- Switzerland

- /

- Metals and Mining

- /

- SWX:STLN

It's Down 28% But Swiss Steel Holding AG (VTX:STLN) Could Be Riskier Than It Looks

Swiss Steel Holding AG (VTX:STLN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

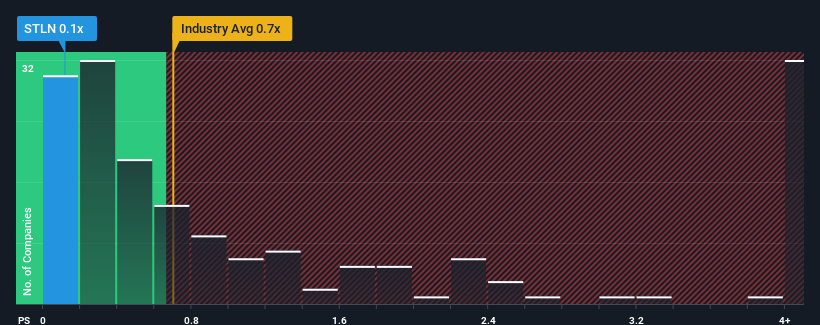

Following the heavy fall in price, Swiss Steel Holding's price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Metals and Mining industry in Switzerland, where around half of the companies have P/S ratios above 0.7x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Swiss Steel Holding

What Does Swiss Steel Holding's Recent Performance Look Like?

For example, consider that Swiss Steel Holding's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Swiss Steel Holding will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Swiss Steel Holding?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Swiss Steel Holding's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 42% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 1.2%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Swiss Steel Holding's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Swiss Steel Holding's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Swiss Steel Holding revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Swiss Steel Holding that you should be aware of.

If you're unsure about the strength of Swiss Steel Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STLN

Swiss Steel Holding

Swiss Steel Holding AG produce and sells engineering, stainless, and tool steel products.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives