As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are keenly observing how these factors influence overall market sentiment. With U.S. job growth slowing and manufacturing showing signs of recovery, dividend stocks continue to appeal as a potential source of steady income amidst fluctuating indices. In this environment, selecting dividend stocks that demonstrate resilience and consistent payouts can be an effective strategy for those seeking stability in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

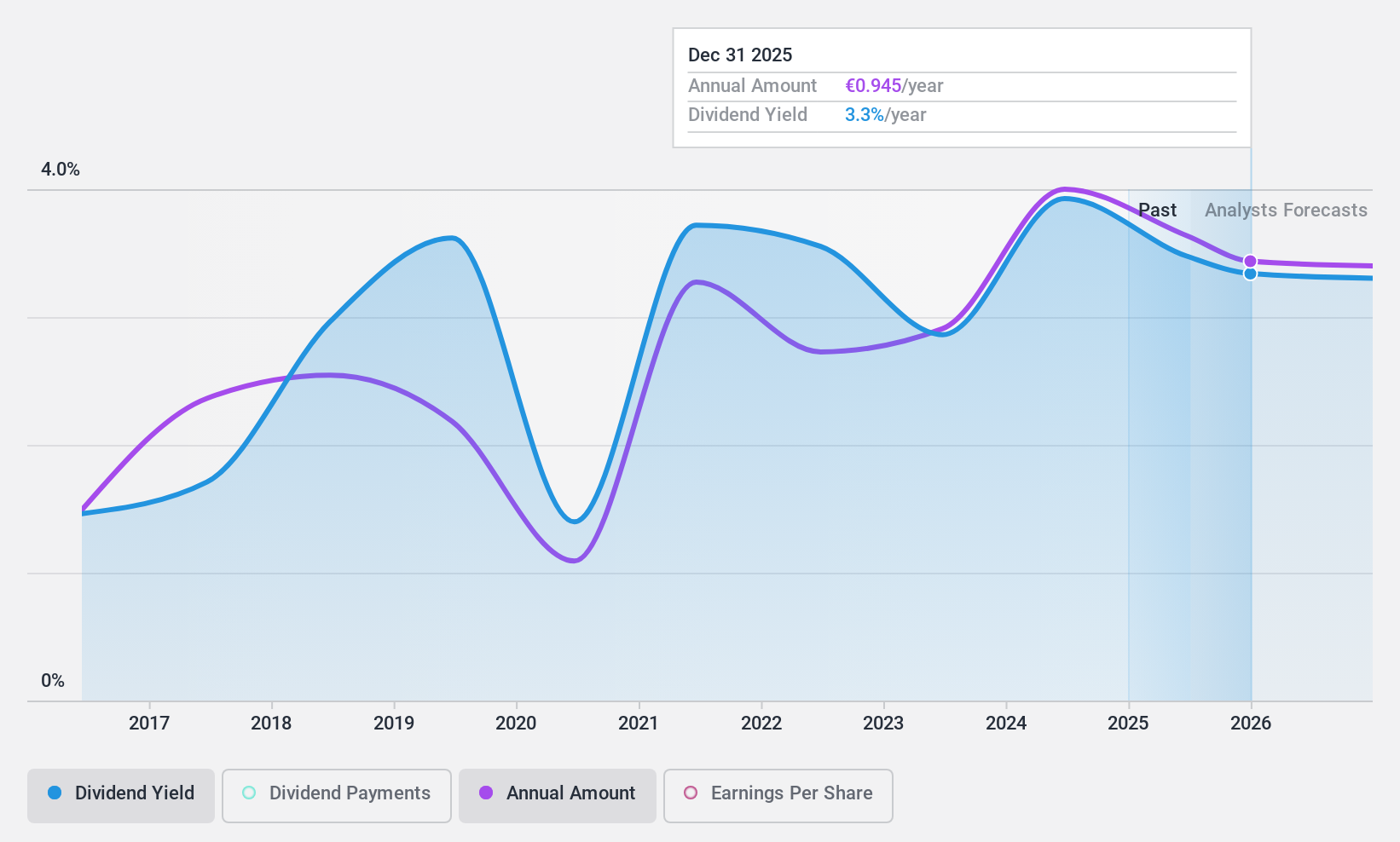

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. is a company that produces and sells food packaging products both in France and internationally, with a market cap of €500.96 million.

