- China

- /

- Household Products

- /

- SHSE:600651

Shenyang Jinbei Automotive And 2 Other Small Caps With Promising Fundamentals

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have weighed heavily on U.S. stocks, particularly impacting small-cap indices like the Russell 2000 that saw a notable decline. Despite these challenges, small-cap companies with strong fundamentals continue to present intriguing opportunities for investors seeking growth potential in a volatile environment. Among these are Shenyang Jinbei Automotive and two other small caps that stand out due to their robust financial health and promising market positions amidst broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 21.55% | 10.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Shenyang Jinbei Automotive (SHSE:600609)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyang Jinbei Automotive Company Limited focuses on the design, production, and sale of auto parts in China with a market capitalization of CN¥6.90 billion.

Operations: The company generates revenue primarily from the design, production, and sale of auto parts in China. It has a market capitalization of CN¥6.90 billion.

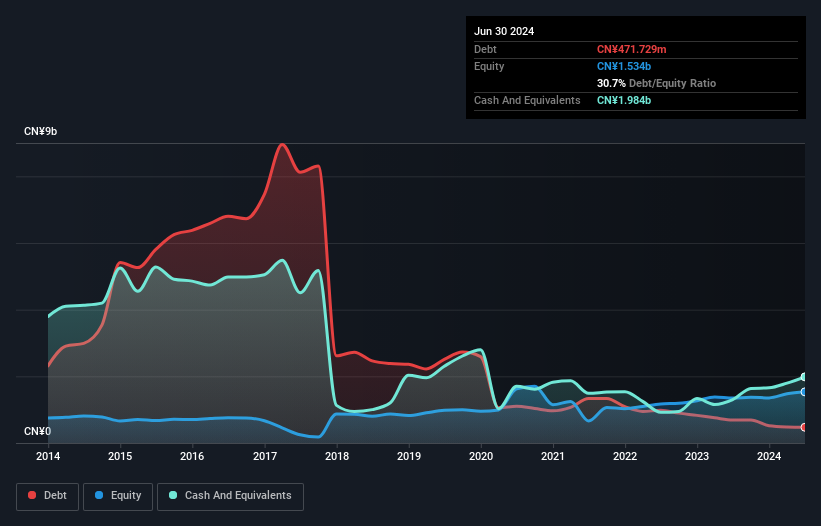

Shenyang Jinbei Automotive, a smaller player in the auto industry, showcases a mixed financial landscape. Despite recent sales of CNY 2.11 billion falling from CNY 2.66 billion last year, net income rose to CNY 198 million from CNY 120 million, indicating improved profitability with basic earnings per share increasing to CNY 0.15 from CNY 0.09. The company's debt-to-equity ratio impressively dropped from 255% to just over 30% over five years, reflecting better financial health and more cash than total debt suggests manageable liabilities. Trading at about two-thirds below estimated fair value might offer potential upside for investors seeking undervalued opportunities in the sector.

Shanghai Feilo AcousticsLtd (SHSE:600651)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Feilo Acoustics Co., Ltd is engaged in the lighting, automotive electronics, and module packaging and chip testing service sectors both in China and internationally, with a market cap of CN¥9.53 billion.

Operations: Shanghai Feilo Acoustics Co., Ltd generates revenue primarily from the manufacturing industry, contributing CN¥1.58 billion, and the service industry, adding CN¥353.91 million. The company's financials reflect a focus on these sectors for its income streams.

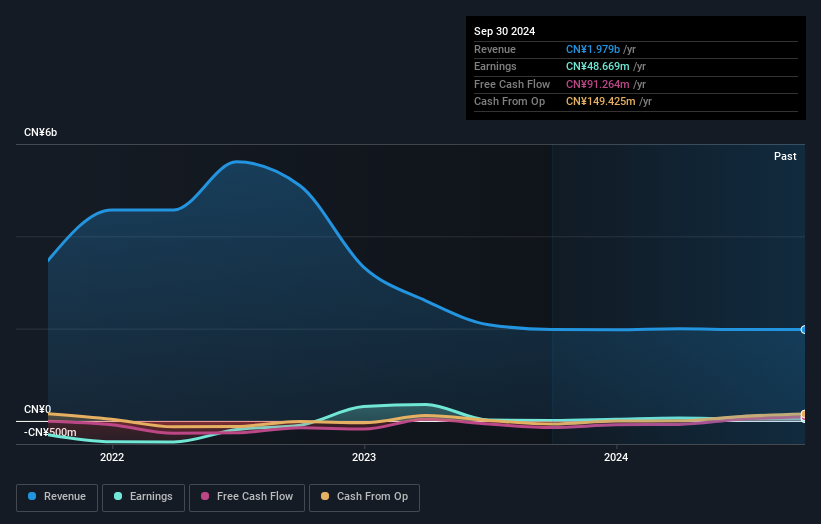

Shanghai Feilo Acoustics has shown considerable growth, with earnings surging by 150% over the past year, outpacing the Household Products industry. Despite a significant one-off gain of CN¥64.7 million affecting recent financial results, the company appears to have turned around its financial health from negative shareholder equity five years ago to a positive state now. It boasts more cash than total debt and is generating positive free cash flow. Recent earnings reports show an increase in net income to CN¥14.28 million for H1 2024 from CN¥6.96 million last year, reflecting improved profitability despite modest sales growth to CNY 887.47 million from CNY 861.69 million.

Shenzhen Textile (Holdings) (SZSE:000045)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Textile (Holdings) Co., Ltd. focuses on the research, development, production, and sale of polarizers primarily in China and has a market cap of CN¥6.04 billion.

Operations: Shenzhen Textile (Holdings) derives its revenue primarily from the sale of polarizers in China. The company's financial performance is influenced by its ability to manage production costs and optimize sales within this specialized market.

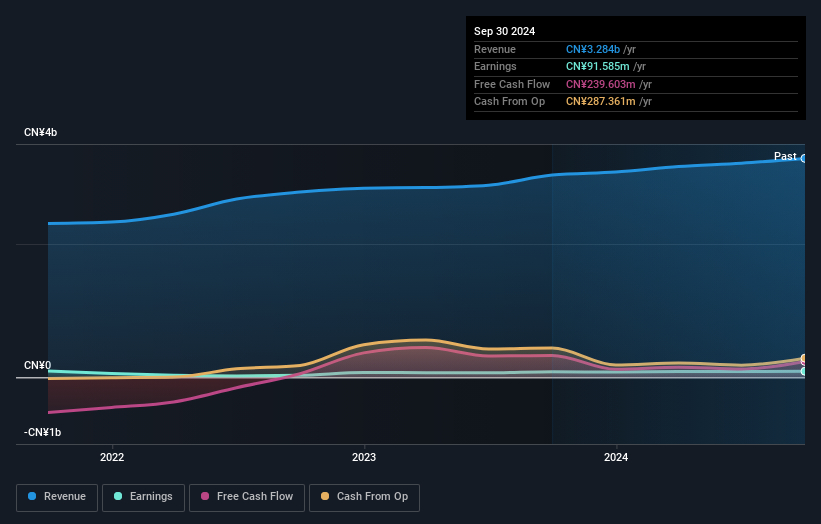

Shenzhen Textile has been making waves with its recent inclusion in the S&P Global BMI Index, reflecting its growing recognition. The company's earnings for the first half of 2024 reached CNY 43.89 million, a rise from CNY 36.31 million last year, showcasing solid growth momentum. Revenue also climbed to CNY 1.62 billion from CNY 1.49 billion previously, while basic earnings per share increased to CNY 0.0867 from CNY 0.0717 a year ago, indicating improved profitability and operational efficiency. With a debt-to-equity ratio rising to 13.4% over five years and interest payments well covered by EBIT at a multiple of nearly twenty-five times, Shenzhen Textile seems financially sound despite increasing leverage levels.

Key Takeaways

- Reveal the 4732 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600651

Shanghai Feilo AcousticsLtd

Operates in lighting, automotive electronics, and module packaging and chip testing service businesses in China and internationally.

Proven track record with adequate balance sheet.