- Switzerland

- /

- Biotech

- /

- SWX:BSLN

Exploring Three High Growth Tech Stocks In None

Reviewed by Simply Wall St

As global markets continue to show resilience with U.S. indexes nearing record highs and small-cap stocks outperforming large-caps, investors are closely watching economic indicators like jobless claims and home sales that hint at broader economic stability. In this context, identifying high-growth tech stocks involves assessing their potential to capitalize on technological advancements and market trends while navigating the current landscape of geopolitical uncertainties and evolving fiscal policies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1295 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Selvas AI (KOSDAQ:A108860)

Simply Wall St Growth Rating: ★★★★★☆

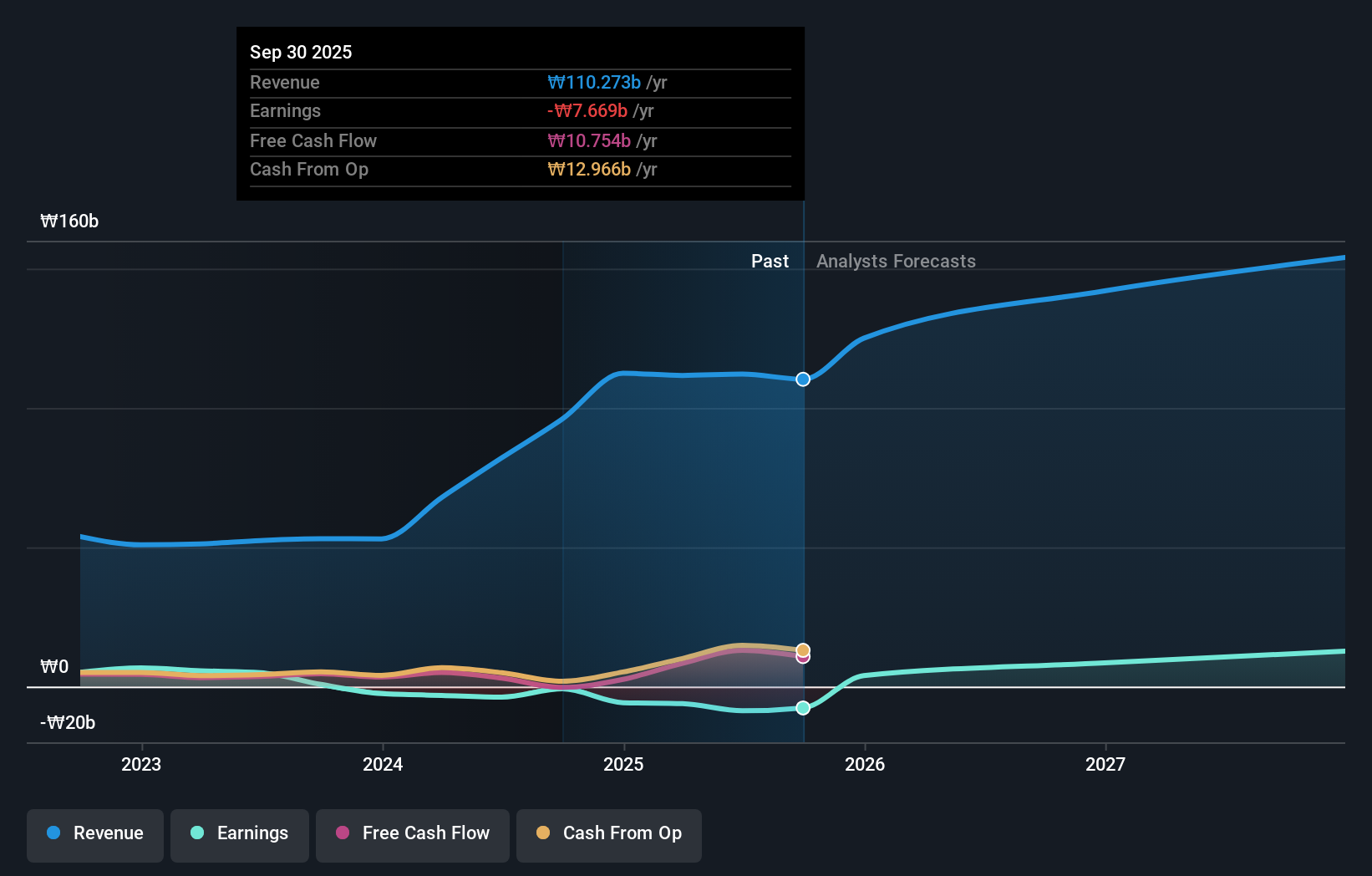

Overview: Selvas AI Inc. is a South Korean company specializing in artificial intelligence technologies, with a market capitalization of ₩357.69 billion.

Operations: Selvas AI generates revenue primarily from its Artificial Intelligence Application Solution segment, including electronic dictionaries, which contributes ₩16.06 billion, followed by Medical Diagnosis Devices at ₩15.17 billion and Assistive Technology Equipment at ₩13.34 billion. The company's focus on AI-based technologies further adds ₩7.85 billion to its revenue stream.

Selvas AI, despite its current unprofitability, is poised for significant growth with projected revenue increases of 20.2% annually, outpacing the broader Korean market's 9%. This tech firm is also expected to swing to profitability within three years, a transition underscored by an anticipated earnings surge of nearly 89.7% per year. Notably, Selvas AI's commitment to innovation is evident in its R&D spending trends which are robust compared to industry norms, ensuring the company remains at the forefront of technological advancements. As it prepares to report Q3 results tomorrow, investors are watching closely how these investments translate into market gains and long-term value creation in a competitive landscape.

- Take a closer look at Selvas AI's potential here in our health report.

Gain insights into Selvas AI's past trends and performance with our Past report.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

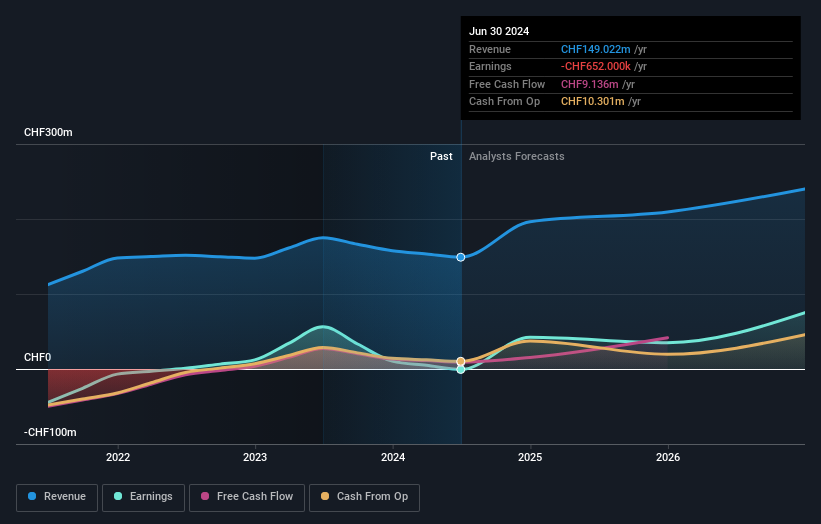

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing products for oncology and anti-infective therapeutic areas, with a market cap of CHF510.30 million.

Operations: The company's revenue primarily stems from the discovery, development, and commercialization of innovative pharmaceutical products, totaling CHF149.02 million.

Basilea Pharmaceutica AG, amidst a challenging landscape, is navigating towards profitability with an anticipated annual earnings growth of 20.05%, signaling robust future prospects. Recent strategic moves, including the extended market exclusivity for its antifungal Cresemba in Europe until October 2027 and a CHF 10 million milestone payment from Pfizer, underscore its commitment to expanding therapeutic offerings and securing financial gains. With R&D expenses aligned closely with these innovations—evidenced by recent pediatric approvals—Basilea is poised to leverage scientific advancements into commercial success. The company's revenue growth forecast at 6% annually outpaces the Swiss market prediction of 4.2%, reflecting a focused strategy that could reshape its financial contours significantly over the coming years.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market capitalization of CHF927.10 million.

Operations: LEM focuses on delivering electrical measurement solutions globally, generating revenue primarily from its diverse regional operations. The company operates in key markets such as Asia, Europe, and the Americas.

LEM Holding's recent financial performance reveals a challenging scenario, with half-year sales dropping to CHF 156.55 million from CHF 223.34 million year-over-year and net income plummeting to CHF 8.58 million from CHF 43.4 million. Despite these setbacks, the company is poised for recovery with an anticipated earnings growth of 36.9% per year, outpacing the Swiss market's forecast of 11.4%. This growth is underpinned by a robust R&D focus, crucial for maintaining competitive advantage in the electronic components industry where innovation leads market trends. Moreover, LEM Holding's strategic emphasis on R&D investment aligns with its future revenue projections which are expected to grow at an annual rate of 11.4%, significantly above the broader market expectation of 4.2%. This investment in innovation not only supports product development but also positions the company favorably among peers in adapting swiftly to evolving technological demands—essential for sustaining long-term growth despite current financial volatilities and a highly competitive landscape marked by rapid technological advancements.

- Click here and access our complete health analysis report to understand the dynamics of LEM Holding.

Explore historical data to track LEM Holding's performance over time in our Past section.

Summing It All Up

- Click this link to deep-dive into the 1295 companies within our High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basilea Pharmaceutica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BSLN

Basilea Pharmaceutica

A commercial-stage biopharmaceutical company, focuses on the development of products that address the medical needs in the therapeutic areas of oncology and anti-infectives.

High growth potential with excellent balance sheet.