High Growth Tech Stocks And 2 Other Exciting Opportunities For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound with major U.S. stock indexes climbing higher, driven by easing core inflation and robust bank earnings, investors are increasingly looking for high-growth opportunities to diversify their portfolios. In this dynamic environment, identifying promising tech stocks requires careful consideration of factors such as innovation potential, market demand, and the company's ability to adapt to economic shifts while maintaining strong financial health.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1229 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

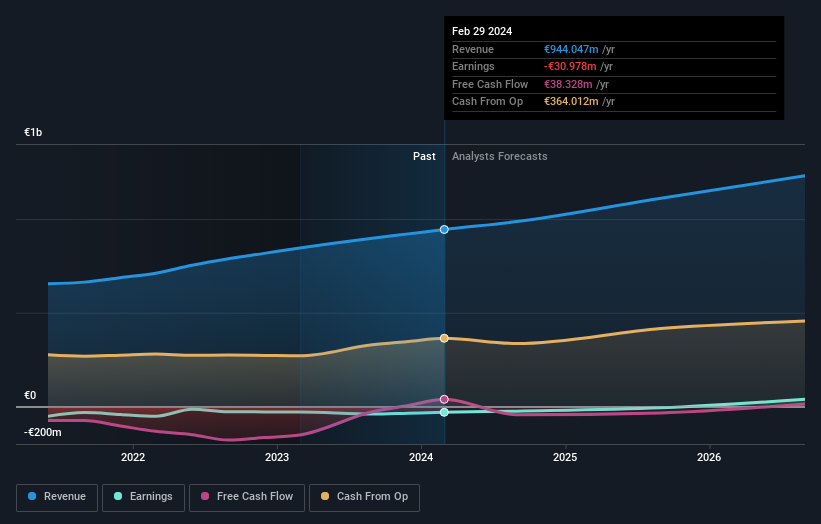

Overview: OVH Groupe S.A. is a global provider of cloud services, including public and private cloud solutions, shared hosting, and dedicated servers, with a market capitalization of approximately €1.61 billion.

Operations: OVH Groupe S.A. generates revenue primarily from its Private Cloud segment, which accounts for €623.53 million, followed by Public Cloud at €182.82 million and Web cloud & Other services at €186.71 million. The company's focus on diverse cloud solutions positions it as a significant player in the global cloud services market.

OVH Groupe, with its robust commitment to innovation, is poised for significant growth, as evidenced by its forecasted revenue increase of 9.8% annually. This growth trajectory surpasses the broader French market's average of 5.5%, highlighting OVH's competitive edge in a challenging environment. The company has also demonstrated a keen focus on R&D, committing substantial resources to foster advancements and maintain technological leadership. Notably, OVHcloud's recent launch of third-generation dedicated Bare Metal game servers integrates cutting-edge AMD EPYC 4004 processors, enhancing gaming performance and deployment efficiency across global locations—a testament to their forward-thinking strategy in cloud computing solutions.

- Click to explore a detailed breakdown of our findings in OVH Groupe's health report.

Assess OVH Groupe's past performance with our detailed historical performance reports.

LUSTER LightTech (SHSE:688400)

