- China

- /

- Auto Components

- /

- SHSE:600698

Investors bid Hunan Tyen MachineryLtd (SHSE:600698) up CN¥407m despite increasing losses YoY, taking five-year CAGR to 17%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Hunan Tyen Machinery Co.,Ltd (SHSE:600698) which saw its share price drive 117% higher over five years. And in the last month, the share price has gained 17%. But the price may well have benefitted from a buoyant market, since stocks have gained 7.3% in the last thirty days.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Hunan Tyen MachineryLtd

Hunan Tyen MachineryLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Hunan Tyen MachineryLtd's revenue has actually been trending down at about 6.4% per year. Given that scenario, we wouldn't have expected the share price to rise 17% per year, but that's what it did. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

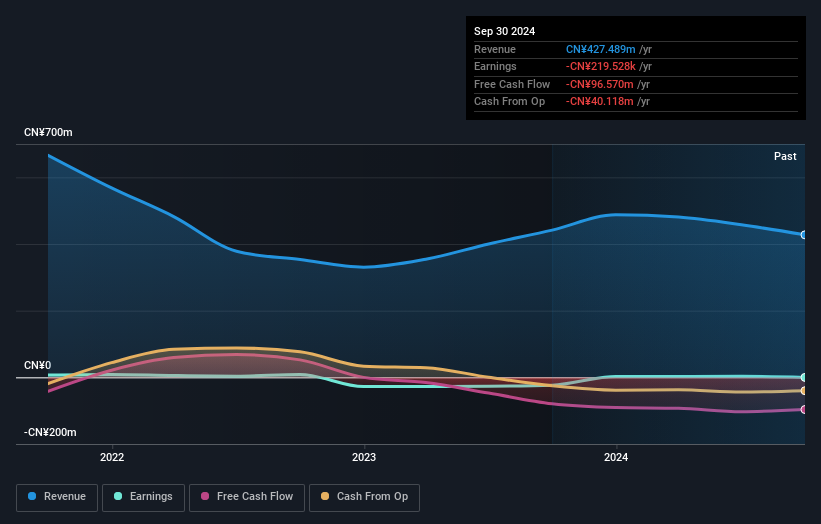

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Hunan Tyen MachineryLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Hunan Tyen MachineryLtd shareholders have received a total shareholder return of 37% over one year. That gain is better than the annual TSR over five years, which is 17%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Hunan Tyen MachineryLtd , and understanding them should be part of your investment process.

Of course Hunan Tyen MachineryLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Tyen MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600698

Hunan Tyen MachineryLtd

Engages in the development, design, production, and sales of engine parts in China.

Flawless balance sheet minimal.

Market Insights

Community Narratives