Operations: Groupe Guillin S.A.'s revenue is primarily derived from the Packaging Sector, contributing €814.51 million, and the Material Sector, adding €50.85 million.

Dividend Yield: 4.1%

Groupe Guillin's dividend yield of 4.07% falls short of the top quartile in the French market. Despite earnings growth of 6.2% over the last year, its dividends have been unreliable over a decade due to volatility and lack of consistent growth. However, with low payout ratios—29.2% for earnings and 30.3% for cash flows—dividends are sustainable from both profits and cash flows, offering some reassurance to investors despite an unstable track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Groupe Guillin.

- In light of our recent valuation report, it seems possible that Groupe Guillin is trading behind its estimated value.

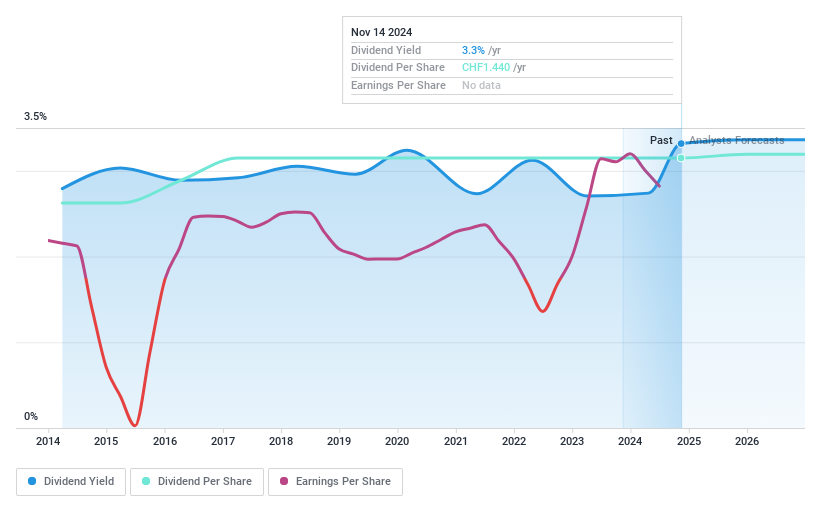

Romande Energie Holding (SWX:REHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Romande Energie Holding SA operates in Switzerland, focusing on the production, distribution, and marketing of electrical and thermal energy, with a market cap of CHF1.20 billion.

Operations: Romande Energie Holding SA's revenue is primarily derived from its Grids segment (CHF318.28 million), Energy Solutions (CHF486.76 million), and Romande Energie Services (CHF157.72 million), with additional contributions from the Corporate segment (CHF59.89 million).

Dividend Yield: 3.1%

Romande Energie Holding's dividend yield of 3.06% is below the Swiss top quartile, and despite stable growth over the past decade, dividends are not covered by free cash flows. The payout ratio of 23.5% suggests earnings cover dividends well, yet sustainability concerns arise due to forecasted earnings decline of 15.1% annually over three years. Trading at a favorable price-to-earnings ratio (7.7x) compared to the market, recent executive changes may impact future performance stability.

- Unlock comprehensive insights into our analysis of Romande Energie Holding stock in this dividend report.

- Our valuation report unveils the possibility Romande Energie Holding's shares may be trading at a discount.

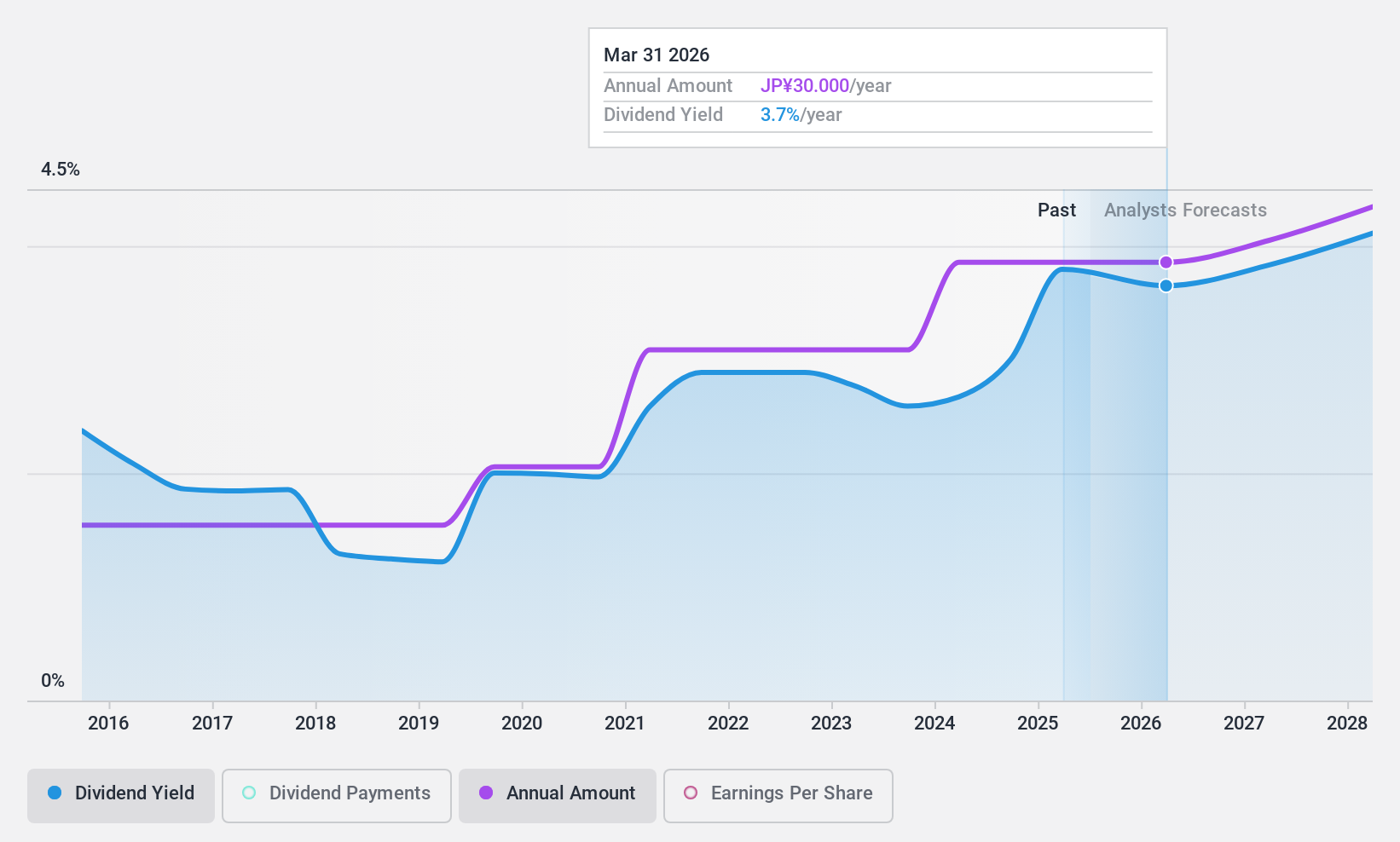

Rengo (TSE:3941)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rengo Co., Ltd., along with its subsidiaries, manufactures and sells paperboard and packaging-related products both in Japan and internationally, with a market cap of ¥202.96 billion.

Operations: Rengo Co., Ltd. generates revenue through its core operations in manufacturing and selling paperboard and packaging-related products, serving both domestic and international markets.

Dividend Yield: 3.7%

Rengo's dividend yield of 3.66% is slightly below the top quartile in Japan, yet it offers stability with consistent growth over the past decade. The payout ratio of 28.2% and cash payout ratio of 38.5% indicate dividends are well covered by earnings and cash flows, despite high debt levels. Trading at a favorable price-to-earnings ratio (7.7x), Rengo presents good value compared to peers, though profit margins have decreased from last year.

- Click here to discover the nuances of Rengo with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Rengo's share price might be too pessimistic.

Seize The Opportunity

- Dive into all 1960 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALGIL

Groupe Guillin

Produces and sells food packaging products in France and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives