- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A020150

High Growth Tech Stocks Including These 3 Promising Names

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment has been influenced by the Federal Reserve's recent rate cut and cautious outlook for future reductions, alongside concerns over a potential government shutdown in the United States. Despite these challenges, economic indicators such as robust third-quarter GDP growth and retail sales suggest underlying strength in certain sectors. In this context, identifying high-growth tech stocks requires focusing on companies that demonstrate resilience and adaptability to navigate these complex economic conditions while capitalizing on technological advancements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pearl Abyss Corp. is a company focused on software development for games, with a market capitalization of ₩1.69 trillion.

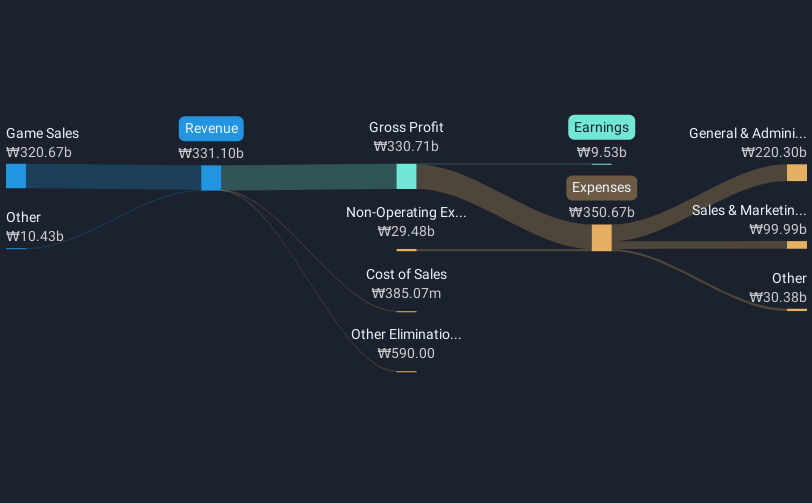

Operations: Pearl Abyss generates revenue primarily through game sales, amounting to ₩320.67 billion. The company's focus on software development for games contributes significantly to its financial performance.

Pearl Abyss, having recently turned profitable, showcases a robust trajectory with its annual revenue and earnings growth rates at 23.3% and 78.4% respectively, significantly outpacing the broader KR market averages of 8.8% and 29.4%. This performance is underpinned by strategic R&D investments, crucial for maintaining its competitive edge in the tech-driven entertainment sector. With an upcoming earnings call on November 12, the company's focus on innovation could further solidify its market position, despite a forecasted low return on equity of 11.8% in three years' time.

- Click here and access our complete health analysis report to understand the dynamics of Pearl Abyss.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation specializes in the production and sale of elecfoils both domestically in Korea and internationally, with a market capitalization of approximately ₩1.14 trillion.

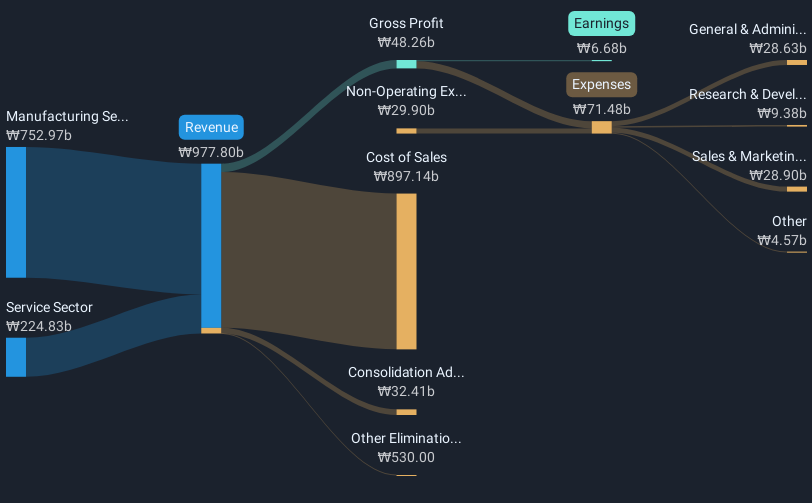

Operations: Lotte Energy Materials Corporation generates revenue primarily from its manufacturing sector, contributing ₩752.97 billion, and a smaller portion from the service sector at ₩224.83 billion. The company's financial structure includes a consolidation adjustment of -₩32.41 billion.

Lotte Energy Materials has demonstrated notable financial dynamics, with its revenue and earnings growth rates standing at 14.8% and 85.2% respectively, outstripping the broader KR market averages of 8.8% and 29.4%. This growth is fueled by strategic R&D investments which amounted to significant figures, aligning with its commitment to innovation in energy materials technology. The company's recent announcement of a KRW 150 billion private placement highlights its proactive approach to funding future expansions, potentially enhancing its competitive stance in the tech sector despite a forecasted low return on equity of 2.8% over three years.

- Unlock comprehensive insights into our analysis of Lotte Energy Materials stock in this health report.

Explore historical data to track Lotte Energy Materials' performance over time in our Past section.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market capitalization of CHF841.68 million.

Operations: LEM Holding focuses on providing electrical parameter measurement solutions across multiple global regions. The company operates with a market capitalization of CHF841.68 million, reflecting its presence and impact in the industry.

LEM Holding, despite a challenging fiscal half with sales dropping to CHF 156.55 million from CHF 223.34 million and net income falling to CHF 8.58 million from CHF 43.4 million, is poised for recovery with anticipated earnings growth of 37.8% annually over the next three years, outpacing the Swiss market's forecast of 11.6%. This optimism is supported by a robust projected annual revenue increase of 11.5%, signaling potential resilience and adaptability in its operational strategy amidst market fluctuations. The company's commitment to innovation through R&D could further solidify its competitive edge in the electronics sector.

- Navigate through the intricacies of LEM Holding with our comprehensive health report here.

Gain insights into LEM Holding's historical performance by reviewing our past performance report.

Key Takeaways

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1268 more companies for you to explore.Click here to unveil our expertly curated list of 1271 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A020150

Lotte Energy Materials

Produces and sells elecfoils in Korea and internationally.

Reasonable growth potential with adequate balance sheet.