Asian Value Stocks Estimated At 15.2% To 40.3% Below Intrinsic Worth

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and shifting monetary policies, Asian markets have shown resilience, with investor interest particularly piqued by the potential for undervalued opportunities. In this context, identifying stocks priced below their intrinsic worth can be a strategic move for investors looking to capitalize on market inefficiencies and long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.56 | CN¥303.64 | 48.8% |

| Nippon Thompson (TSE:6480) | ¥722.00 | ¥1394.19 | 48.2% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.08 | CN¥26.02 | 49.7% |

| Morimatsu International Holdings (SEHK:2155) | HK$8.33 | HK$16.04 | 48.1% |

| MNC SolutionLtd (KOSE:A484870) | ₩124900.00 | ₩243739.89 | 48.8% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.59 | CN¥20.43 | 48.2% |

| H.U. Group Holdings (TSE:4544) | ¥3402.00 | ¥6592.59 | 48.4% |

| COVER (TSE:5253) | ¥1580.00 | ¥3098.08 | 49% |

| China Beststudy Education Group (SEHK:3978) | HK$4.68 | HK$9.30 | 49.7% |

| Beijing Roborock Technology (SHSE:688169) | CN¥154.07 | CN¥301.15 | 48.8% |

We'll examine a selection from our screener results.

Damai Entertainment Holdings (SEHK:1060)

Overview: Damai Entertainment Holdings Limited is an investment holding company engaged in content, technology, and IP merchandising and commercialization in Hong Kong and the People's Republic of China, with a market cap of HK$26.89 billion.

Operations: The company's revenue segments include Drama Series Production, which generated CN¥923.11 million.

Estimated Discount To Fair Value: 15.2%

Damai Entertainment Holdings' recent earnings report shows a strong increase in net income to CNY 519.53 million, reflecting robust cash flow generation. The company is trading at a discount to its estimated fair value of HK$1.06, with analysts forecasting significant profit growth of 38% annually, surpassing the Hong Kong market average. Despite this, the stock's return on equity remains modestly low at 7.6%, suggesting potential limitations in profitability efficiency moving forward.

- The analysis detailed in our Damai Entertainment Holdings growth report hints at robust future financial performance.

- Click here to discover the nuances of Damai Entertainment Holdings with our detailed financial health report.

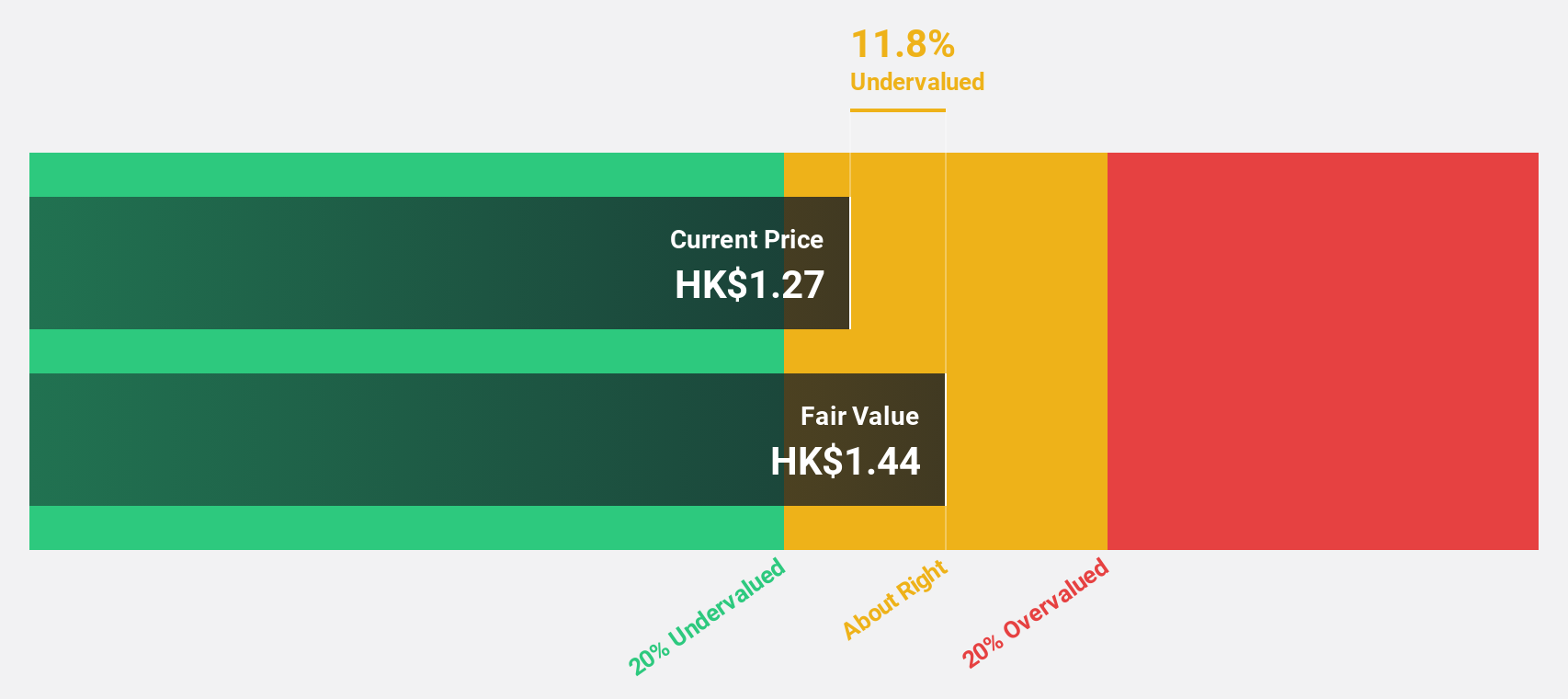

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally with a market cap of HK$110.17 billion.

