High Growth Tech Stocks in Europe Featuring Northern Data and Two Others

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances across European indices, the pan-European STOXX Europe 600 Index has managed to end higher, buoyed by optimism around potential government spending increases despite ongoing concerns about U.S. tariffs. In this environment of economic uncertainty and cautious central bank policies, identifying high-growth tech stocks in Europe requires focusing on companies that demonstrate robust innovation and adaptability to navigate these challenges effectively.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| CD Projekt | 30.55% | 39.06% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Devyser Diagnostics | 26.50% | 94.65% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

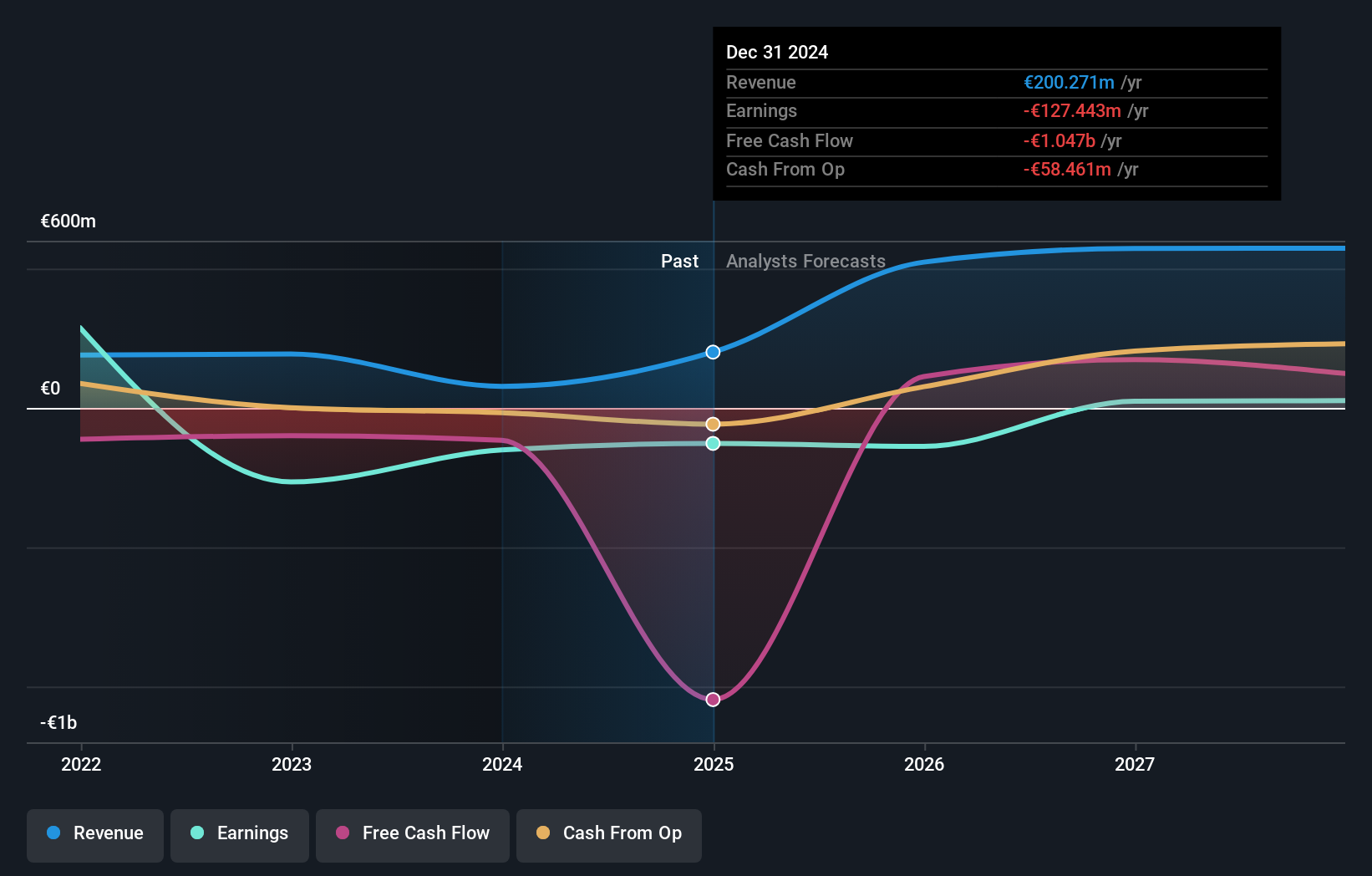

Overview: Northern Data AG focuses on developing and operating high-performance computing infrastructure solutions for businesses and research institutions globally, with a market capitalization of €1.61 billion.

