- Switzerland

- /

- Biotech

- /

- SWX:BSLN

High Growth Tech Stocks In Switzerland To Watch

Reviewed by Simply Wall St

The Switzerland market ended higher on Monday, in line with trends across Europe, as investors looked ahead to key inflation data from the U.S. and the European Central Bank's monetary policy announcement this week. The benchmark SMI closed with a gain of 72.40 points or 0.61% at 11,980.64, reflecting positive sentiment despite some mid-session volatility. In this favorable market environment, high growth tech stocks in Switzerland present intriguing opportunities for investors looking to capitalize on innovation and robust economic indicators.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 9.02% | 17.07% | ★★★★☆☆ |

| ALSO Holding | 11.99% | 23.95% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 22.30% | 32.48% | ★★★★★★ |

| Comet Holding | 21.67% | 48.51% | ★★★★★★ |

| Temenos | 7.59% | 14.32% | ★★★★☆☆ |

| SoftwareONE Holding | 8.61% | 52.57% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| Basilea Pharmaceutica | 8.99% | 36.39% | ★★★★★☆ |

| Sensirion Holding | 13.96% | 104.68% | ★★★★☆☆ |

| MCH Group | 5.18% | 83.82% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company dedicated to developing products for oncology and anti-infective therapeutic areas, with a market cap of CHF544.84 million.

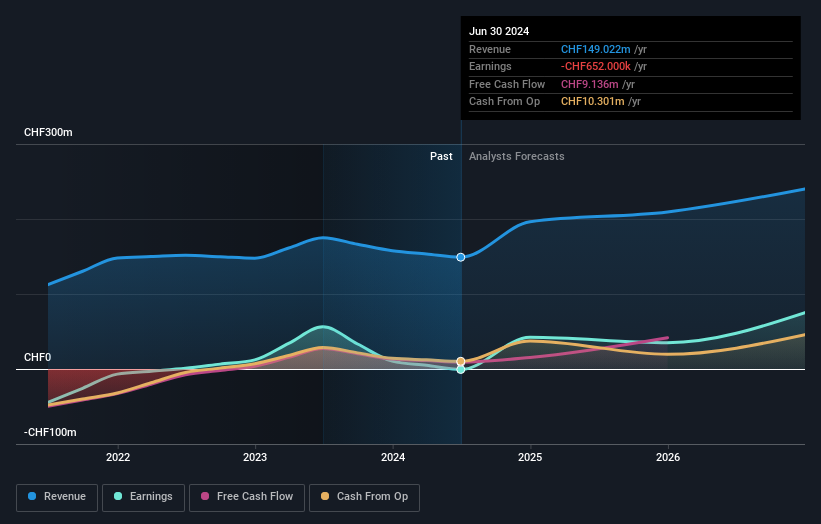

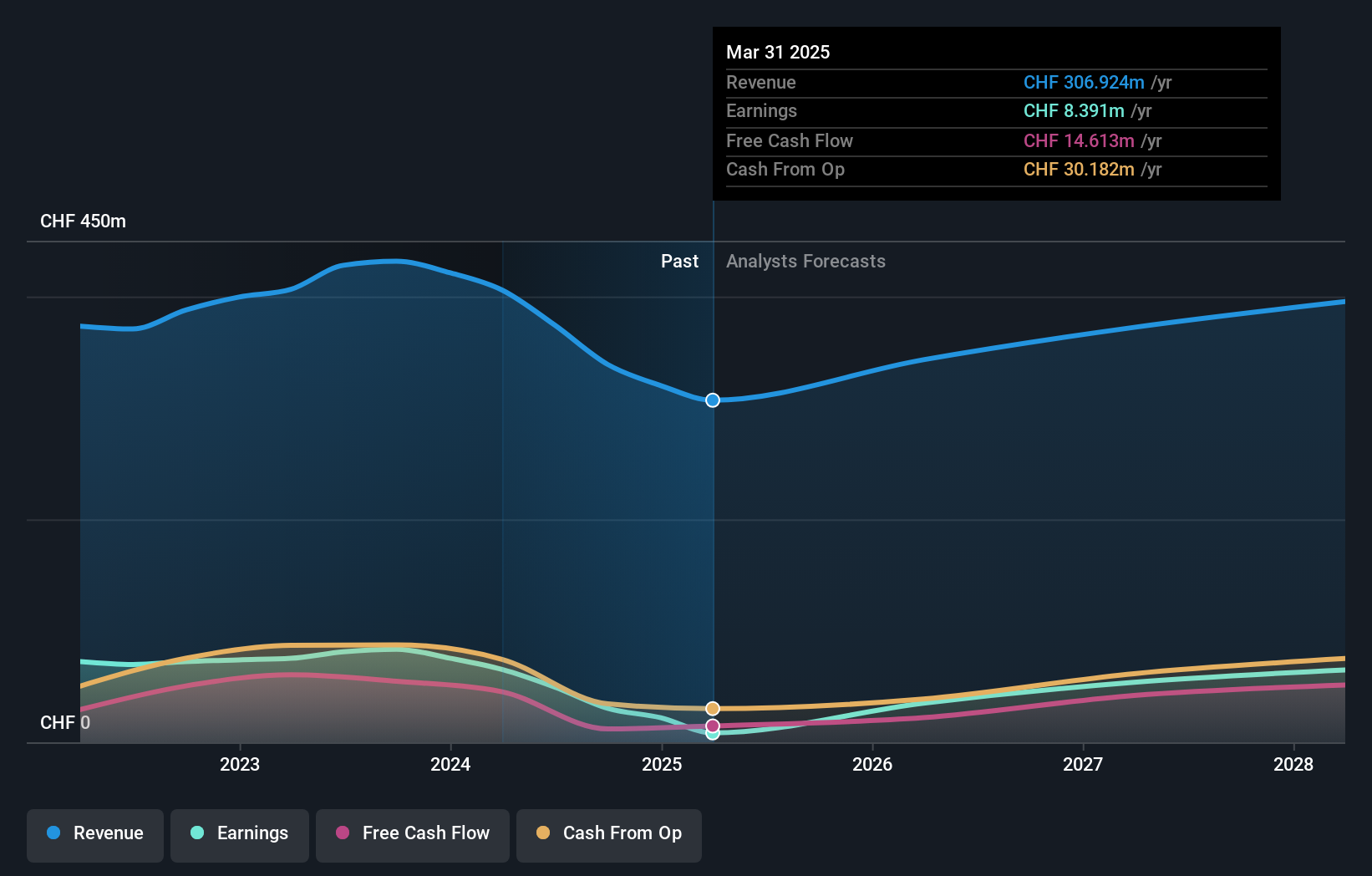

Operations: The company generates revenue primarily from the discovery, development, and commercialization of innovative pharmaceutical products, amounting to CHF149.02 million. It focuses on addressing medical needs in oncology and anti-infective therapeutic areas.

Basilea Pharmaceutica's revenue is projected to grow at 9% annually, outpacing the Swiss market's 4.4% growth rate. Despite being unprofitable, earnings are forecasted to surge by 36.39% per year over the next three years, indicating a strong recovery trajectory. Recent European Commission approval for Cresemba® in pediatric use extended its market exclusivity by two years and triggered a CHF 10 million milestone payment from Pfizer Inc., highlighting significant strides in their R&D efforts.

- Navigate through the intricacies of Basilea Pharmaceutica with our comprehensive health report here.

Assess Basilea Pharmaceutica's past performance with our detailed historical performance reports.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market cap of CHF1.44 billion.

Operations: LEM Holding SA focuses on providing electrical parameter measurement solutions globally. The company generates revenue from diverse geographical markets, including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

LEM Holding has seen its earnings forecasted to grow at 17.1% annually, significantly outpacing the Swiss market's average of 11.7%. Despite a challenging year with a 39% decline in earnings and sales dropping to CHF 80.96 million from CHF 112.34 million, the company's focus on innovation remains strong, evidenced by substantial R&D expenses contributing to future growth prospects. The company repurchased shares recently, signaling confidence in its long-term value proposition amidst high industry volatility.

- Click here to discover the nuances of LEM Holding with our detailed analytical health report.

Explore historical data to track LEM Holding's performance over time in our Past section.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.29 billion.

Operations: Temenos AG specializes in providing integrated banking software systems to financial institutions worldwide. The company's revenue is primarily derived from the sale of software licenses, maintenance fees, and professional services.

Temenos has demonstrated robust growth, with earnings increasing by 13.5% over the past year, outpacing the software industry's 9.3%. The firm's revenue is forecasted to grow at 7.6% annually, while its earnings are expected to rise by 14.3%, surpassing the Swiss market's average of 11.7%. Significant investments in R&D underscore this potential; last year alone, Temenos allocated CHF 200 million towards innovation and technology development. Recent strategic appointments aim to bolster their SaaS capabilities and US market presence further enhancing their competitive edge in digital banking solutions.

Taking Advantage

- Unlock more gems! Our SIX Swiss Exchange High Growth Tech and AI Stocks screener has unearthed 8 more companies for you to explore.Click here to unveil our expertly curated list of 11 SIX Swiss Exchange High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basilea Pharmaceutica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BSLN

Basilea Pharmaceutica

A commercial-stage biopharmaceutical company, focuses on the development of products that address the medical needs in the therapeutic areas of oncology and anti-infectives.

Excellent balance sheet with reasonable growth potential.