- Switzerland

- /

- Tech Hardware

- /

- SWX:LOGN

Evaluating Logitech After Shares Jump 6% and Outlook Remains Strong for 2025

Reviewed by Bailey Pemberton

If you are following Logitech International and weighing your next move, recent stock activity might have caught your eye. Over the past week, Logitech’s shares climbed 6.1%, building on a 6.8% gain in the last month. The stock has notched up an impressive 21.5% return since the start of the year. If you zoom out to the three-year picture, it is up a remarkable 116.8%. That kind of run naturally raises questions: is there even more growth ahead, or is now the moment to lock in gains?

Some investors attribute the latest rally to broader shifts in tech confidence and evolving demand for hybrid work tools. With home offices here to stay and digital collaboration no longer optional, momentum in the sector remains strong. Market sentiment seems to be warming, but there is always that underlying question of value. Are you paying too much, or is there further room to run?

On that front, valuation models give Logitech a score of 2 out of 6 for being undervalued. This suggests some checks flag the shares as attractive while others urge a closer look. However, standard valuation checklists only tell part of the story and sometimes miss nuances that matter.

Let’s break down what the main valuation approaches say about Logitech right now. Then, explore a unique perspective that could give you a clearer edge by the end of this article.

Logitech International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Logitech International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is one of the most widely used approaches for assessing a company’s intrinsic value. It estimates what a business is worth today by projecting its future free cash flows and then discounting them back to the present, reflecting the time value of money. This approach depends heavily on the company’s ability to consistently generate cash over many years.

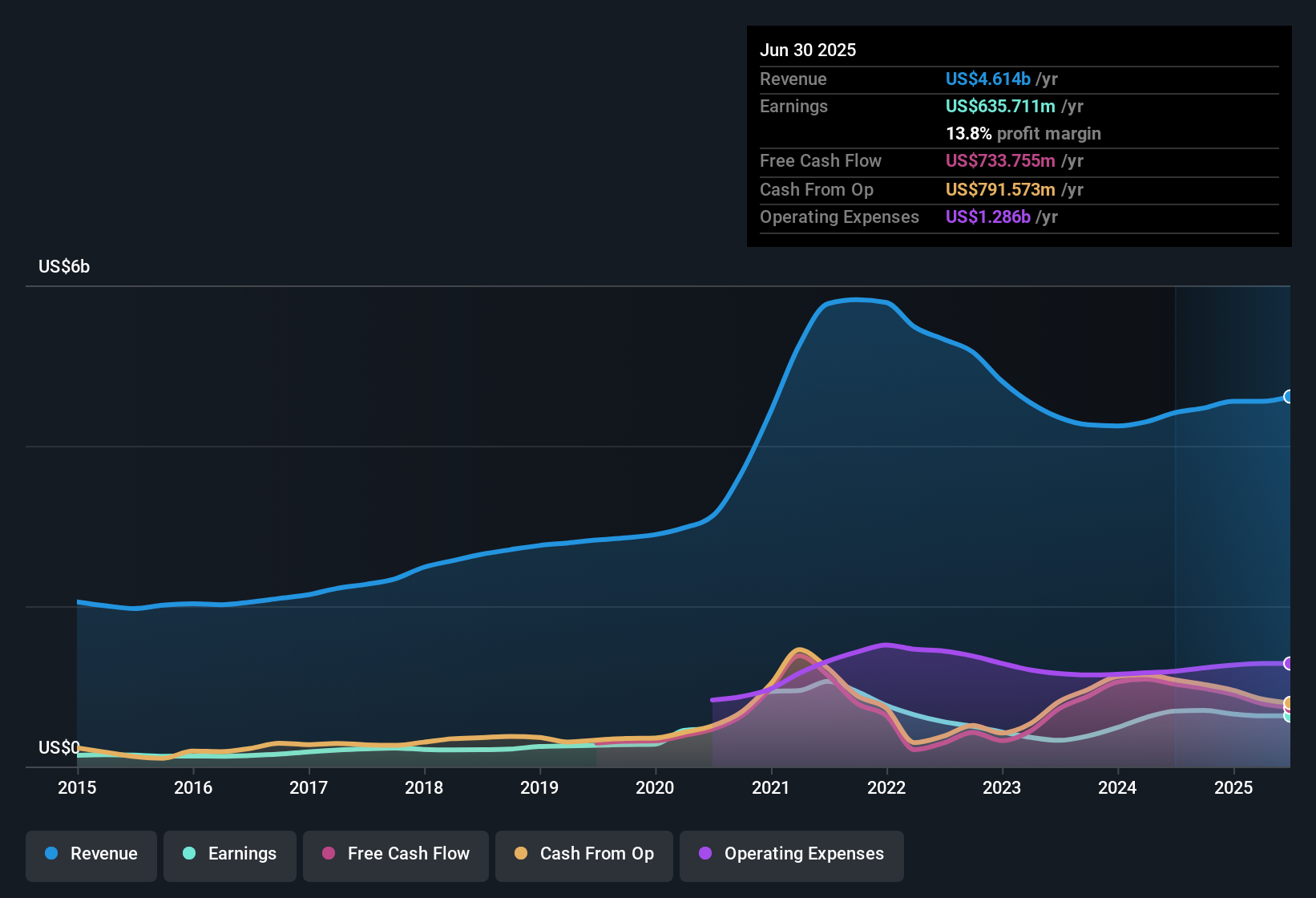

For Logitech International, the latest reported Free Cash Flow (FCF) stands at $722 million. Analysts have projected moderate growth, with FCF expected to reach $840 million by 2028. While analysts directly estimate figures for the initial five-year period, projections from 2029 onward rely on methodical extrapolations. Over the next decade, these cash flows are assumed to gradually increase, providing a foundation for the valuation.

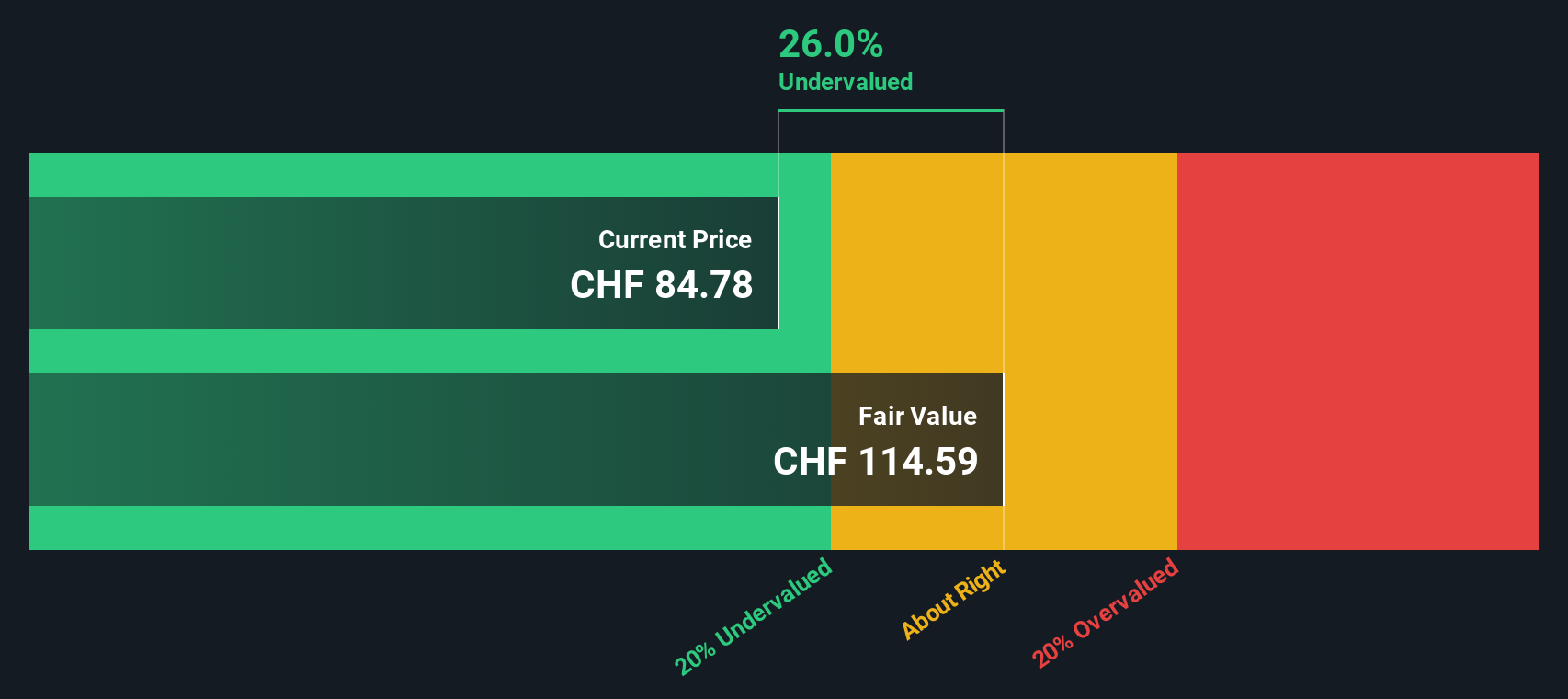

According to the DCF model, Logitech’s intrinsic value is calculated at $113.60 per share. Compared to its current market price, this implies the stock is trading at a 19.9% discount. In other words, it may be undervalued based on these cash flow assumptions, signaling potential opportunity for investors who trust the forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Logitech International is undervalued by 19.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Logitech International Price vs Earnings

For profitable companies like Logitech International, the Price-to-Earnings (PE) ratio is a widely accepted yardstick for valuation. It captures how much investors are willing to pay for each Swiss franc of earnings and serves as a quick gauge of whether a stock is expensive or a bargain relative to its profits.

A company’s PE ratio is not just a static number, though. Investors tend to pay higher PE ratios for businesses with greater growth prospects or lower risk, while slower-growing or riskier companies trade at lower multiples. This means context is crucial when evaluating Logitech’s current position.

Logitech trades at a PE ratio of 25x, which is marginally above the broader tech industry average of 24x. It is also just above both its peer group average of 20.6x and its own recent range. However, benchmarking against industry averages or direct competitors can miss important differences such as profitability, margins, and growth rate between companies.

This is where the Simply Wall St “Fair Ratio” comes in. Instead of taking a ‘one-size-fits-all’ approach, the Fair Ratio (29.2x for Logitech) blends in unique company factors like earnings growth, industry dynamics, profit margins, and even specific risks. This helps provide a more tailored and accurate yardstick for whether the current valuation makes sense.

Comparing Logitech’s actual PE of 25x to its calculated Fair Ratio of 29.2x, the stock appears to be trading at a discount to what is considered justified by its performance and profile. This leans toward the shares being undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Logitech International Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful approach in which you combine your view of a company’s future, such as its sales growth, profit margins, and risks, into a story that directly links to your own fair value estimate. This lets investors move beyond standard ratios and connect the company’s ongoing developments with tailored financial forecasts and valuations.

Narratives make investing more accessible and interactive. On the Simply Wall St Community page, millions of users can create their own Logitech International Narratives, update them when big news or earnings are released, and quickly see how their story compares to the market. Crucially, Narratives help you decide when to buy or sell by tracking the gap between your Fair Value and the current share price, keeping your investment rationale transparent and up-to-date as new data emerges.

For example, while some see robust global demand and product innovation sustaining Logitech’s upside, justifying a fair value as high as CHF111.66, others caution that competition and margin headwinds could mean a much lower value, down to CHF61.42. Narratives put these perspectives into clear numbers so your decision is based on your actual expectations, not just consensus.

Do you think there's more to the story for Logitech International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LOGN

Logitech International

Through its subsidiaries, designs, manufactures, and markets software-enabled hardware solutions that connect people to working, creating, and gaming worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives