- Switzerland

- /

- Electric Utilities

- /

- SWX:REHN

Here's Why We Don't Think Romande Energie Holding's (VTX:HREN) Statutory Earnings Reflect Its Underlying Earnings Potential

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Romande Energie Holding's (VTX:HREN) statutory profits are a good guide to its underlying earnings.

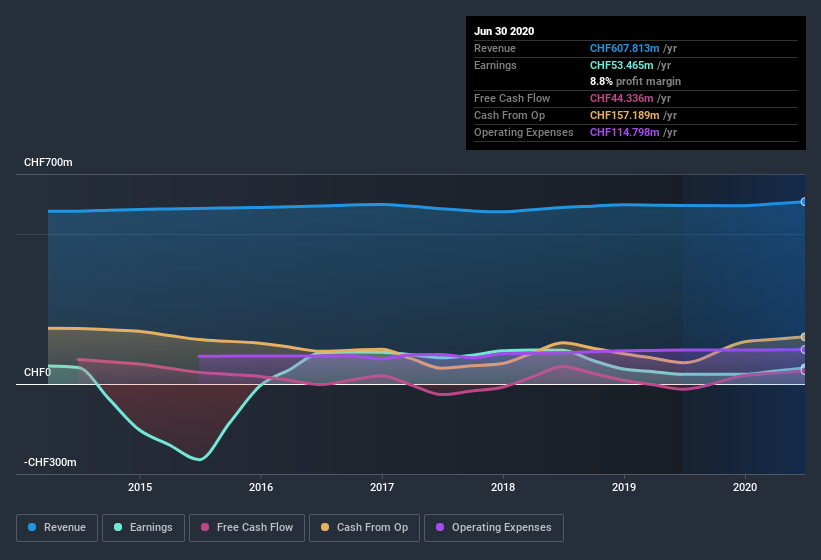

We like the fact that Romande Energie Holding made a profit of CHF53.5m on its revenue of CHF607.8m, in the last year. While it managed to grow its revenue over the last three years, its profit has moved in the other direction, as you can see in the chart below.

View our latest analysis for Romande Energie Holding

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, we think it is well worth considering the impact that unusual items and a spike in non-operating revenue have had on Romande Energie Holding's statutory profit result. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that Romande Energie Holding saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from CHF21.7m last year to CHF57.6m this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

How Do Unusual Items Influence Profit?

As well as that spike in non-operating revenue, we should also consider the CHF19m boost to profit coming from unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. We can see that Romande Energie Holding's positive unusual items were quite significant relative to its profit in the year to June 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Romande Energie Holding's Profit Performance

In its last report Romande Energie Holding benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated and everything else is equal. For the reasons mentioned above, we think that a perfunctory glance at Romande Energie Holding's statutory profits might make it look better than it really is on an underlying level. So while earnings quality is important, it's equally important to consider the risks facing Romande Energie Holding at this point in time. In terms of investment risks, we've identified 2 warning signs with Romande Energie Holding, and understanding these bad boys should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Romande Energie Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:REHN

Romande Energie Holding

Engages in the production, distribution, and marketing of electrical and thermal energy in Switzerland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026