Operations: The company's revenue primarily comes from its biopharmaceutical products, generating CN¥2.51 billion.

Estimated Discount To Fair Value: 40.3%

Akeso is trading at HK$119.6, significantly below its estimated fair value of HK$200.28, highlighting its potential undervaluation based on cash flows. Analysts forecast Akeso to become profitable within three years, with robust revenue growth expected at 34.8% annually, outpacing the Hong Kong market average. Recent developments include regulatory approval for clinical trials of AK152 for Alzheimer's and advancements in ivonescimab's cancer treatment trials, reinforcing Akeso's innovative pipeline and potential long-term value creation.

- Our growth report here indicates Akeso may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Akeso.

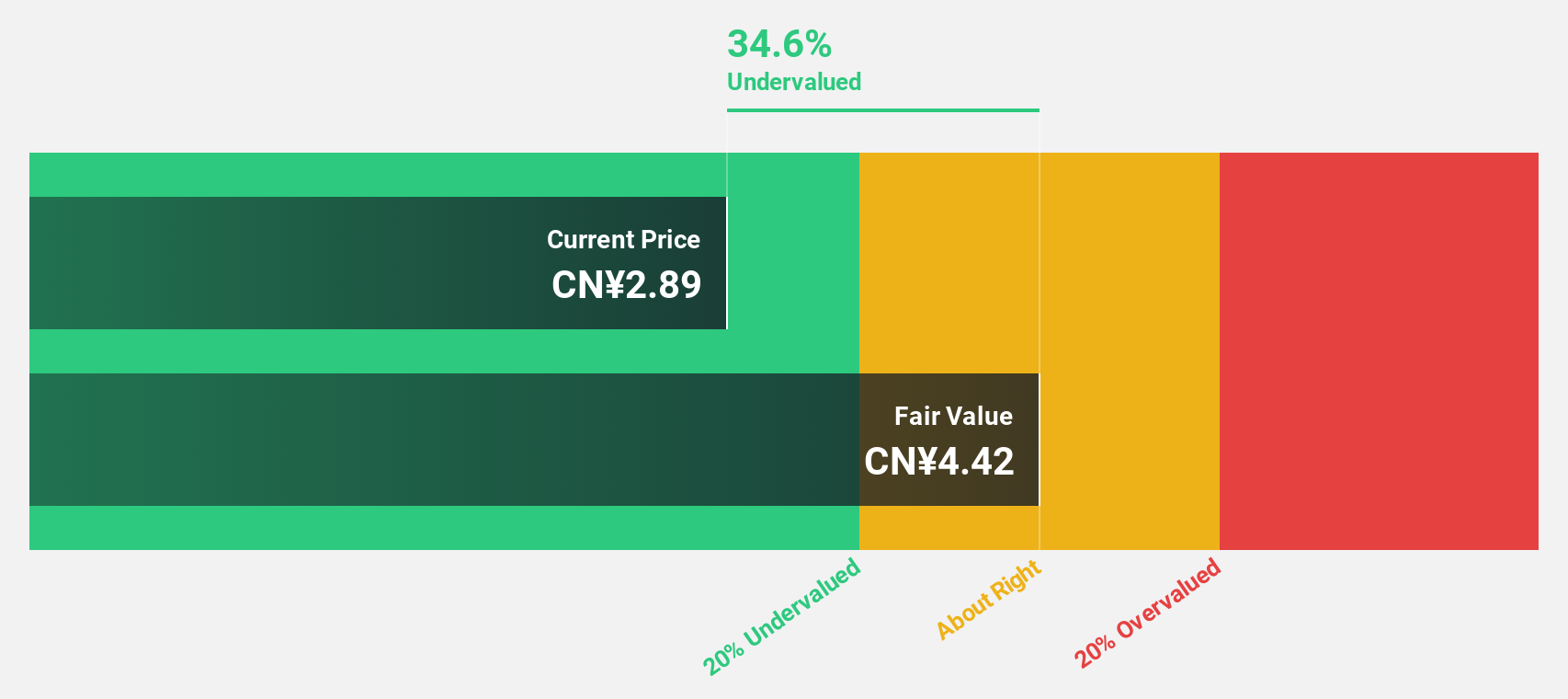

Beiqi Foton MotorLtd (SHSE:600166)

Overview: Beiqi Foton Motor Co., Ltd. is involved in the manufacture and sale of commercial vehicles globally, with a market cap of CN¥22.33 billion.

Operations: The company generates revenue from its global operations in the manufacture and sale of commercial vehicles.

Estimated Discount To Fair Value: 36.3%

Beiqi Foton Motor Ltd. trades at CN¥2.82, significantly below its estimated fair value of CN¥4.43, indicating potential undervaluation based on cash flows. Recent earnings show robust growth with net income rising to CNY 1.11 billion from CNY 432 million year-on-year, reflecting strong financial performance despite low forecasted return on equity of 11.4%. The launch of innovative products like GALAXUS and DAYSTAR highlights strategic advancements in green logistics solutions, supporting future revenue growth expectations exceeding the market average.

- Insights from our recent growth report point to a promising forecast for Beiqi Foton MotorLtd's business outlook.

- Unlock comprehensive insights into our analysis of Beiqi Foton MotorLtd stock in this financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 275 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026