- China

- /

- Auto Components

- /

- SHSE:600480

The 3.8% return this week takes Ling Yun Industrial's (SHSE:600480) shareholders five-year gains to 210%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For instance, the price of Ling Yun Industrial Corporation Limited (SHSE:600480) stock is up an impressive 189% over the last five years. It's also good to see the share price up 57% over the last quarter.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

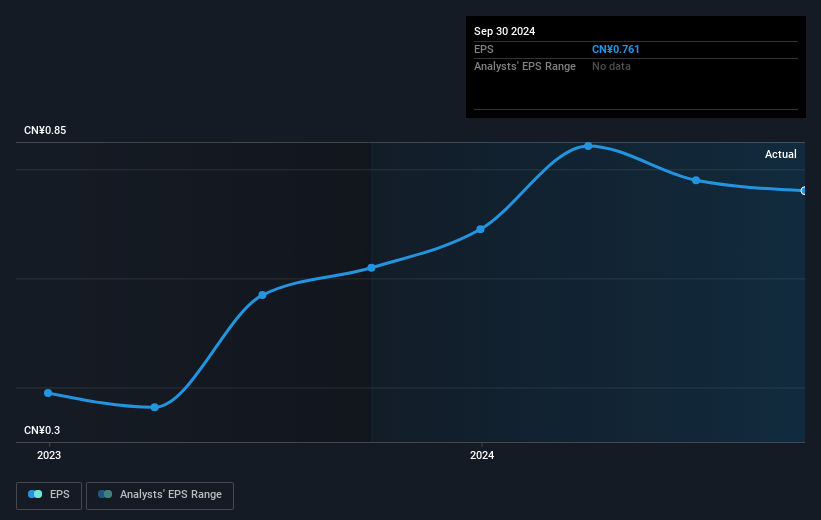

During the five years of share price growth, Ling Yun Industrial moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Ling Yun Industrial share price has gained 103% in three years. Meanwhile, EPS is up 25% per year. That makes EPS very close to the 27% share price growth, each year, over the same period. That suggests that the market sentiment around the company hasn't changed much over that time. There's a strong correlation between the share price and EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Ling Yun Industrial's key metrics by checking this interactive graph of Ling Yun Industrial's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Ling Yun Industrial the TSR over the last 5 years was 210%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Ling Yun Industrial shareholders have received a total shareholder return of 87% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 25%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Ling Yun Industrial you should be aware of.

But note: Ling Yun Industrial may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600480

Ling Yun Industrial

Engages in the production and sale of metal, automotive plastic, and plastic piping systems in China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives