Here's Why Cicor Technologies Ltd.'s (VTX:CICN) CEO Compensation Is The Least Of Shareholders' Concerns

The share price of Cicor Technologies Ltd. (VTX:CICN) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. The upcoming AGM on 15 April 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Cicor Technologies

Comparing Cicor Technologies Ltd.'s CEO Compensation With the industry

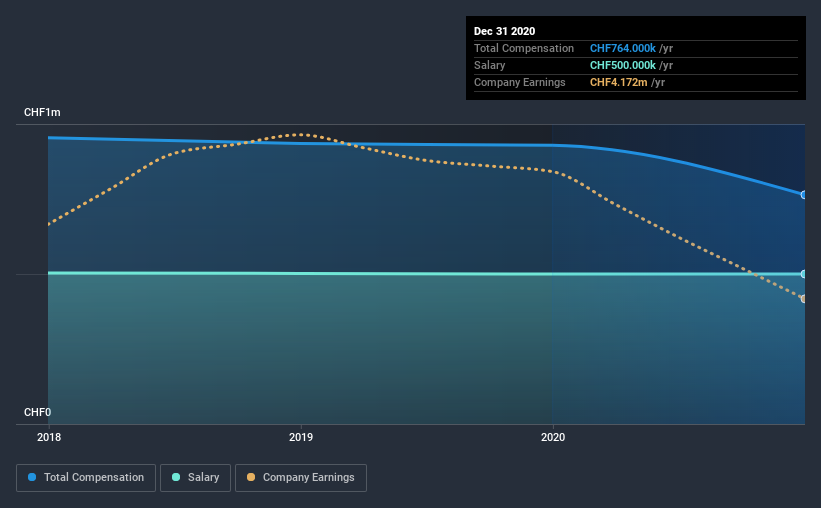

Our data indicates that Cicor Technologies Ltd. has a market capitalization of CHF151m, and total annual CEO compensation was reported as CHF764k for the year to December 2020. That's a notable decrease of 18% on last year. We note that the salary portion, which stands at CHF500.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from CHF93m to CHF371m, we found that the median CEO total compensation was CHF660k. So it looks like Cicor Technologies compensates Alexander Hagemann in line with the median for the industry. What's more, Alexander Hagemann holds CHF365k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CHF500k | CHF500k | 65% |

| Other | CHF264k | CHF429k | 35% |

| Total Compensation | CHF764k | CHF929k | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. It's interesting to note that Cicor Technologies pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Cicor Technologies Ltd.'s Growth

Cicor Technologies Ltd. has reduced its earnings per share by 14% a year over the last three years. Its revenue is down 15% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Cicor Technologies Ltd. Been A Good Investment?

Cicor Technologies Ltd. has generated a total shareholder return of 5.1% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Cicor Technologies that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Cicor Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives