- Switzerland

- /

- Real Estate

- /

- SWX:PSPN

Will Barclays' Downgrade Shift the Resilience Narrative for PSP Swiss Property (SWX:PSPN)?

Reviewed by Sasha Jovanovic

- In October 2025, Barclays downgraded PSP Swiss Property from Overweight to Equalweight, highlighting lower projected earnings growth and full valuation compared to peers with stronger growth prospects.

- Despite the downgrade, Barclays continues to see PSP Swiss Property as a preferable defensive option within real estate, underscoring the company's perceived resilience among investors prioritizing stability.

- We'll explore how Barclays' concerns around future earnings growth could influence PSP Swiss Property's investment narrative and outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

PSP Swiss Property Investment Narrative Recap

Remaining invested in PSP Swiss Property requires confidence in the enduring demand for premium Swiss office and retail space, backed by disciplined cost control and stable, recurring rental income. Barclays’ recent downgrade based on lower projected earnings growth does not materially affect the immediate key catalyst, the company’s ability to maintain high occupancy and rents in prime Zurich and Geneva locations, nor does it substantially alter the main risk, which remains potential oversupply and vacancy pressures in upcoming years.

Of the company’s recent updates, the Q2 2025 earnings release stands out, as it showed a notable rebound in net income. While this positive result is partially attributed to one-off items, consistent quarterly profitability remains closely watched, especially given the heightened focus on future earnings growth from both analysts and shareholders following Barclays’ revised outlook.

However, investors should be aware that despite apparent stability, the risk of increased vacancy as large tenants prepare to release office space in 2026 could ...

Read the full narrative on PSP Swiss Property (it's free!)

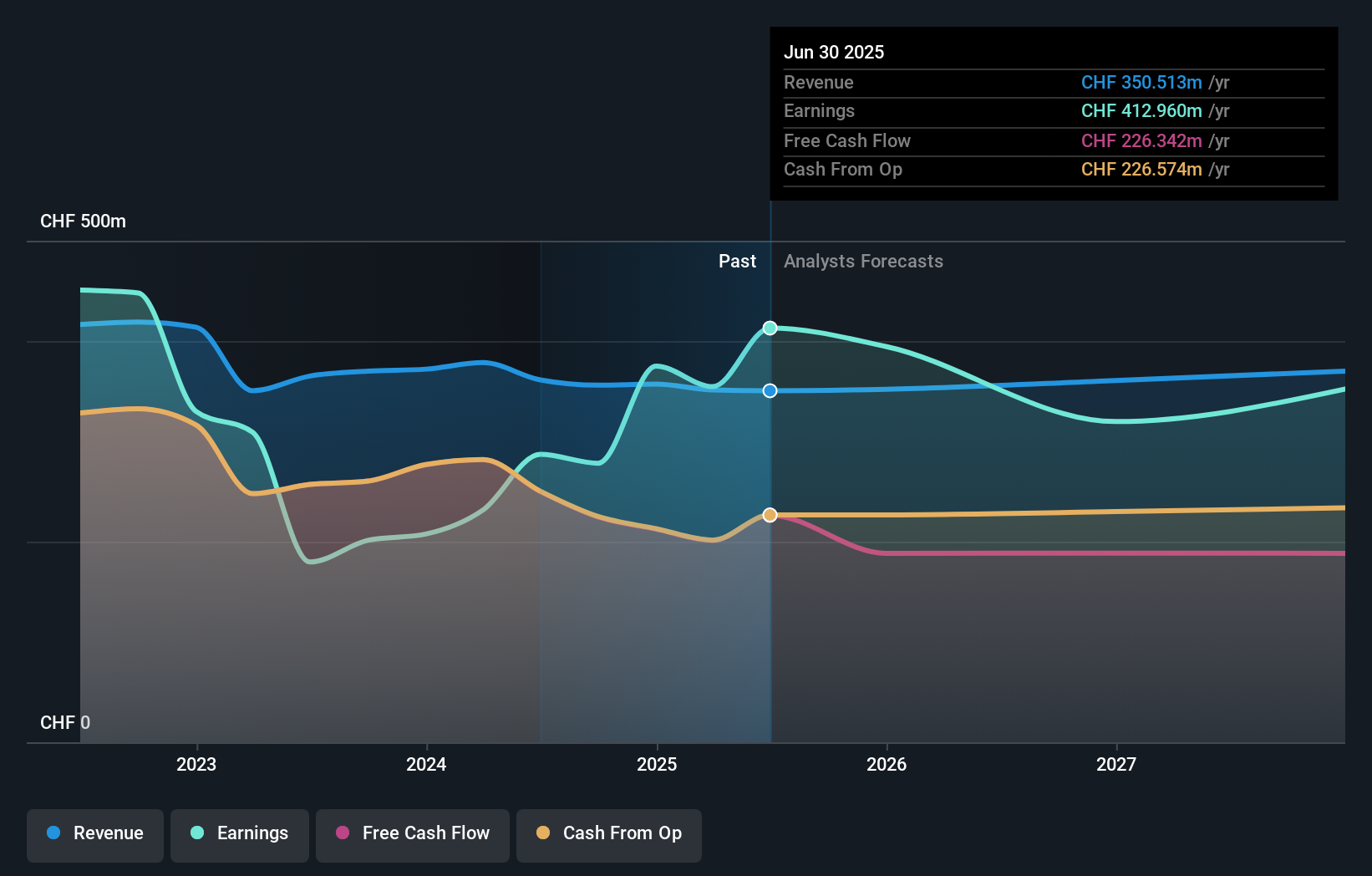

PSP Swiss Property's outlook anticipates CHF374.5 million in revenue and CHF274.3 million in earnings by 2028. This projection requires a 2.2% annual revenue growth rate and a CHF138.7 million decrease in earnings from the current CHF413.0 million.

Uncover how PSP Swiss Property's forecasts yield a CHF141.70 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community pegs PSP Swiss Property at CHF141.70, just above current consensus price targets. With projected earnings declines flagged by analysts, you might want to compare multiple viewpoints before deciding where you stand on this stock’s outlook.

Explore another fair value estimate on PSP Swiss Property - why the stock might be worth as much as CHF141.70!

Build Your Own PSP Swiss Property Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PSP Swiss Property research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PSP Swiss Property research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PSP Swiss Property's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PSPN

PSP Swiss Property

Owns and manages real estate properties in Switzerland.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives