- Chile

- /

- Capital Markets

- /

- SNSE:CUPRUM

Market Participants Recognise Administradora de Fondos de Pensiones Cuprum S.A.'s (SNSE:CUPRUM) Earnings Pushing Shares 29% Higher

Administradora de Fondos de Pensiones Cuprum S.A. (SNSE:CUPRUM) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 32%.

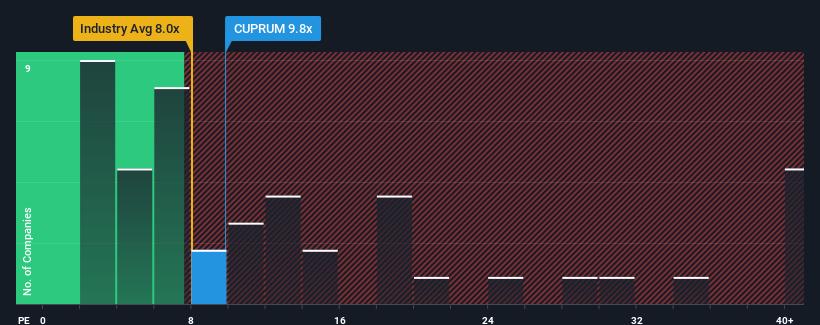

In spite of the firm bounce in price, there still wouldn't be many who think Administradora de Fondos de Pensiones Cuprum's price-to-earnings (or "P/E") ratio of 9.8x is worth a mention when the median P/E in Chile is similar at about 8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen at a steady rate over the last year for Administradora de Fondos de Pensiones Cuprum, which is generally not a bad outcome. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Administradora de Fondos de Pensiones Cuprum

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Administradora de Fondos de Pensiones Cuprum would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 7.5% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 84% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 22% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Administradora de Fondos de Pensiones Cuprum's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Administradora de Fondos de Pensiones Cuprum's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Administradora de Fondos de Pensiones Cuprum maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Administradora de Fondos de Pensiones Cuprum, and understanding should be part of your investment process.

If you're unsure about the strength of Administradora de Fondos de Pensiones Cuprum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:CUPRUM

Administradora de Fondos de Pensiones Cuprum

Administradora de Fondos de Pensiones Cuprum S.A.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives