- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

High Growth Tech Stocks To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and small-cap stocks lagging behind their larger counterparts, investors are closely monitoring the tech sector for high-growth opportunities. In this environment, a good stock is often characterized by strong innovation potential and resilience to economic fluctuations, making certain tech companies particularly intriguing for those exploring growth prospects in February 2025.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Xspray Pharma | 127.78% | 104.91% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.56 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €830.16 million.

VusionGroup, despite its current unprofitability, is poised for significant growth with a projected annual revenue increase of 20.8% and earnings expected to surge by 62.78% per year. This growth trajectory is notably higher than the broader French market's forecast of 5.8%. The recent partnership with The Fresh Market to deploy Vusion 360 technology across all locations underscores their innovative edge in digital retail solutions, enhancing inventory management and operational efficiency through AI and IoT integrations. This strategic move not only expands their North American presence but also aligns with increasing demand for tech-driven retail enhancements, setting a robust foundation for future profitability and market penetration.

- Get an in-depth perspective on VusionGroup's performance by reading our health report here.

Understand VusionGroup's track record by examining our Past report.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) specializes in providing products that facilitate communication and information sharing for industrial equipment globally, with a market capitalization of approximately SEK25.26 billion.

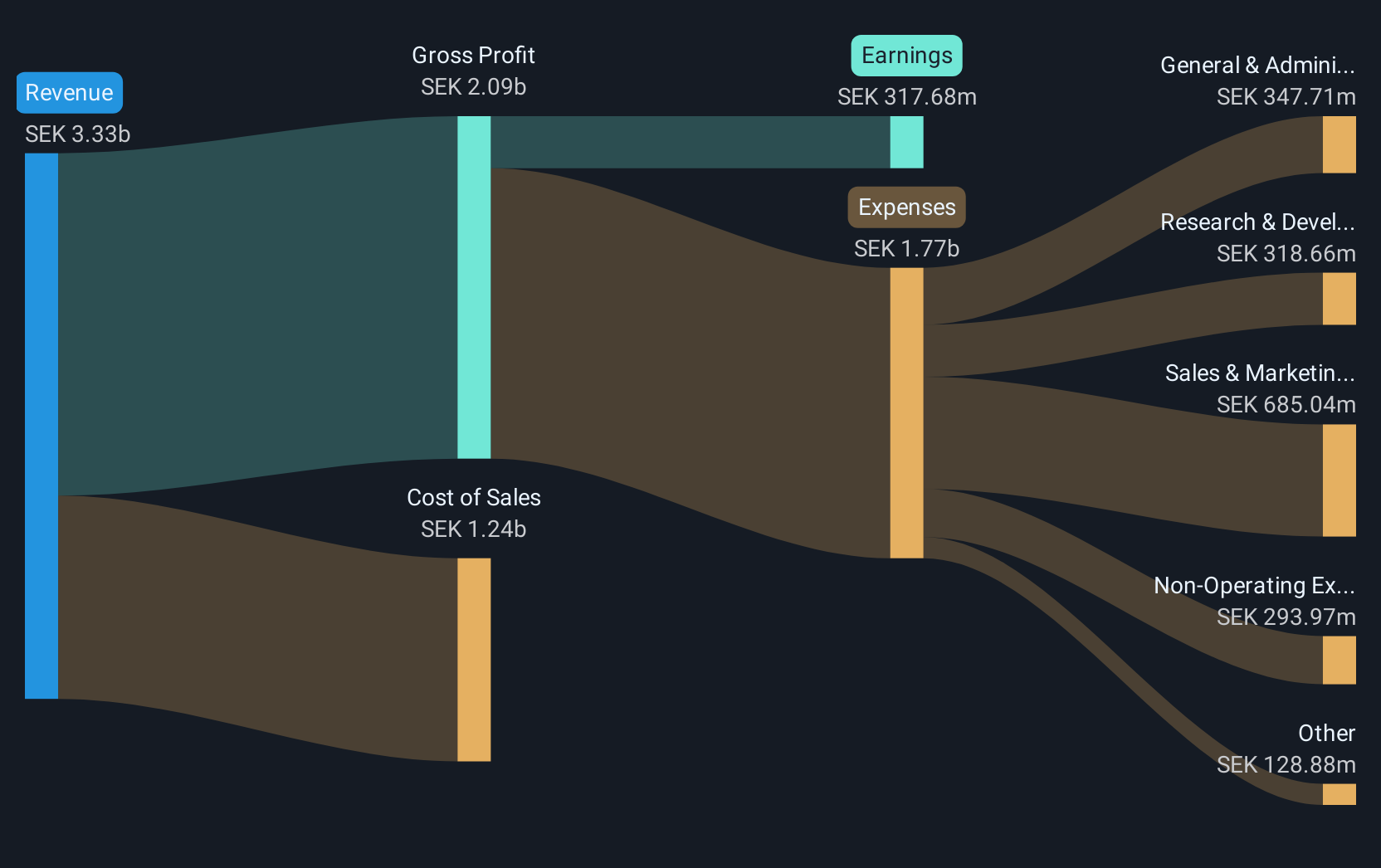

Operations: HMS Networks AB (publ) generates revenue primarily through its wireless communications equipment segment, which accounted for SEK3.06 billion. The company's operations focus on enabling connectivity and data exchange for industrial machinery worldwide.

HMS Networks, navigating a challenging year with a net income decrease to SEK 310 million from SEK 571 million, still forecasts robust annual earnings growth at 32.7%, outpacing the Swedish market's expectation of 10.5%. Despite a slight uptick in sales to SEK 3.06 billion, up from SEK 3.03 billion, the company is optimistic about improved performance in the latter half of 2025. This resilience is further underscored by strategic acquisitions aimed at long-term value creation, although these moves led to a suspension of dividends for the year.

- Click to explore a detailed breakdown of our findings in HMS Networks' health report.

Assess HMS Networks' past performance with our detailed historical performance reports.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

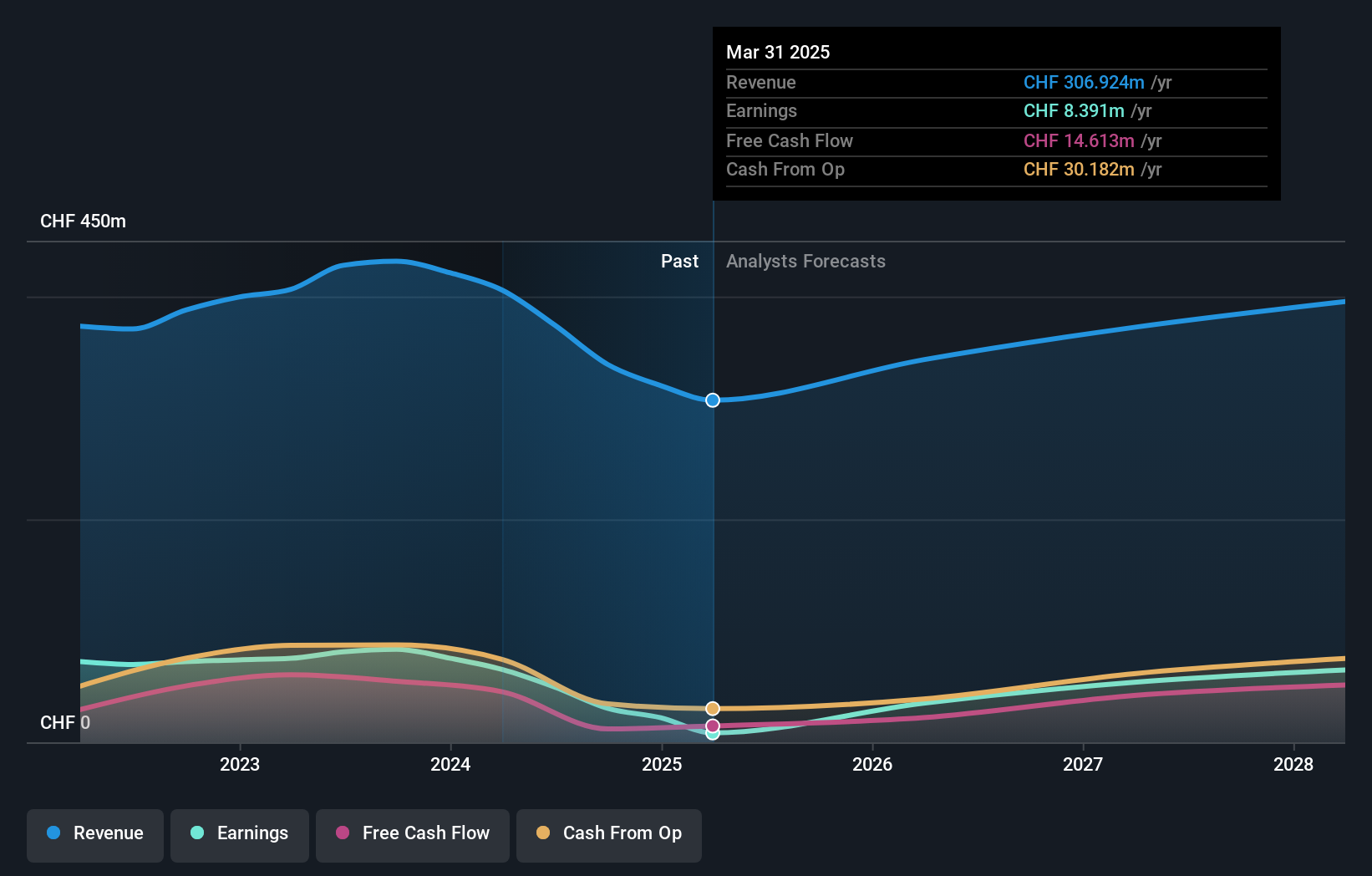

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF1.01 billion.

Operations: The company focuses on delivering electrical measurement solutions across multiple global markets. It operates with a market capitalization of CHF1.01 billion, emphasizing its significant presence in the industry.

Amidst a challenging backdrop, LEM Holding SA has demonstrated resilience with a strategic executive reshuffle poised to strengthen its financial and operational leadership. Despite experiencing a significant drop in sales to CHF 230.88 million and net income to CHF 12.09 million for the nine months ending December 2024, the company's forward-looking indicators suggest robust potential. Notably, LEM's anticipated revenue and earnings growth rates stand at 13.3% and an impressive 56.8% annually, respectively, outpacing broader market expectations significantly. This growth is underpinned by high-quality earnings and an expected return on equity of 27.5% in three years, signaling strong future prospects despite current volatility and high debt levels.

- Navigate through the intricacies of LEM Holding with our comprehensive health report here.

Examine LEM Holding's past performance report to understand how it has performed in the past.

Summing It All Up

- Explore the 1202 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Engages in the provision of digitalization solutions for commerce in Europe, Asia, and North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)