Simply Wall St Growth Rating: ★★★★★☆

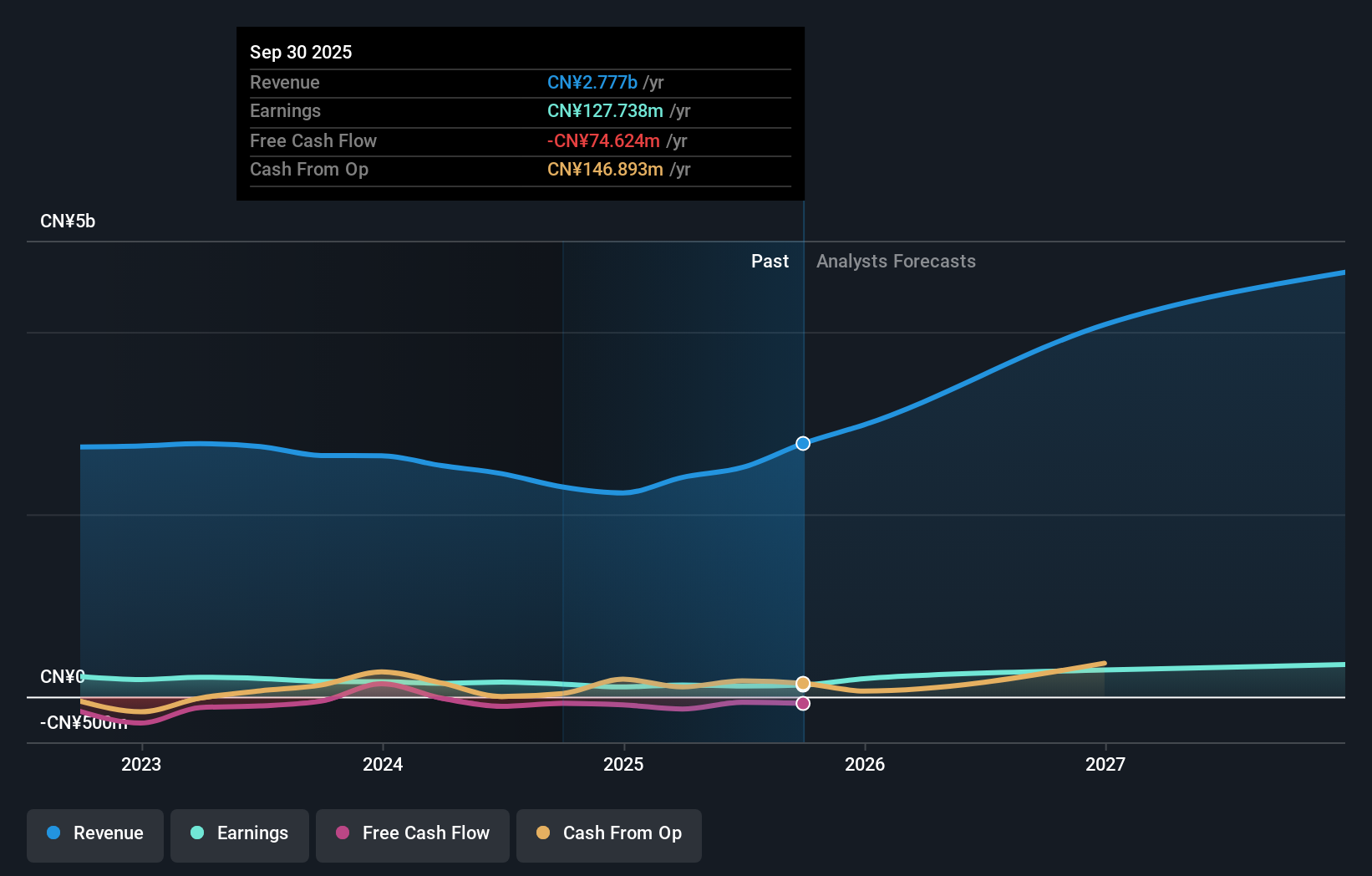

Overview: LUSTER LightTech Co., LTD. focuses on the research and development of configurable visual systems, intelligent visual equipment, and core visual devices in China, with a market cap of CN¥10.26 billion.

Operations: LUSTER LightTech specializes in developing advanced visual technology solutions, including configurable systems and intelligent equipment. The company operates primarily within China, leveraging its expertise in core visual devices to drive innovation.

LUSTER LightTech's trajectory in the tech sector is underscored by a robust annual revenue growth of 22.3% and an even more impressive earnings growth forecast at 35.7% per year, signaling strong market performance and potential for sustained profitability. The company's commitment to innovation is evident from its R&D investments, which are strategically aligned with industry demands, although specific figures were not disclosed. Recent strategic moves include a significant private placement aimed at raising up to CNY 785 million and a share repurchase program totaling CNY 100 million, enhancing shareholder value and investing back into the company’s core operations. These initiatives reflect LUSTER's proactive approach in capital management and its dedication to advancing technology in its sector.

- Dive into the specifics of LUSTER LightTech here with our thorough health report.

Explore historical data to track LUSTER LightTech's performance over time in our Past section.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

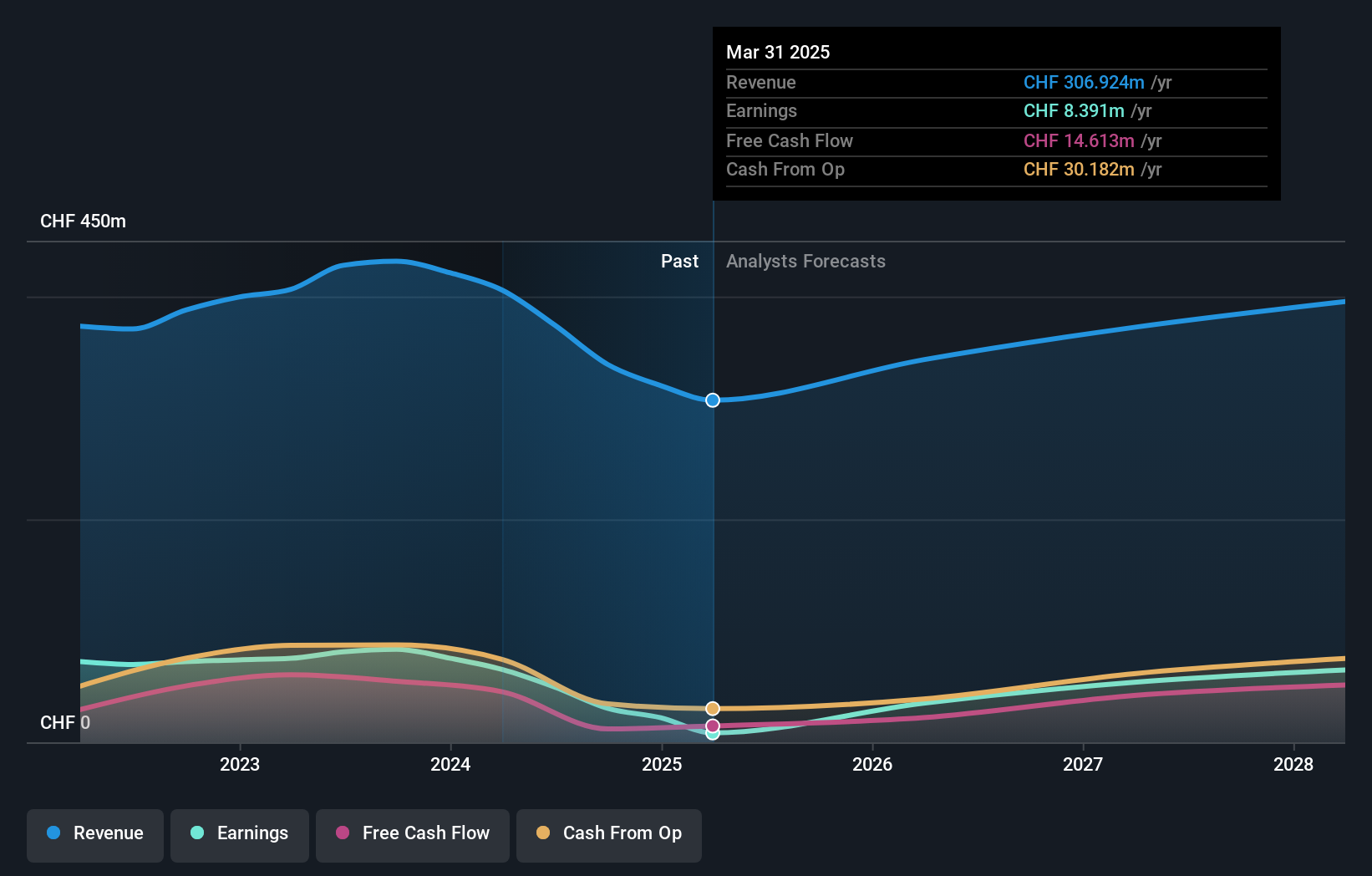

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America; it has a market capitalization of CHF930.69 million.

Operations: The company generates revenue primarily from two regions, with CHF175.10 million from Asia and CHF163.88 million from Europe/Americas. Its business focuses on solutions for measuring electrical parameters across multiple global markets.

Despite a challenging half-year with sales dropping to CHF 156.55 million from CHF 223.34 million and net income falling to CHF 8.58 million from CHF 43.4 million, LEM Holding's outlook remains cautiously optimistic due to its forecasted earnings growth of 35.1% per year. This anticipated growth outpaces the Swiss market's average, highlighting potential resilience and adaptability in its operational strategy. Moreover, with R&D expenses not explicitly detailed but integral to its business model, LEM is likely maintaining a focus on innovation to drive future performance in the electronic sector where technological advancements are critical for staying competitive.

- Unlock comprehensive insights into our analysis of LEM Holding stock in this health report.

Examine LEM Holding's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1226 High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives