- Chile

- /

- Transportation

- /

- SNSE:FEPASA

These 4 Measures Indicate That Ferrocarril del Pacífico (SNSE:FEPASA) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Ferrocarril del Pacífico S.A. (SNSE:FEPASA) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ferrocarril del Pacífico

What Is Ferrocarril del Pacífico's Net Debt?

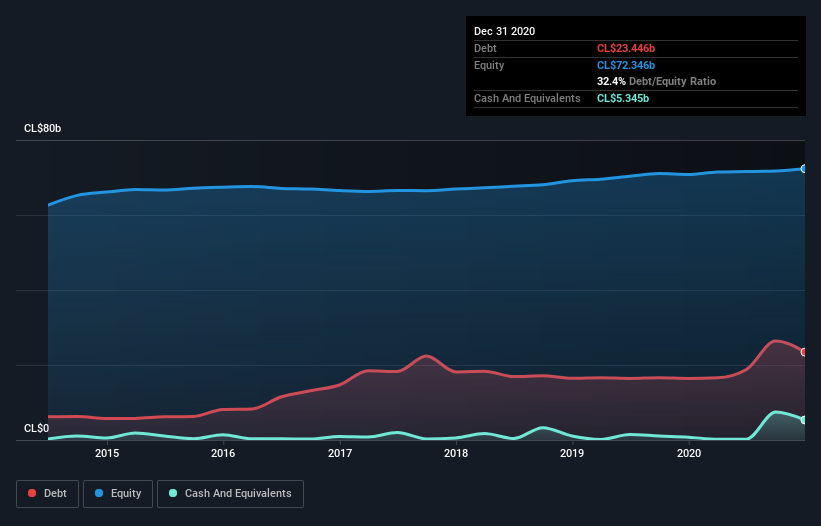

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Ferrocarril del Pacífico had CL$23.4b of debt, an increase on CL$16.4b, over one year. However, it also had CL$5.35b in cash, and so its net debt is CL$18.1b.

A Look At Ferrocarril del Pacífico's Liabilities

According to the last reported balance sheet, Ferrocarril del Pacífico had liabilities of CL$18.6b due within 12 months, and liabilities of CL$19.8b due beyond 12 months. Offsetting this, it had CL$5.35b in cash and CL$16.4b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CL$16.7b.

This deficit is considerable relative to its market capitalization of CL$27.3b, so it does suggest shareholders should keep an eye on Ferrocarril del Pacífico's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ferrocarril del Pacífico has a debt to EBITDA ratio of 2.5 and its EBIT covered its interest expense 3.7 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Importantly, Ferrocarril del Pacífico's EBIT fell a jaw-dropping 23% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Ferrocarril del Pacífico's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Ferrocarril del Pacífico recorded free cash flow worth 71% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Ferrocarril del Pacífico's EBIT growth rate was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. In particular, its conversion of EBIT to free cash flow was re-invigorating. Taking the abovementioned factors together we do think Ferrocarril del Pacífico's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Ferrocarril del Pacífico has 2 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:FEPASA

Ferrocarril del Pacífico

Operates as a multimodal freight transportation solutions company in Chile.

Established dividend payer with proven track record.