3 European Growth Companies With High Insider Ownership Achieving 76% Earnings Growth

Reviewed by Simply Wall St

Amidst a backdrop of economic uncertainty and political instability, European markets have recently faced challenges such as renewed tariff concerns and geopolitical tensions, leading to declines in major indices like the STOXX Europe 600. In this environment, investors often look for growth companies with high insider ownership as these firms can offer alignment of interests between management and shareholders, potentially providing resilience against market volatility.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 91% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's dive into some prime choices out of the screener.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK6.06 billion.

Operations: The company generates revenue through its Streaming segment, which accounts for SEK3.45 billion, and its Publishing segment, contributing SEK1.20 billion.

Insider Ownership: 12.7%

Earnings Growth Forecast: 26.3% p.a.

Storytel's earnings are anticipated to grow significantly at 26.3% per year, outpacing the Swedish market's 16.6%. Despite trading at a substantial discount to its estimated fair value, recent executive changes may impact stability. The company's revenue is forecasted to grow faster than the market but remains below high growth thresholds. Insider activity shows more shares sold than bought recently, indicating potential insider concerns despite the positive financial outlook and recent profitability.

- Take a closer look at Storytel's potential here in our earnings growth report.

- Our valuation report here indicates Storytel may be undervalued.

Kuros Biosciences (SWX:KURN)

Simply Wall St Growth Rating: ★★★★★☆

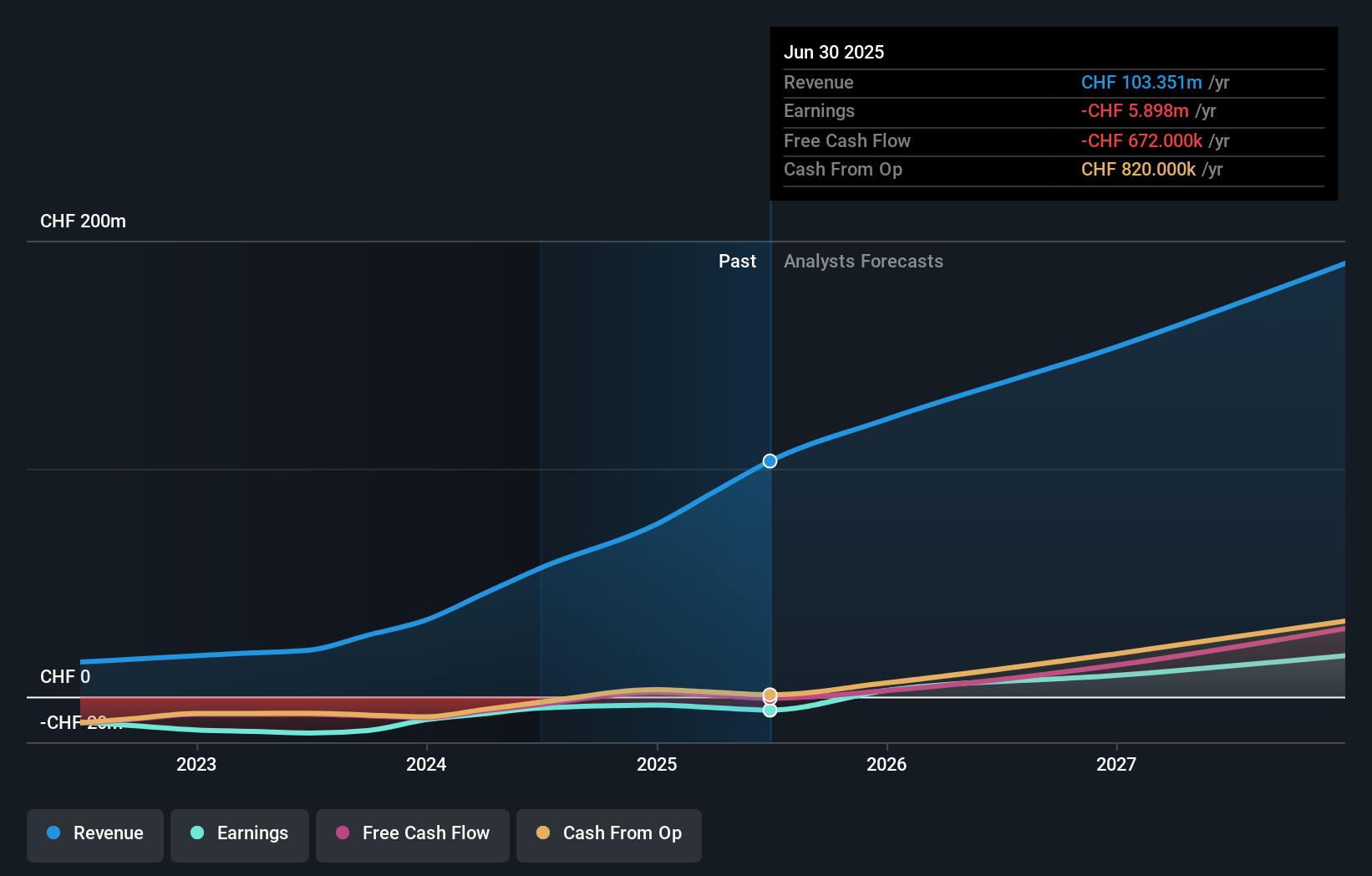

Overview: Kuros Biosciences AG focuses on the commercialization and development of biologic technologies for musculoskeletal care across the USA, EU, and internationally, with a market cap of CHF974.61 million.

Operations: The company's revenue is primarily derived from its Medical Devices segment, which generated CHF103.35 million.

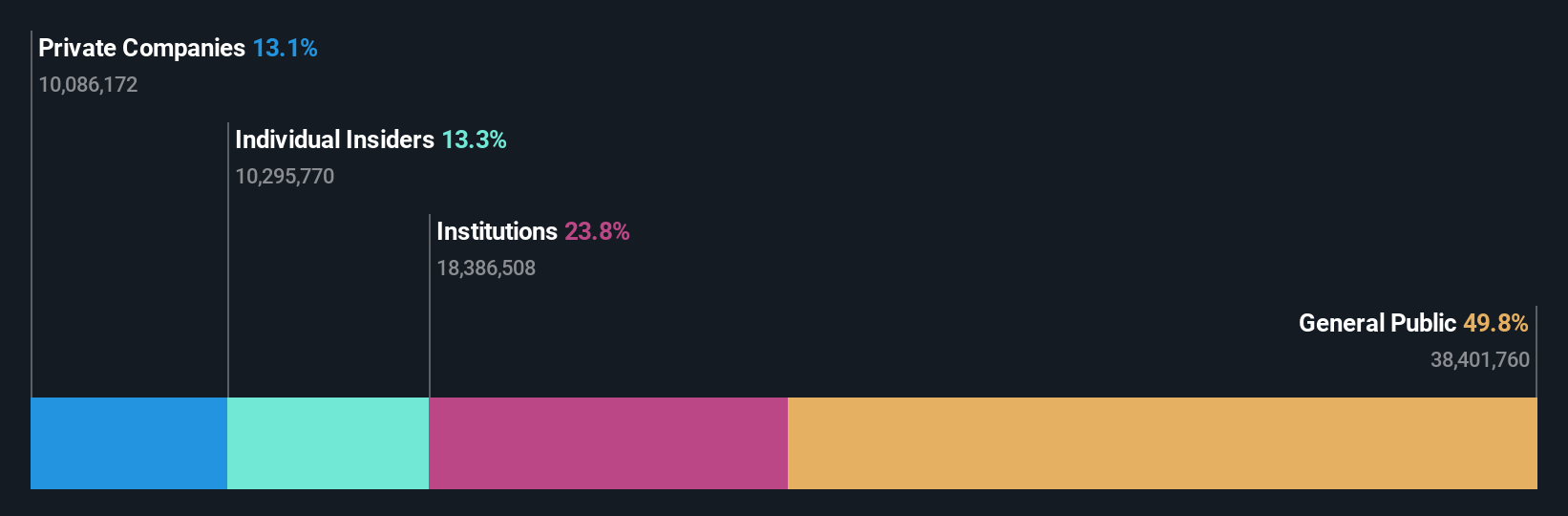

Insider Ownership: 26.2%

Earnings Growth Forecast: 54.2% p.a.

Kuros Biosciences is poised for significant growth, with revenue expected to increase by 21.5% annually, outpacing the Swiss market. The company anticipates robust sales growth of at least 60% in 2025 and targets US$220-250 million by 2027. Recent product innovations like the MagnetOs MIS Delivery System enhance its market position. However, despite strong revenue prospects, Kuros reported a net loss of CHF2.01 million for H1 2025 amidst executive board changes that may affect strategic direction.

- Unlock comprehensive insights into our analysis of Kuros Biosciences stock in this growth report.

- The valuation report we've compiled suggests that Kuros Biosciences' current price could be inflated.

Landis+Gyr Group (SWX:LAND)

Simply Wall St Growth Rating: ★★★★☆☆

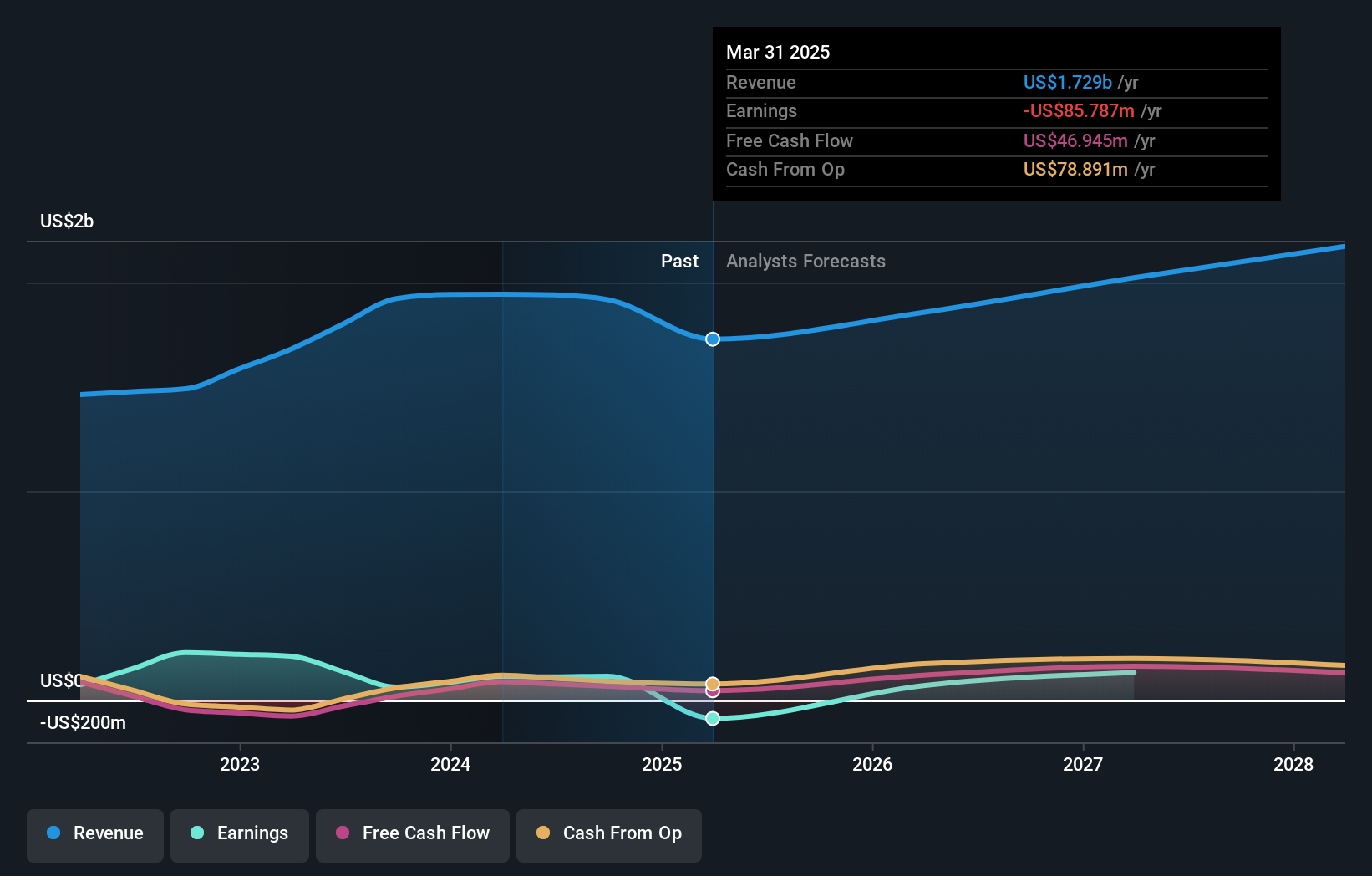

Overview: Landis+Gyr Group AG, along with its subsidiaries, offers integrated energy management solutions to the utility sector across the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions and has a market capitalization of CHF1.85 billion.

Operations: The company's revenue segments include $967.49 million from the Americas, $158.68 million from Asia Pacific, and $639.04 million from Europe, the Middle East, and Africa (EMEA).

Insider Ownership: 10.8%

Earnings Growth Forecast: 76.9% p.a.

Landis+Gyr Group shows promising growth potential with revenue forecasted to grow at 6.6% annually, surpassing the Swiss market average. The company is expected to achieve profitability within three years, indicating above-average market growth in profits. Recent strategic moves include a significant agreement with Withlacoochee River Electric Cooperative for deploying advanced metering solutions and achieving IoT Network Certification for their Revelo grid sensors, enhancing their position in smart grid technology.

- Get an in-depth perspective on Landis+Gyr Group's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Landis+Gyr Group implies its share price may be too high.

Where To Now?

- Investigate our full lineup of 214 Fast Growing European Companies With High Insider Ownership right here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives