Salmones Camanchaca's(SNSE:SALMOCAM) Share Price Is Down 21% Over The Past Year.

While it may not be enough for some shareholders, we think it is good to see the Salmones Camanchaca S.A. (SNSE:SALMOCAM) share price up 22% in a single quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 21% in the last year, significantly under-performing the market.

View our latest analysis for Salmones Camanchaca

Salmones Camanchaca recorded just US$328,766,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Salmones Camanchaca will significantly advance the business plan before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

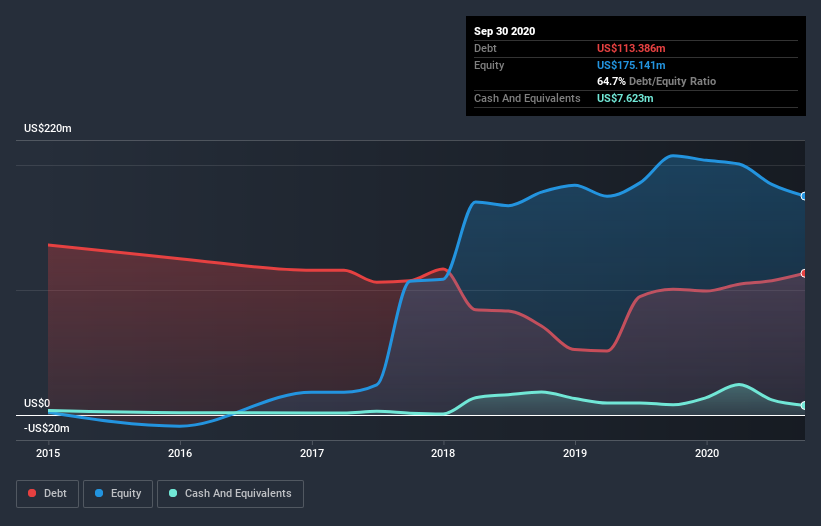

Our data indicates that Salmones Camanchaca had US$195m more in total liabilities than it had cash, when it last reported in September 2020. That puts it in the highest risk category, according to our analysis. But since the share price has dived 21% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how Salmones Camanchaca's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Salmones Camanchaca, it has a TSR of -16% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We doubt Salmones Camanchaca shareholders are happy with the loss of 16% over twelve months (even including dividends). That falls short of the market, which lost 2.2%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 22% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Salmones Camanchaca better, we need to consider many other factors. Take risks, for example - Salmones Camanchaca has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

When trading Salmones Camanchaca or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:SALMOCAM

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives