- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

Little Excitement Around mobilezone holding ag's (VTX:MOZN) Earnings As Shares Take 28% Pounding

The mobilezone holding ag (VTX:MOZN) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

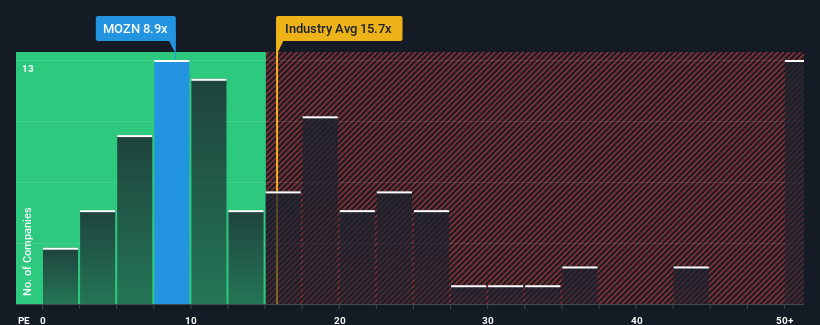

Even after such a large drop in price, mobilezone holding ag may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.9x, since almost half of all companies in Switzerland have P/E ratios greater than 21x and even P/E's higher than 32x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

mobilezone holding ag could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for mobilezone holding ag

How Is mobilezone holding ag's Growth Trending?

In order to justify its P/E ratio, mobilezone holding ag would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 11% overall rise in EPS. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 2.6% per annum as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 13% per year growth forecast for the broader market.

In light of this, it's understandable that mobilezone holding ag's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, mobilezone holding ag's share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of mobilezone holding ag's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for mobilezone holding ag (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on mobilezone holding ag, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives