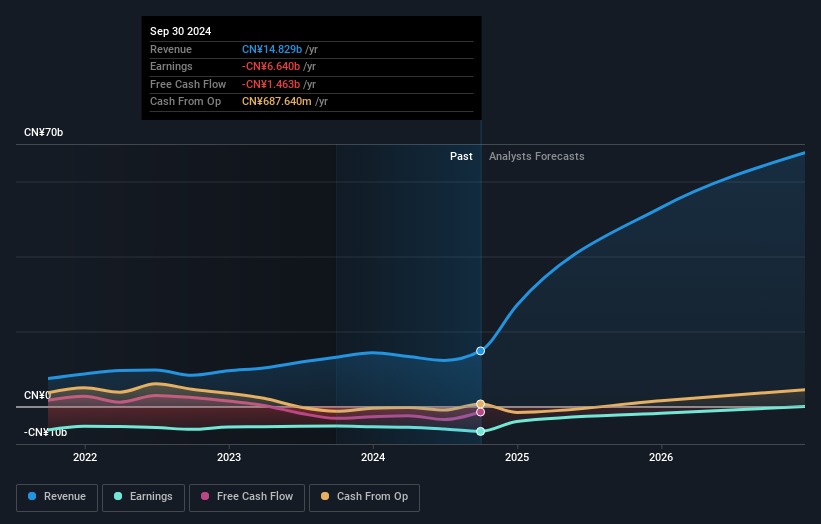

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that BAIC BluePark New Energy TechnologyLtd shareholders have received a total shareholder return of 38% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BAIC BluePark New Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600733

BAIC BluePark New Energy TechnologyLtd

BAIC BluePark New Energy Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives