Enaex (SNSE:ENAEX) stock performs better than its underlying earnings growth over last five years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. Long term Enaex S.A. (SNSE:ENAEX) shareholders would be well aware of this, since the stock is up 242% in five years. On top of that, the share price is up 13% in about a quarter. But this could be related to the strong market, which is up 9.9% in the last three months.

Since the stock has added CL$104b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

We don't think that Enaex's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Enaex can boast revenue growth at a rate of 15% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 28% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. Enaex seems like a high growth stock - so growth investors might want to add it to their watchlist.

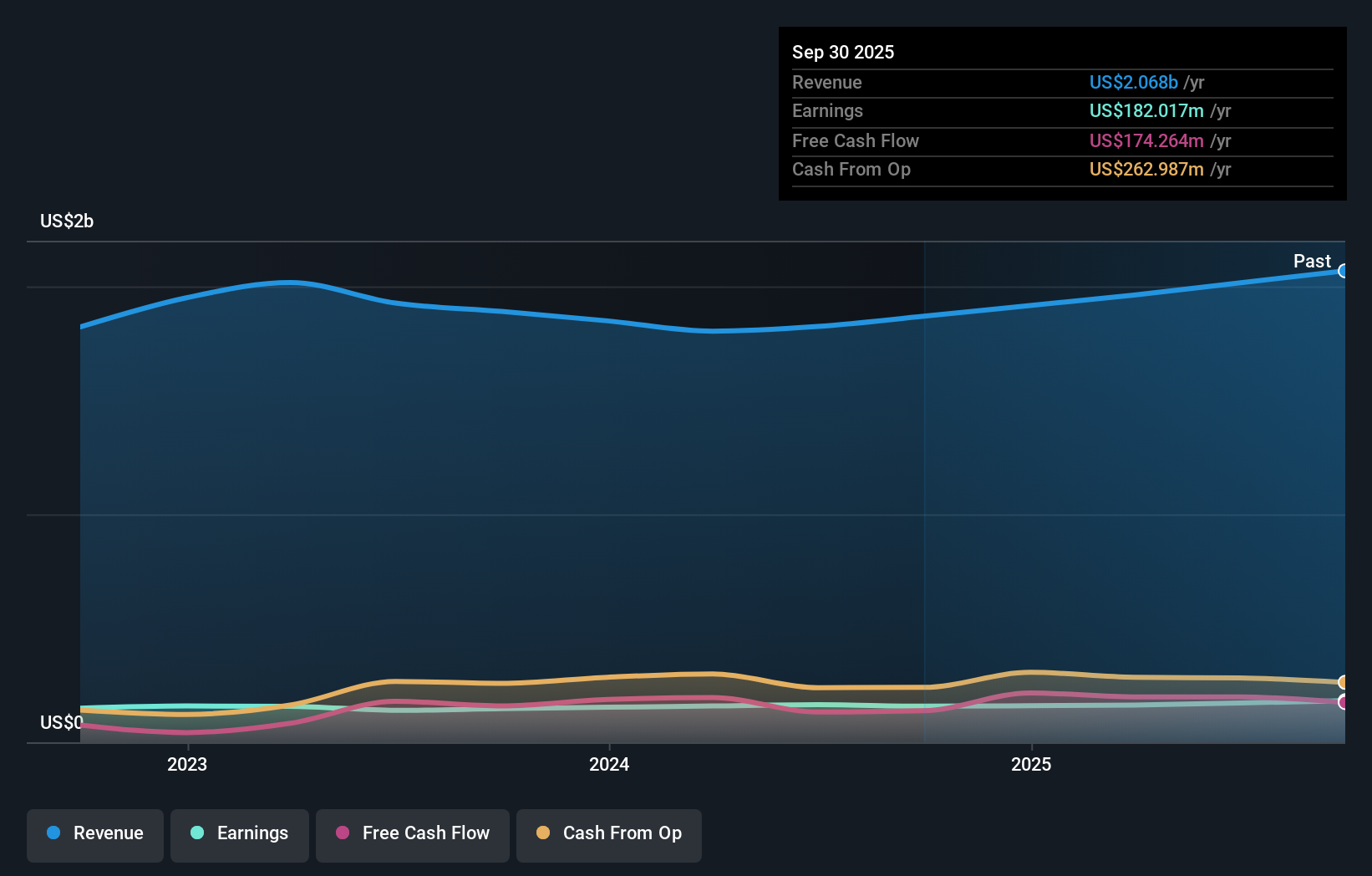

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Enaex's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Enaex the TSR over the last 5 years was 349%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Enaex shareholders have received a total shareholder return of 74% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 35%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Enaex .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chilean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enaex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENAEX

Enaex

Together its subsidiaries, engages in the production and sale of explosives in Chile and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026