- Chile

- /

- Renewable Energy

- /

- SNSE:ENELGXCH

Earnings are growing at Enel Generación Chile (SNSE:ENELGXCH) but shareholders still don't like its prospects

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. So we wouldn't blame long term Enel Generación Chile S.A. (SNSE:ENELGXCH) shareholders for doubting their decision to hold, with the stock down 62% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 32%. Unfortunately the share price momentum is still quite negative, with prices down 14% in thirty days. But this could be related to poor market conditions -- stocks are down 8.7% in the same time.

Since Enel Generación Chile has shed CL$87b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Enel Generación Chile

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Enel Generación Chile moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The revenue fall of 2.2% per year for five years is neither good nor terrible. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

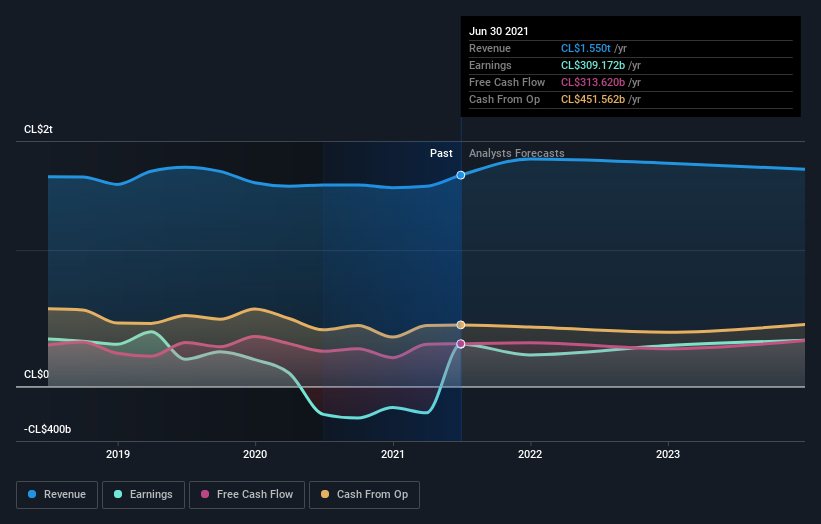

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Enel Generación Chile has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Enel Generación Chile in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Enel Generación Chile's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Enel Generación Chile's TSR, which was a 46% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Investors in Enel Generación Chile had a tough year, with a total loss of 25%, against a market gain of about 1.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Enel Generación Chile you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enel Generación Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:ENELGXCH

Enel Generación Chile

Engages in the generation, transmission, and distribution of energy in Chile.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives