Market Cool On SoftwareOne Holding AG's (VTX:SWON) Revenues

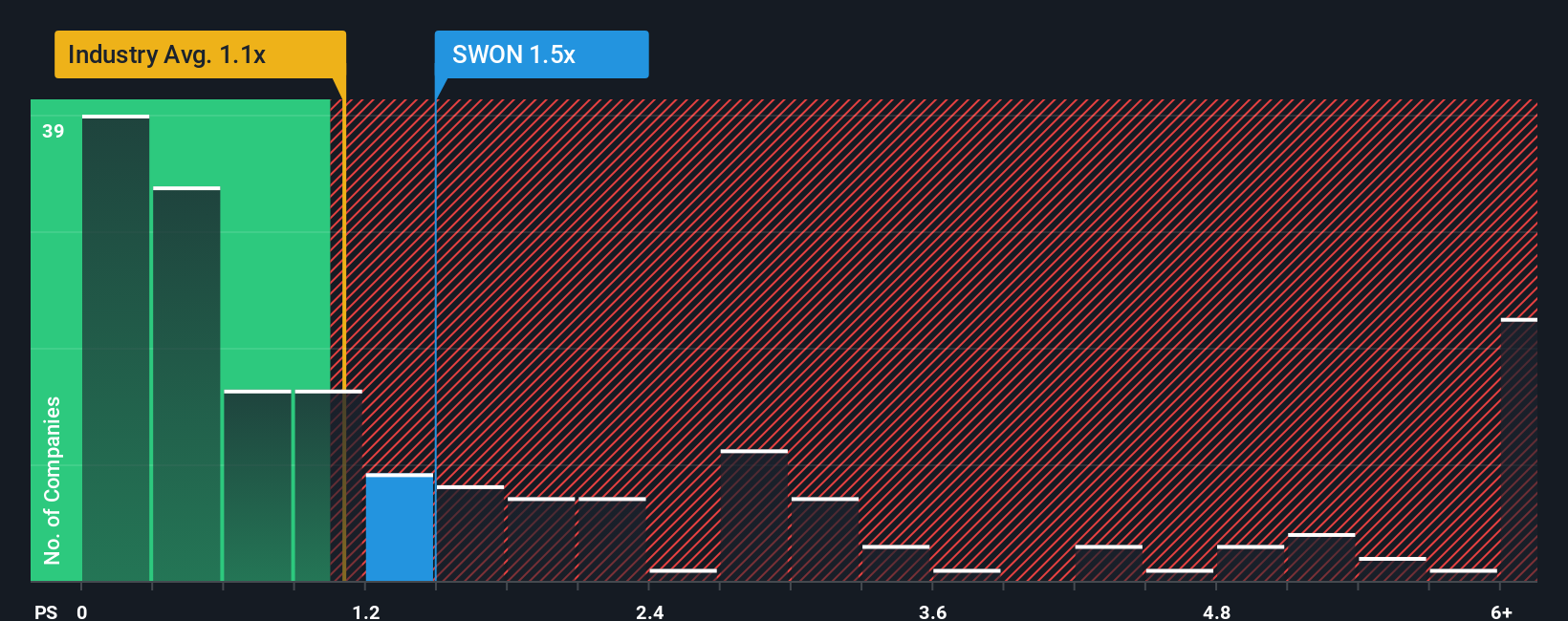

With a median price-to-sales (or "P/S") ratio of close to 1.6x in the Electronic industry in Switzerland, you could be forgiven for feeling indifferent about SoftwareOne Holding AG's (VTX:SWON) P/S ratio of 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for SoftwareOne Holding

How Has SoftwareOne Holding Performed Recently?

Recent revenue growth for SoftwareOne Holding has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on SoftwareOne Holding will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like SoftwareOne Holding's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 11% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 24% each year over the next three years. With the industry only predicted to deliver 14% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that SoftwareOne Holding's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On SoftwareOne Holding's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, SoftwareOne Holding's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 3 warning signs for SoftwareOne Holding (of which 2 are potentially serious!) you should know about.

If you're unsure about the strength of SoftwareOne Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SWON

SoftwareOne Holding

Provides software and cloud solutions in Switzerland, Germany, Austria, rest of Europe, Mauritius, South Africa, the United States, Canada, Latin America, the Asia Pacific, Dubai, and Qatar.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)