The Swiss market recently experienced a downturn, with the benchmark SMI closing 0.8% lower as investors remained cautious and sought clearer market directions amidst economic uncertainties. In such an environment, identifying high-growth tech stocks requires focusing on companies that demonstrate resilience and innovation, offering potential for robust performance even when broader market sentiment is subdued.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.81% | 20.48% | ★★★★★☆ |

| Santhera Pharmaceuticals Holding | 26.80% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.58% | 26.76% | ★★★★☆☆ |

| Comet Holding | 20.11% | 48.25% | ★★★★★★ |

| SoftwareONE Holding | 8.55% | 52.33% | ★★★★★☆ |

| Cicor Technologies | 6.78% | 27.14% | ★★★★☆☆ |

| Addex Therapeutics | 26.51% | 33.31% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 33.25% | ★★★★★☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

| MCH Group | 4.41% | 100.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★★

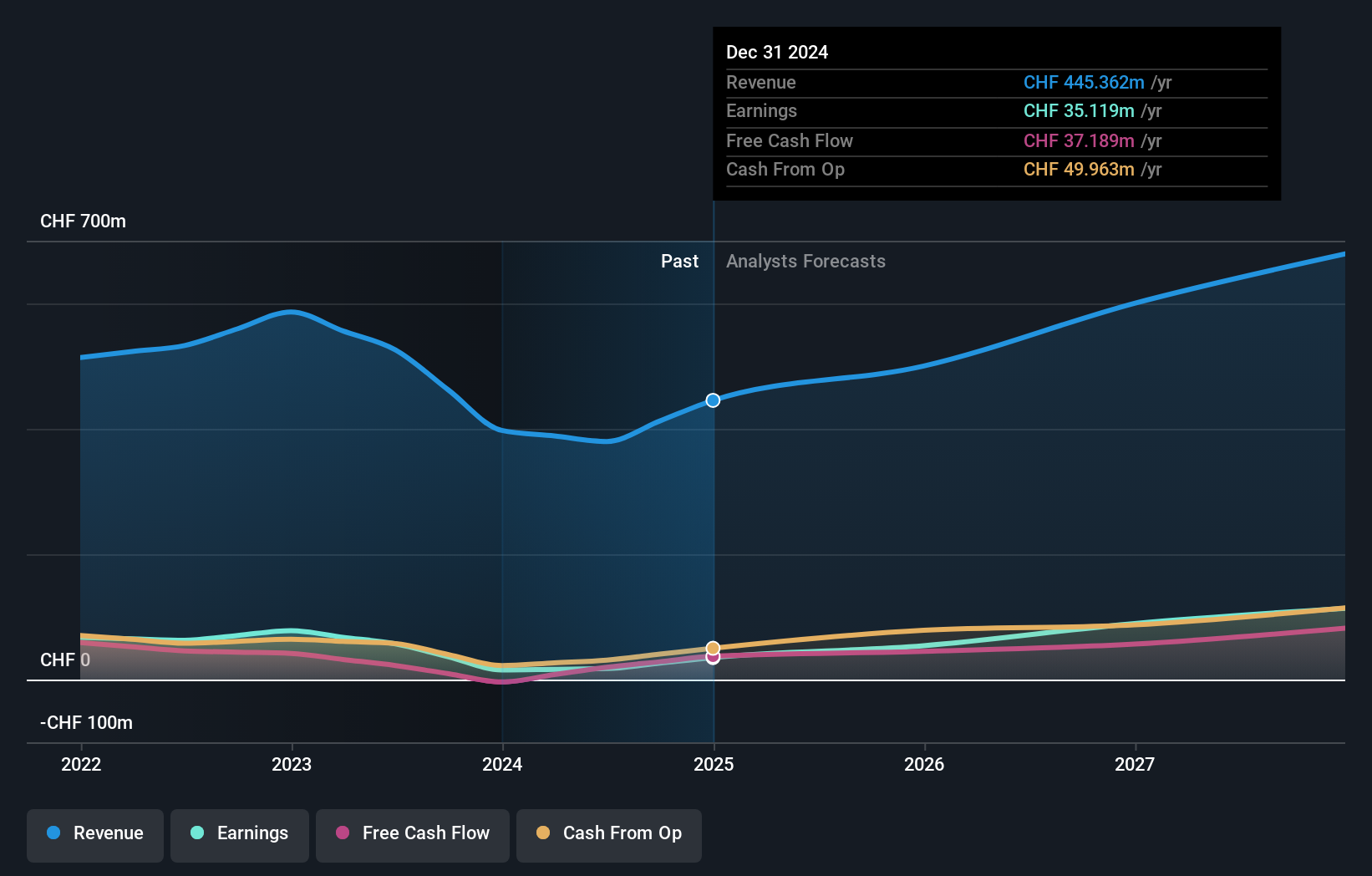

Overview: Comet Holding AG, with a market cap of CHF 2.25 billion, operates globally through its subsidiaries to deliver X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company generates revenue primarily from three segments: X-Ray Systems (CHF 115.34 million), Industrial X-Ray Modules (CHF 95.90 million), and Plasma Control Technologies (CHF 180.62 million).

Comet Holding AG, amid a challenging market, has shown resilience with a 108% increase in net income to CHF 4.06 million for the first half of 2024 from CHF 1.94 million in the previous year, reflecting robust operational improvements. This performance is underpinned by significant R&D investments, aligning with industry trends towards advanced tech deployment. Despite a slight dip in sales to CHF 189.32 million from CHF 207.03 million, the company's future revenue is expected to surge by an annual rate of 20.1%, outpacing the Swiss market's growth forecast of just over 4%. Moreover, Comet's earnings are projected to skyrocket by approximately 48% annually over the next three years, showcasing potential for substantial financial growth and industry impact.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

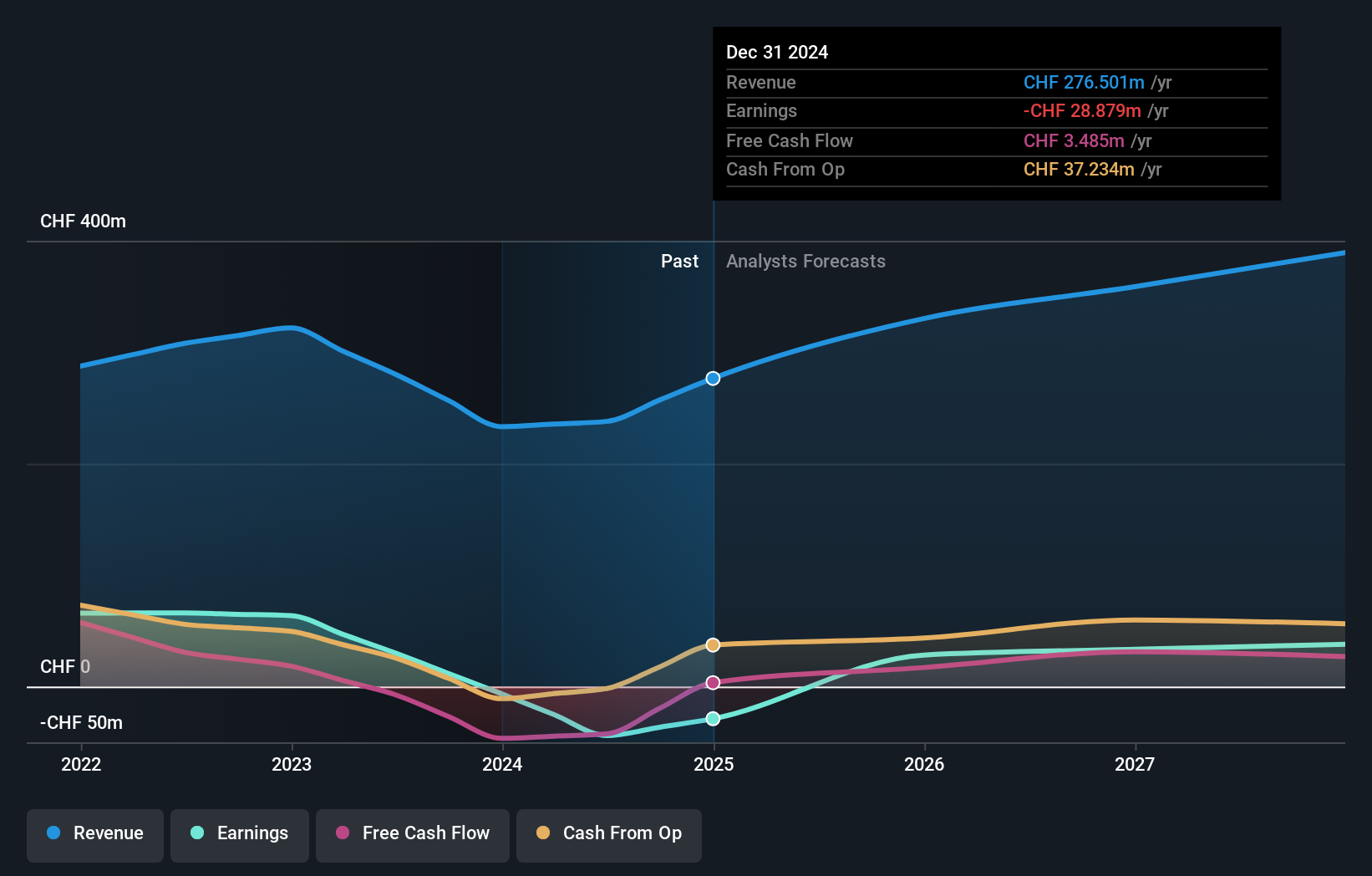

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components globally with a market capitalization of CHF1.04 billion.

Operations: Sensirion Holding AG generates revenue primarily from its sensor systems, modules, and components segment, totaling CHF237.91 million. The company operates on a global scale through its subsidiaries.

Sensirion Holding AG, navigating a challenging period with a net loss of CHF 36.01 million for the first half of 2024, contrasts starkly against its prior year's profit of CHF 1.43 million. Despite this setback, the firm is poised for recovery with anticipated earnings growth at an impressive rate of 102.7% annually over the next three years. This optimism is bolstered by Sensirion’s commitment to innovation, as evidenced by its strategic R&D investments which are integral to its long-term strategy in the high-tech ecosystem of Switzerland. With revenue growth projected at 13.9% per year, outpacing the Swiss market's average of 4.2%, Sensirion demonstrates potential resilience and adaptability in a swiftly evolving industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of Sensirion Holding.

Examine Sensirion Holding's past performance report to understand how it has performed in the past.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

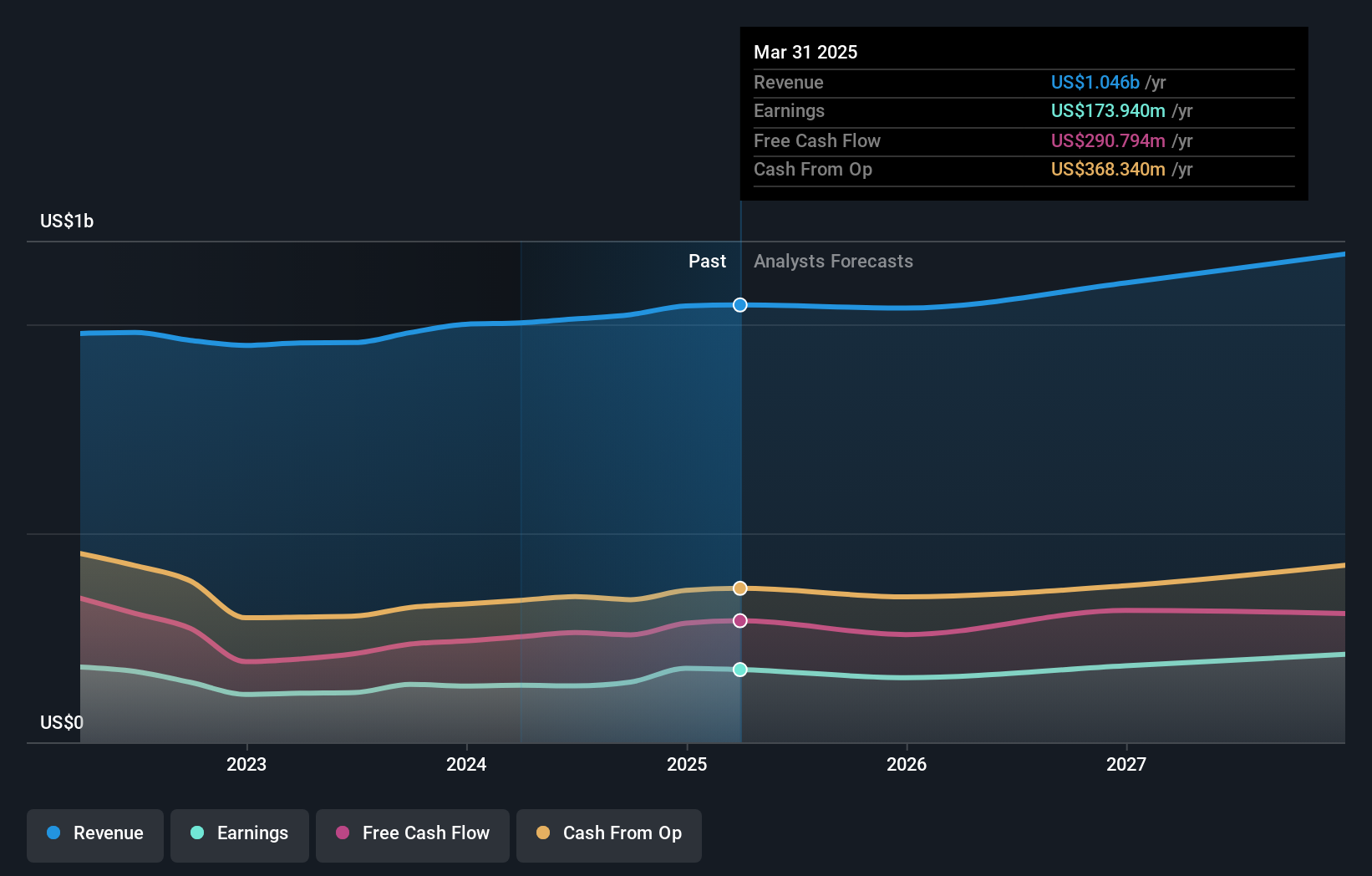

Overview: Temenos AG is a company that develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.71 billion.

Operations: The company generates revenue primarily through its Product segment, accounting for $879.99 million, and its Services segment, contributing $132.98 million.

Temenos AG, a Swiss tech firm specializing in banking software, is set to expand its influence with a 7.6% annual revenue growth rate, outstripping the broader Swiss market's 4.2%. This growth is supported by strategic executive appointments and a recent share buyback of CHF 200 million, reflecting confidence in operational stability and future prospects. Moreover, Temenos is intensifying its R&D efforts which currently stand at 14.4% of its revenue, underscoring a commitment to innovation and maintaining competitiveness in the fast-evolving financial technology landscape.

- Unlock comprehensive insights into our analysis of Temenos stock in this health report.

Gain insights into Temenos' past trends and performance with our Past report.

Summing It All Up

- Unlock more gems! Our SIX Swiss Exchange High Growth Tech and AI Stocks screener has unearthed 9 more companies for you to explore.Click here to unveil our expertly curated list of 12 SIX Swiss Exchange High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.