Operations: The company generates revenue primarily through its Peak Mining and Ardent Data Centers segments, contributing €156.13 million and €31.46 million, respectively. The Taiga Cloud segment adds €22.13 million to the revenue stream.

Northern Data's trajectory in the high-growth tech sector is marked by a robust forecasted revenue increase of 23.8% annually, significantly outpacing the German market's 6%. Despite current unprofitability, earnings are expected to surge by an impressive 91.3% per year, positioning the company for potential profitability within three years. Recent executive shifts, including the appointment of John Hoffman as COO, underscore a strategic push to capitalize on its AI and High-Performance Computing solutions. This leadership renewal could be pivotal in steering Northern Data towards harnessing its full growth potential amidst market challenges.

- Click to explore a detailed breakdown of our findings in Northern Data's health report.

Assess Northern Data's past performance with our detailed historical performance reports.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★☆

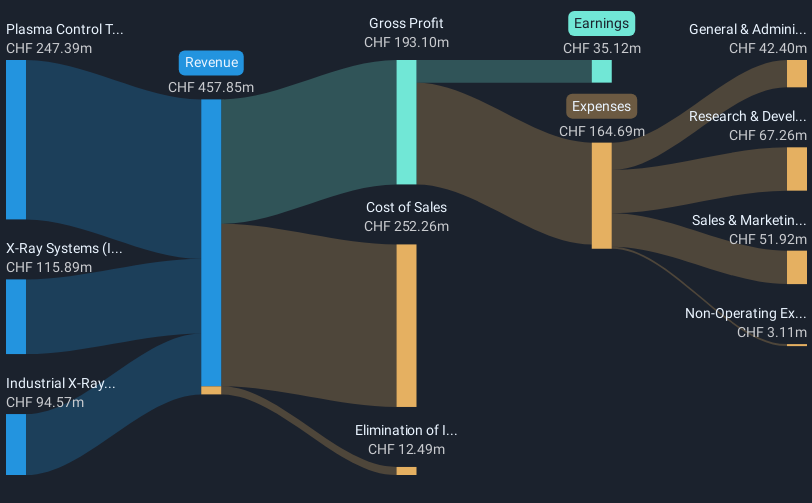

Overview: Comet Holding AG, along with its subsidiaries, delivers X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other international markets with a market capitalization of CHF1.83 billion.

Operations: The company's revenue streams are primarily derived from Plasma Control Technologies (CHF247.39 million), X-Ray Systems (CHF115.89 million), and Industrial X-Ray Modules (CHF94.57 million).

Comet Holding's recent performance underscores its robust position in the high-tech European market, with a notable 128.2% surge in earnings last year and a dividend increase to CHF 1.50 per share, reflecting strong financial health and shareholder confidence. The company’s revenue growth at 13.2% annually outpaces the Swiss market average of 4.5%, supported by significant R&D investments aimed at pioneering advancements in tech sectors crucial for future growth. With earnings expected to grow by an impressive 38.4% annually over the next three years, Comet Holding is well-positioned to leverage its technological innovations and market adaptability despite a highly volatile share price recently, highlighting both potential rewards and risks inherent in its sector.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

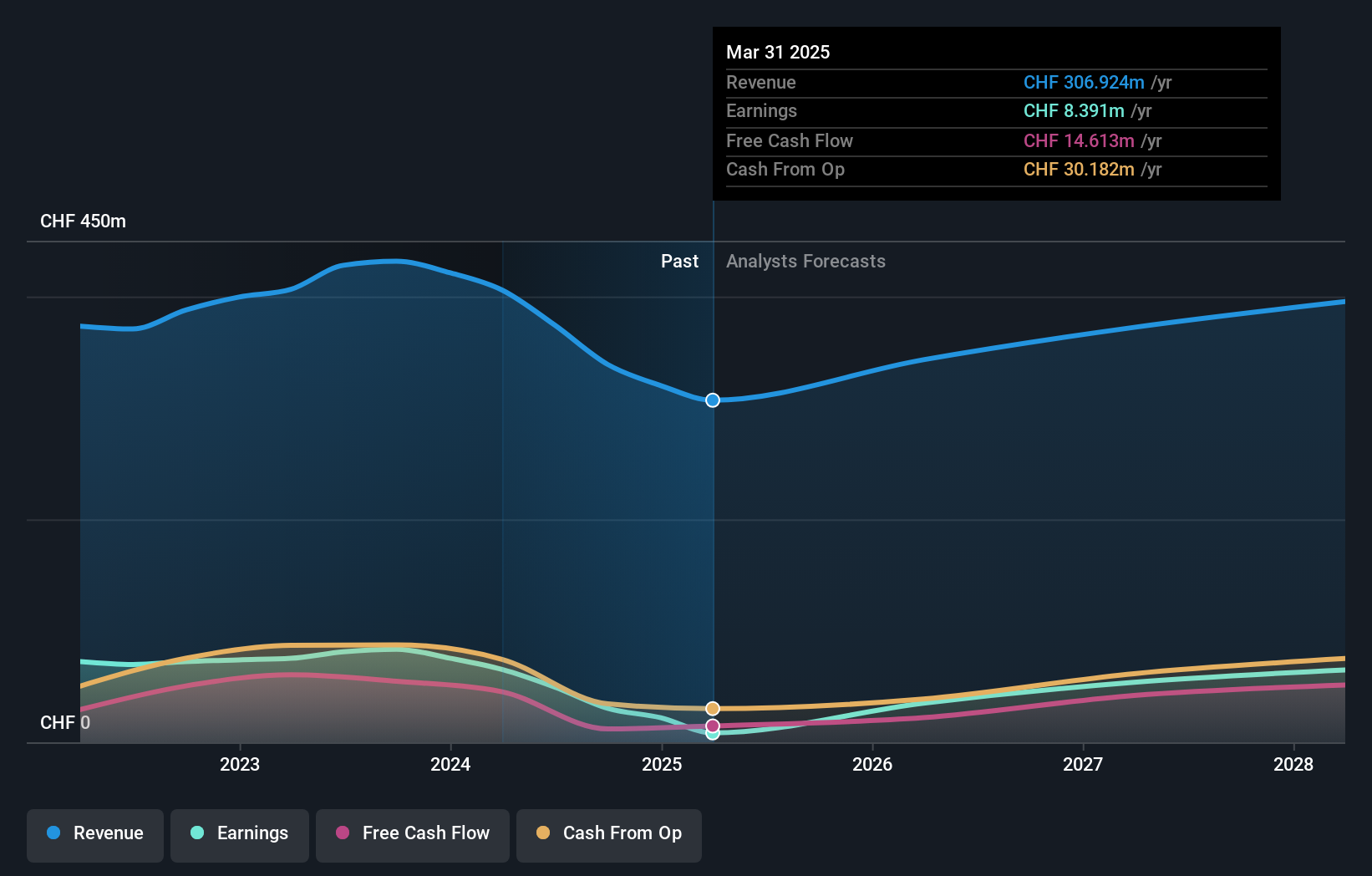

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various global regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market capitalization of CHF854.36 million.

Operations: The company generates revenue by offering electrical measurement solutions across diverse regions, with a significant presence in Asia, Europe, and the Americas. It focuses on leveraging its expertise in measuring electrical parameters to cater to various industries globally.

LEM Holding's trajectory in the high-tech European sector is marked by a robust 13.3% annual revenue growth, outpacing the Swiss market average of 4.5%. Despite a challenging year with earnings declining by 70.9%, the company's commitment to innovation is evident from its R&D investments, which are crucial for future competitiveness in electronics and automation industries. With new executive leadership poised to steer future strategies starting May 2025, LEM aims to leverage its technical prowess and deep industry connections to navigate through market volatilities and enhance shareholder value.

- Get an in-depth perspective on LEM Holding's performance by reading our health report here.

Review our historical performance report to gain insights into LEM Holding's's past performance.

Turning Ideas Into Actions

- Click this link to deep-dive into the 243 companies within our European High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEHN

LEM Holding

Provides solutions for measuring electrical parameters in China, Japan, South Korea, India, Southeast Asia, Europe, Middle East, Africa, NAFTA and Latin America.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives