- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Undiscovered Gems in Switzerland to Watch This August 2024

Reviewed by Simply Wall St

Despite a mid-session setback, the Switzerland market ended on a firm note on Tuesday as stocks found some support in late afternoon trades. The benchmark SMI closed with a gain of 54.43 points or 0.46% at 11,928.14, reflecting resilience amid mixed corporate earnings reports. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors looking to capitalize on potential growth and innovation within the Swiss market.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Jungfraubahn Holding | 17.74% | 3.55% | 9.25% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.14 billion.

Operations: The company generates revenue from three primary regions: Americas (CHF350.89 million), Asia-Pacific (CHF271.44 million), and Europe, Middle East, and Africa (CHF431.78 million).

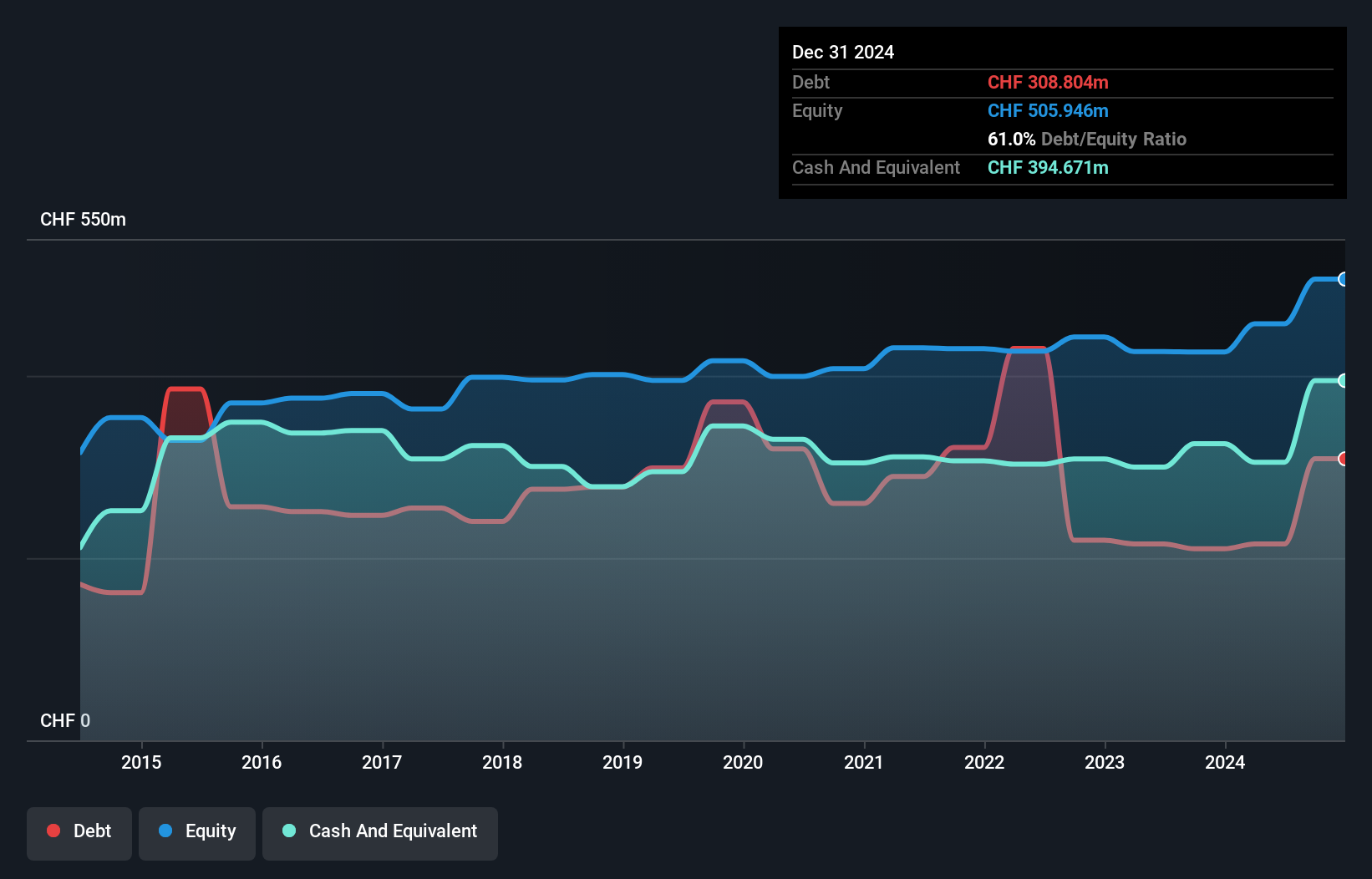

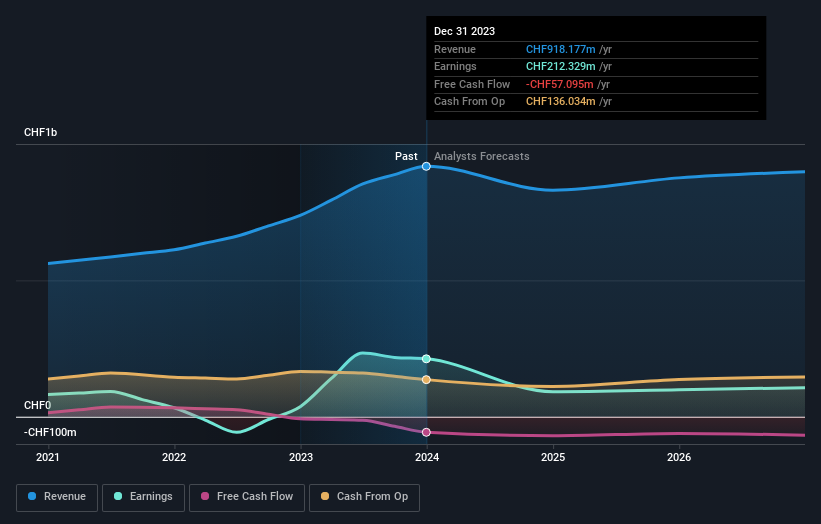

Compagnie Financière Tradition (CFT) has seen its debt-to-equity ratio improve from 69.2% to 49.3% over the past five years, signaling better financial health. Trading at 39.4% below its estimated fair value, it offers potential upside for investors. Despite a volatile share price in recent months, CFT's earnings have grown by an average of 11.5% annually over the last five years and remain profitable with high-quality earnings and positive free cash flow.

- Take a closer look at Compagnie Financière Tradition's potential here in our health report.

Understand Compagnie Financière Tradition's track record by examining our Past report.

Romande Energie Holding (SWX:REHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Romande Energie Holding SA focuses on the production, distribution, and marketing of electrical and thermal energy in Switzerland, with a market cap of CHF1.41 billion.

Operations: Romande Energie Holding SA generates revenue primarily from its Energy Solutions segment (CHF539.70 million) and Grids segment (CHF311.94 million). The company also has significant contributions from Romande Energie Services (CHF163.79 million) and Corporate activities (CHF68.28 million).

Romande Energie Holding, a small Swiss utility company, has seen its earnings soar by 476.6% over the past year, outpacing the Electric Utilities industry growth of 7.6%. Despite this impressive performance, earnings are expected to decline by an average of 22.7% per year for the next three years. The company’s debt to equity ratio rose from 6% to 9.2% over five years; however, with a net debt to equity ratio of just 3.8%, it's considered satisfactory and interest payments are well covered at 33.7x EBIT coverage.

- Click here to discover the nuances of Romande Energie Holding with our detailed analytical health report.

Gain insights into Romande Energie Holding's past trends and performance with our Past report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.68 billion.

Operations: Revenue streams for TX Group AG include Tamedia (CHF446.40 million), Goldbach (CHF274.70 million), 20 Minutes (CHF118.40 million), TX Markets (CHF133.80 million), and Groups & Ventures (CHF159.40 million).

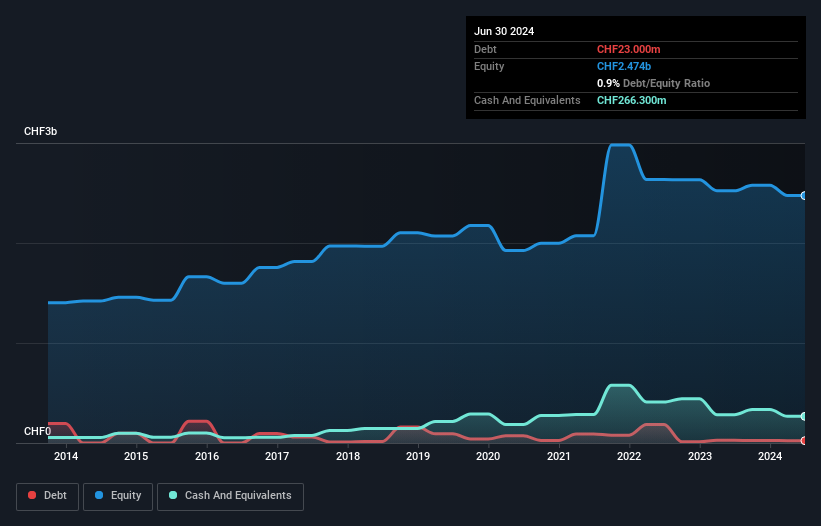

TX Group, a promising name in the Swiss market, has recently turned profitable, making it an intriguing prospect. The company trades at 70.8% below its estimated fair value and boasts high-quality earnings. Over the past five years, TXGN's debt to equity ratio improved from 7.6% to 1%, reflecting better financial health. With earnings forecasted to grow by 21.22% annually and more cash than total debt, TXGN appears well-positioned for future growth in the media industry.

- Get an in-depth perspective on TX Group's performance by reading our health report here.

Examine TX Group's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Dive into all 18 of the SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.