- Switzerland

- /

- Real Estate

- /

- SWX:SPSN

Swiss Prime Site (SWX:SPSN): Valuation Insights After Barclays Upgrade and Growth Guidance

Reviewed by Kshitija Bhandaru

Barclays has upgraded Swiss Prime Site (SWX:SPSN), citing the company’s guidance for 10% FFO per share growth through 2028 and continued expansion in its asset management business. The upgrade signals increased investor confidence.

See our latest analysis for Swiss Prime Site.

Investor sentiment around Swiss Prime Site appears to be gaining strength, with the latest analyst upgrade coming alongside a solid year-to-date share price return of 12.4%. Notably, the company’s one-year total shareholder return stands at an impressive 21.2%, reflecting both capital growth and dividends. Momentum is building in the wake of upbeat growth guidance and renewed confidence in the asset management division.

If you’re interested in uncovering more market movers with strong growth stories, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

The question for investors now is whether Swiss Prime Site’s shares still offer value, or if the market has already factored in every bit of that optimistic growth. Could there be an overlooked buying opportunity here?

Most Popular Narrative: 5.6% Undervalued

With Swiss Prime Site's fair value set at CHF118.17 in the most widely followed narrative, shares are currently trading slightly below that estimate. This suggests modest upside for those who believe in the company's momentum and future plans.

The company's active portfolio optimization, disposing of noncore assets in secondary locations and buying prime assets in urban centers like Geneva, Lausanne, and Bern, positions it to benefit from ongoing urbanization and increasing demand for high-quality office and mixed-use space. This supports future rental growth and reduces vacancy risk, which should drive higher rental income and asset valuations.

Want to know the ingredients behind this attractive valuation? The heart of the narrative lies in bold growth bets, shifting property portfolios, and ambitious returns. Curious about how analysts project future earnings, margins, and market multiples to build this price target? The full narrative unpacks the finance drivers you can't afford to miss.

Result: Fair Value of $118.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential headwinds from prolonged redevelopment projects as well as the continued challenges facing office and retail property demand in Switzerland.

Find out about the key risks to this Swiss Prime Site narrative.

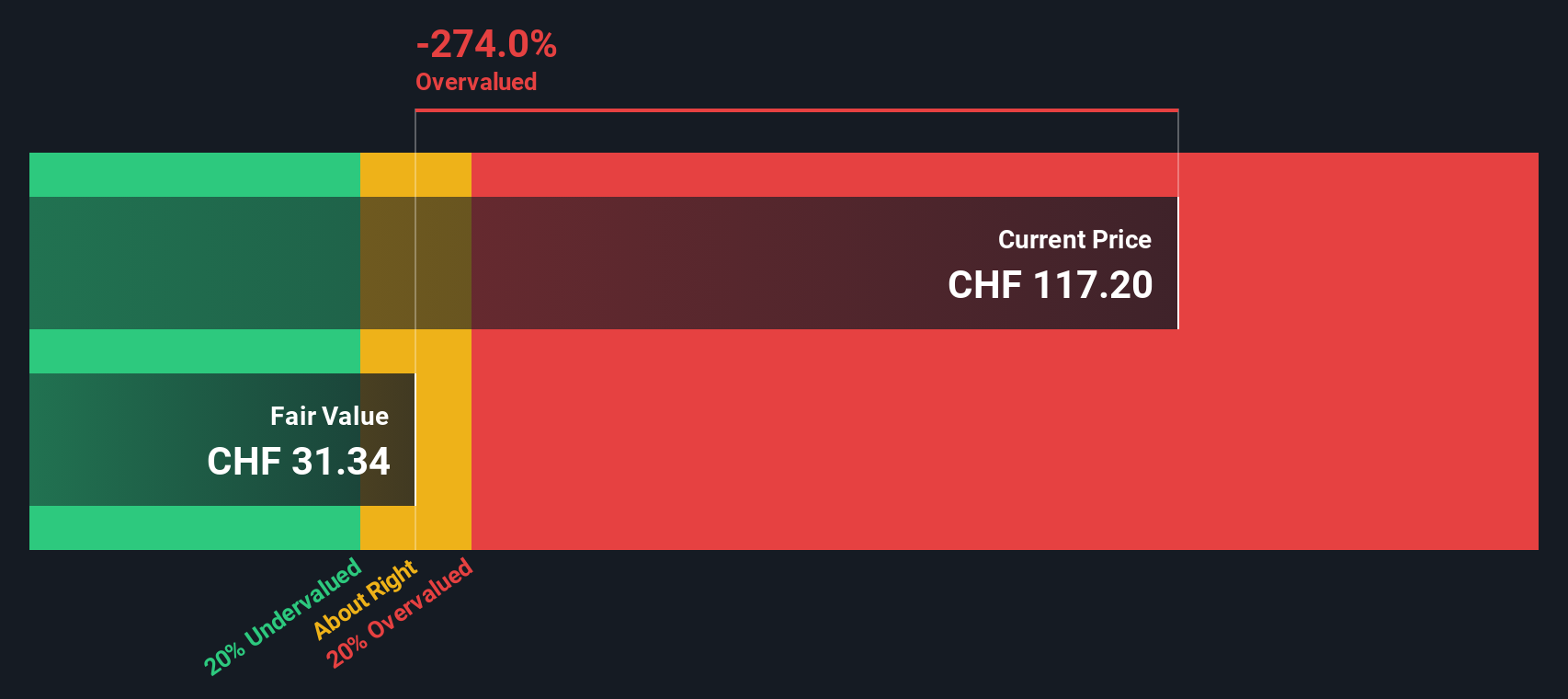

Another View: DCF Model Offers a Mixed Signal

Looking at Swiss Prime Site through our DCF model brings a different perspective. On this basis, the shares are currently trading above our estimate of fair value. This suggests they may actually be overvalued rather than undervalued as the previous approach indicated. Does this more cautious outlook flag a real risk for buyers, or could it be too conservative in light of the company's growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Swiss Prime Site for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Swiss Prime Site Narrative

If you see things differently or want to dive deeper into the numbers, creating your personal Swiss Prime Site narrative only takes a few minutes. Do it your way

A great starting point for your Swiss Prime Site research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves start with the right opportunities. Don’t let the next big winner slip by. Expand your search with these handpicked avenues and find your portfolio’s next strength.

- Unlock potential with steady income streams by checking out these 19 dividend stocks with yields > 3% boasting high yields that regularly outperform market averages.

- Capitalize on emerging disruptors with these 24 AI penny stocks powered by artificial intelligence, and keep pace with innovation-driven growth.

- Access value opportunities today through these 892 undervalued stocks based on cash flows, where market mispricings could translate into tomorrow’s gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SPSN

Swiss Prime Site

Through its subsidiaries, operates as a real estate company in Switzerland.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026