Stock Analysis

Exploring Three Growth Leaders With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

The Swiss market displayed resilience on Thursday, closing slightly higher amidst a broader evaluation of European economic indicators and corporate earnings. The modest uptick in the SMI index reflects cautious optimism among investors navigating the current financial landscape. In such a market environment, companies with high insider ownership can be particularly compelling, as substantial internal investment often signals strong confidence in the company's growth prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| LEM Holding (SWX:LEHN) | 34.5% | 9.9% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.4% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.8% |

| Arbonia (SWX:ARBN) | 28.8% | 80% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Let's uncover some gems from our specialized screener.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: INFICON Holding AG, based in Switzerland, specializes in developing instruments for gas analysis, measurement, and control across global markets, with a market capitalization of CHF 3.54 billion.

Operations: The company generates revenue primarily through its global instrumentation segment for gas analysis, measurement, and control, amounting to $673.71 million.

Insider Ownership: 10.3%

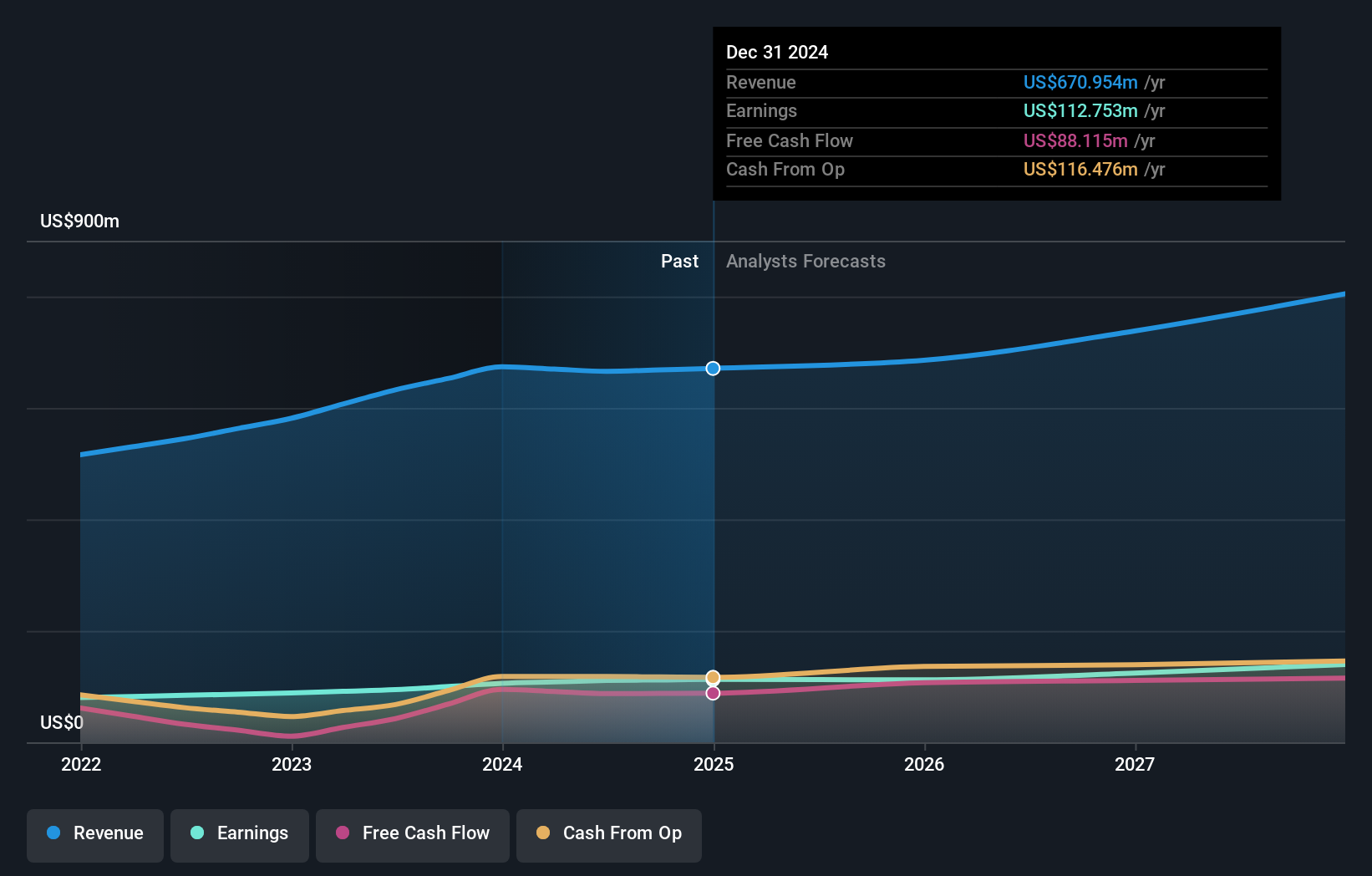

INFICON Holding AG, a growth-oriented company with substantial insider ownership, exhibits consistent financial performance. In 2023, the company achieved significant sales of US$673.71 million and net income of US$105.68 million, marking noticeable year-over-year increases. While its revenue and earnings are forecasted to grow at 7.2% and 9.85% per year respectively—outpacing the Swiss market averages—these figures do not meet the high-growth threshold of over 20%. Additionally, INFICON's return on equity is expected to be robust at 27.6% in three years' time.

- Get an in-depth perspective on INFICON Holding's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility INFICON Holding's shares may be trading at a premium.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.23 billion.

Operations: The company generates its revenue by developing, marketing, and selling integrated banking software systems to financial institutions worldwide.

Insider Ownership: 17.4%

Temenos, a Swiss company with high insider ownership, showcases robust growth potential and technological advancement. Recent developments highlight its commitment to sustainability and efficiency in banking solutions. On May 15, 2024, Temenos demonstrated significant improvements in its cloud-native platform's efficiency on Microsoft Azure—achieving a substantial reduction in carbon impact validated by GoCodeGreen. Moreover, the partnership with PC Financial® to expand into the Canadian market underscores its strategic growth initiatives. However, its revenue growth forecast of 7.7% per year trails the high-growth benchmark of over 20%, reflecting moderate rather than explosive future revenue expansion.

- Click here to discover the nuances of Temenos with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Temenos is priced lower than what may be justified by its financials.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG specializes in developing, manufacturing, and supplying vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across various global markets, with a market capitalization of approximately CHF 14.97 billion.

Operations: The company generates revenue primarily through its Valves and Global Service segments, with earnings of CHF 782.74 million and CHF 172.87 million respectively.

Insider Ownership: 10.2%

VAT Group, a Swiss entity, is poised for substantial growth with earnings expected to increase by 21.2% annually, outpacing the local market's 8.1%. Additionally, revenue forecasts predict a 15.5% yearly rise, also above the Swiss average of 4.3%. Despite these promising figures, VAT Group faces challenges with a highly volatile share price and recent financial results showing a downturn in net income from CHF 306.78 million to CHF 190.31 million year-over-year as of December 2023. The firm maintains high insider ownership but lacks recent insider trading activity to gauge current sentiment further.

- Unlock comprehensive insights into our analysis of VAT Group stock in this growth report.

- In light of our recent valuation report, it seems possible that VAT Group is trading beyond its estimated value.

Taking Advantage

- Investigate our full lineup of 17 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether INFICON Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:IFCN

INFICON Holding

Develops instruments for gas analysis, measurement, and control in the Switzerland and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.