- Switzerland

- /

- Software

- /

- SWX:TEMN

Temenos (SWX:TEMN): Assessing Valuation After a Strong Three-Month Share Price Rebound

Reviewed by Simply Wall St

Temenos (SWX:TEMN) has quietly climbed about 6% over the past week and more than 30% in the past 3 months, putting fresh attention on whether this banking software specialist’s rebound still has room to run.

See our latest analysis for Temenos.

That recent momentum builds on a solid recovery trend, with a strong 90 day share price return helping push year to date gains higher. A 1 year total shareholder return above 35% suggests confidence is slowly coming back after a tougher multi year stretch.

If Temenos has you rethinking what quality looks like in financial tech, it could be a good moment to explore high growth tech and AI stocks for more potential ideas.

Yet with the share price now sitting slightly above analyst targets and only modest fundamental growth, the key question is whether Temenos is still trading below its true potential or if markets are already pricing in the next leg of expansion.

Price to Earnings of 21.1x: Is it justified?

At a last close of CHF 77.50, Temenos trades on a 21.1x price to earnings multiple, which screens as inexpensive versus software peers despite the recent rally.

The price to earnings ratio compares what investors pay for each unit of the company’s current earnings, a key yardstick for profitable, mature software firms like Temenos.

With earnings having grown 118.7% over the past year and margins improving, a mid 20s multiple suggests the market is not aggressively pricing in that rebound.

Compared with the European software industry average of 26.7x and a peer average of 48.6x, Temenos carries a marked valuation discount that implies investors remain cautious despite the strong recent profit acceleration.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Earnings of 21.1x (UNDERVALUED)

However, lingering concerns around modest revenue growth and last year’s net income decline could quickly challenge the idea that Temenos’ recovery is firmly established.Find out about the key risks to this Temenos narrative.

Another View on Value

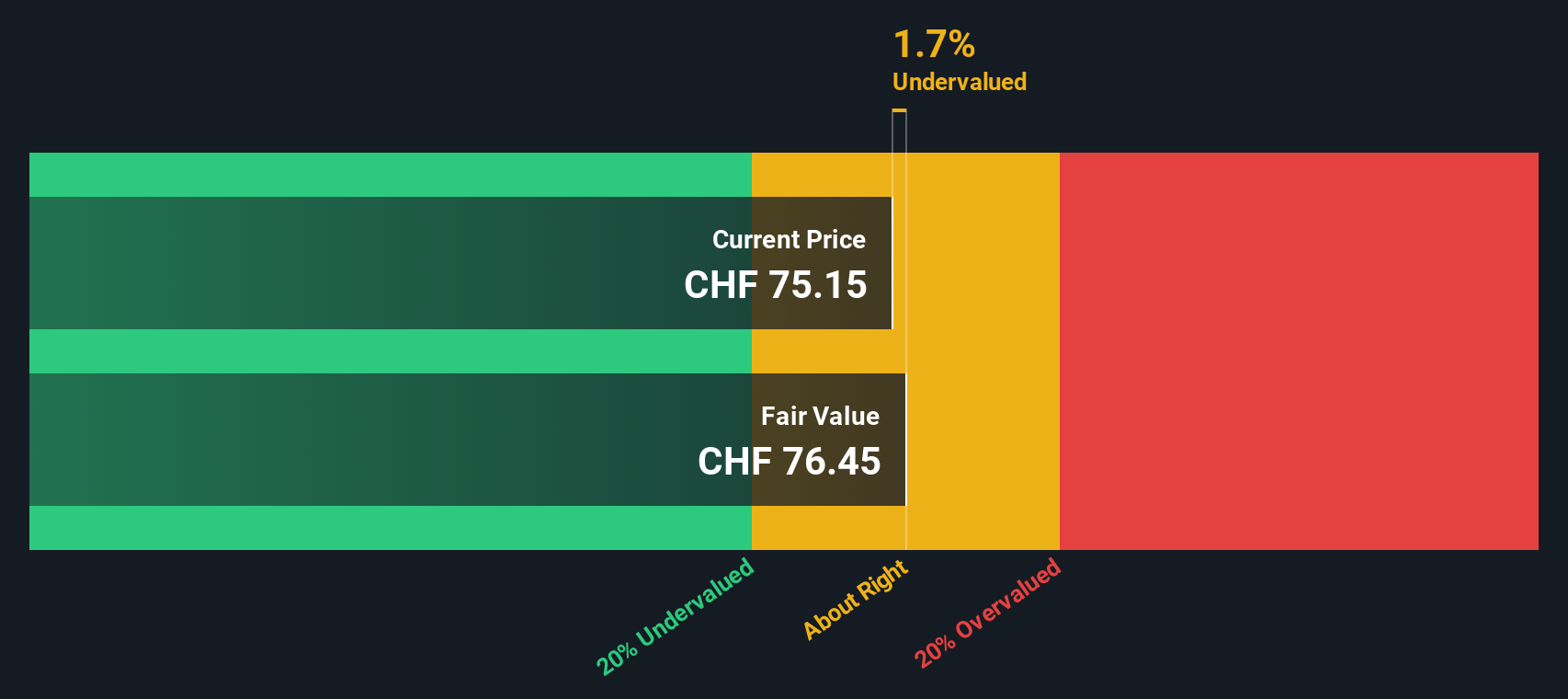

Our DCF model is slightly more cautious, putting Temenos fair value near CHF 75.8, a touch below the current CHF 77.5 share price. This points to the stock being marginally overvalued rather than clearly cheap.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Temenos for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Temenos Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Temenos research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning hand picked opportunities in minutes using the Simply Wall St Screener, instead of hoping the next winner finds you.

- Seize potential bargain entries with these 906 undervalued stocks based on cash flows that look mispriced relative to their future cash flows and long term prospects.

- Tap into powerful innovation trends by reviewing these 26 AI penny stocks positioned to benefit from accelerating adoption of machine learning and automation.

- Lock in stronger income streams by checking these 15 dividend stocks with yields > 3% that combine attractive yields with more sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial services institutions.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026