Exploring Three Growth Companies With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market recently closed on a positive note, buoyed by the European Central Bank's decision to cut interest rates and a stable unemployment rate. This optimistic economic backdrop provides a favorable environment for exploring growth companies with high insider ownership, which often signals confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

| Leonteq (SWX:LEON) | 12.7% | 26.4% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.3% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Underneath we present a selection of stocks filtered out by our screen.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

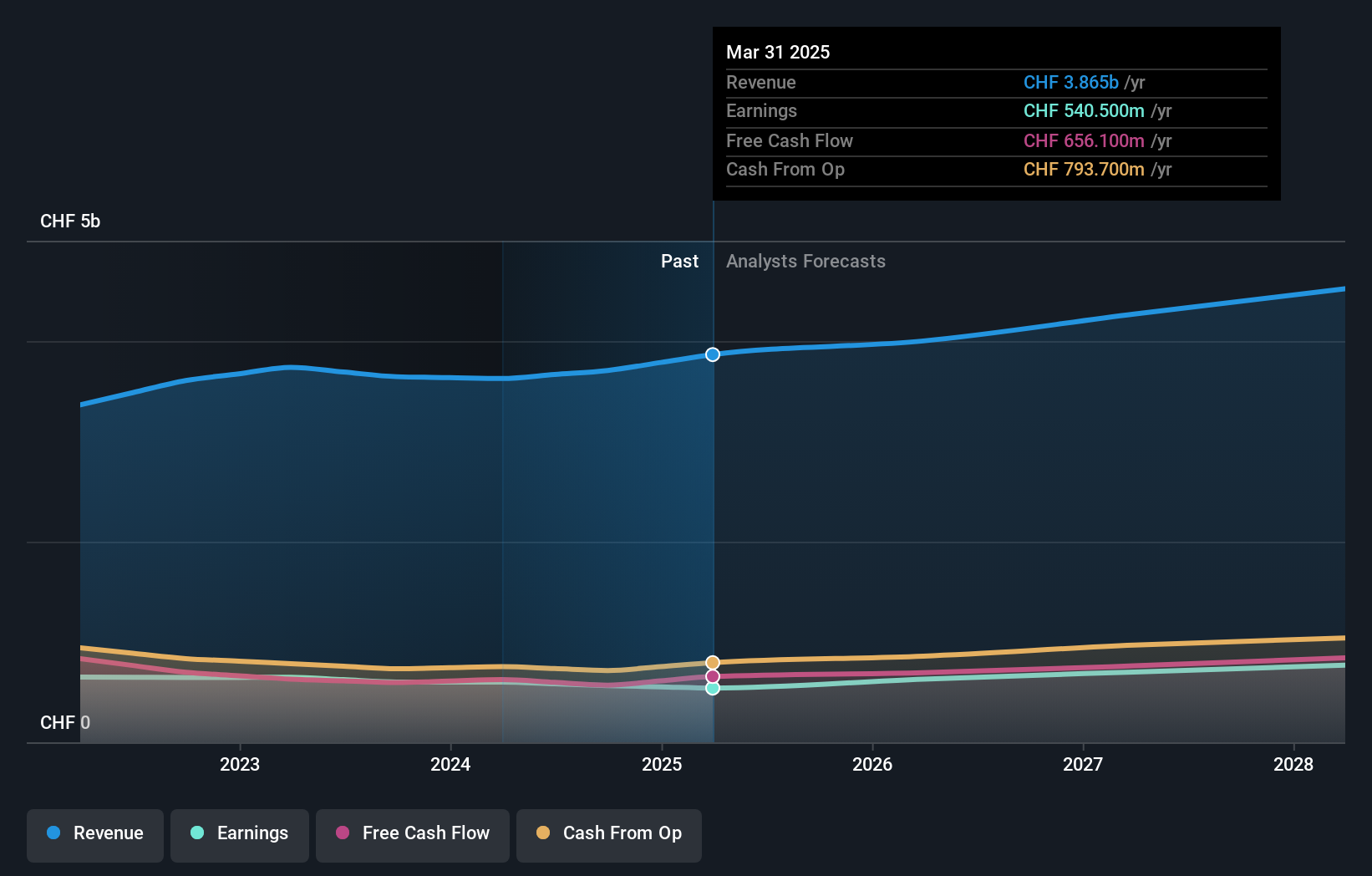

Overview: INFICON Holding AG specializes in developing instruments for gas analysis, measurement, and control, operating both in Switzerland and internationally, with a market capitalization of approximately CHF 3.64 billion.

Operations: The company generates its revenue primarily from its global instrumentation segment for gas analysis, measurement, and control, totaling $673.71 million.

Insider Ownership: 10.3%

INFICON Holding, a Swiss company, demonstrates strong insider alignment without recent substantial buying or selling. Its earnings grew by 19.4% last year and are expected to rise by 9.85% annually, slightly outpacing the Swiss market's 8.3%. Revenue growth is also robust at 7.2% annually, exceeding the market average of 4.4%. Additionally, a forecasted high Return on Equity of 27.6% in three years underscores potential efficiency gains and profitability.

- Delve into the full analysis future growth report here for a deeper understanding of INFICON Holding.

- Our valuation report unveils the possibility INFICON Holding's shares may be trading at a premium.

Sonova Holding (SWX:SOON)

Simply Wall St Growth Rating: ★★★★☆☆

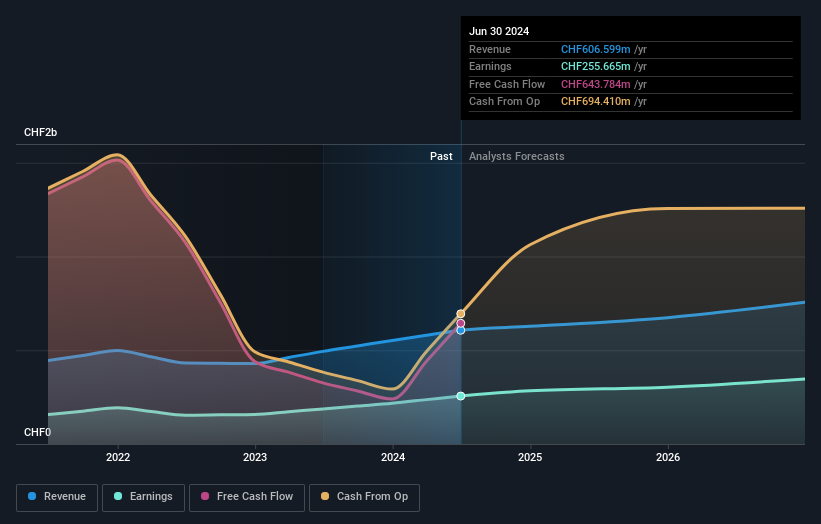

Overview: Sonova Holding AG is a company that specializes in the production and distribution of hearing care solutions across various regions including the United States, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of CHF 17.25 billion.

Operations: Sonova's revenue is primarily generated from two segments: Cochlear Implants, which brought in CHF 282.40 million, and Hearing Instruments, contributing CHF 3.36 billion.

Insider Ownership: 17.7%

Sonova Holding AG, a Swiss firm, reported robust full-year earnings with sales reaching CHF 3.63 billion and net income at CHF 609.5 million as of March 2024. While its annual profit growth of 9.9% is set to outperform the Swiss market's 8.3%, revenue growth projections are more modest at 7.1% annually, slightly above the market's 4.4%. Despite trading at a significant discount to fair value and possessing high insider ownership, concerns linger over its substantial debt levels.

- Unlock comprehensive insights into our analysis of Sonova Holding stock in this growth report.

- The valuation report we've compiled suggests that Sonova Holding's current price could be quite moderate.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd is a global provider of online financial services catering to retail, affluent, and institutional clients, with a market capitalization of approximately CHF 4.34 billion.

Operations: The company generates revenue primarily through leveraged Forex and securities trading, amounting to CHF 101.09 million and CHF 429.78 million respectively.

Insider Ownership: 11.4%

Swissquote Group Holding Ltd, a Swiss-based company, has demonstrated significant growth with earnings up 38.3% last year and forecasts predicting further annual growth of 14.3%. This outpaces the broader Swiss market's forecasted growth. Despite slower revenue increase predictions at 10.6% annually, this still exceeds the market average. The firm's high insider ownership aligns with strong corporate governance expectations, though no recent insider trading activity was reported. Trading at a notable discount to estimated fair value suggests potential undervaluation.

- Dive into the specifics of Swissquote Group Holding here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Swissquote Group Holding's current price could be inflated.

Turning Ideas Into Actions

- Unlock our comprehensive list of 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:IFCN

INFICON Holding

Develops instruments for gas analysis, measurement, and control in the Switzerland and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives