- Switzerland

- /

- Real Estate

- /

- SWX:HIAG

We Discuss Why HIAG Immobilien Holding AG's (VTX:HIAG) CEO Compensation May Be Closely Reviewed

Key Insights

- HIAG Immobilien Holding to hold its Annual General Meeting on 17th of April

- Salary of CHF715.0k is part of CEO Marco Feusi's total remuneration

- The total compensation is 162% higher than the average for the industry

- HIAG Immobilien Holding's EPS declined by 11% over the past three years while total shareholder loss over the past three years was 3.5%

Shareholders will probably not be too impressed with the underwhelming results at HIAG Immobilien Holding AG (VTX:HIAG) recently. At the upcoming AGM on 17th of April, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for HIAG Immobilien Holding

How Does Total Compensation For Marco Feusi Compare With Other Companies In The Industry?

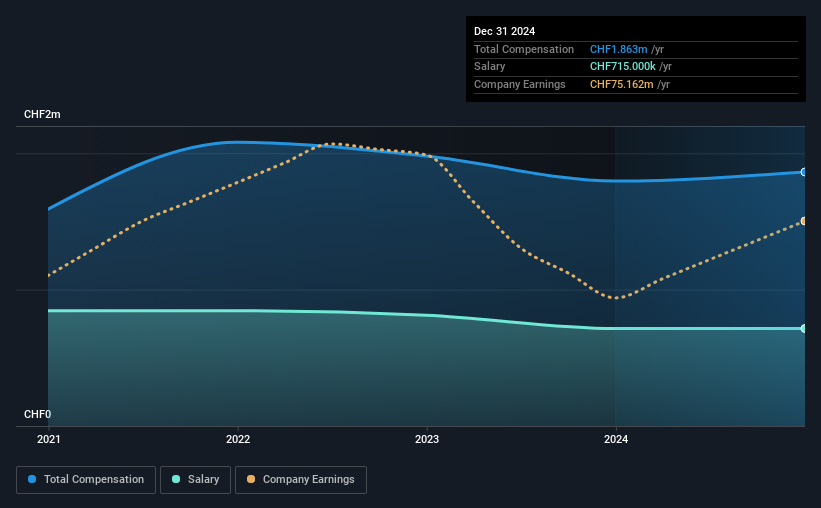

Our data indicates that HIAG Immobilien Holding AG has a market capitalization of CHF914m, and total annual CEO compensation was reported as CHF1.9m for the year to December 2024. That's a modest increase of 3.7% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF715k.

In comparison with other companies in the Swiss Real Estate industry with market capitalizations ranging from CHF343m to CHF1.4b, the reported median CEO total compensation was CHF712k. Hence, we can conclude that Marco Feusi is remunerated higher than the industry median. Moreover, Marco Feusi also holds CHF3.2m worth of HIAG Immobilien Holding stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF715k | CHF715k | 38% |

| Other | CHF1.1m | CHF1.1m | 62% |

| Total Compensation | CHF1.9m | CHF1.8m | 100% |

Speaking on an industry level, nearly 48% of total compensation represents salary, while the remainder of 52% is other remuneration. In HIAG Immobilien Holding's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

HIAG Immobilien Holding AG's Growth

Over the last three years, HIAG Immobilien Holding AG has shrunk its earnings per share by 11% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue is seriously uninspiring. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings. .

Has HIAG Immobilien Holding AG Been A Good Investment?

Given the total shareholder loss of 3.5% over three years, many shareholders in HIAG Immobilien Holding AG are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for HIAG Immobilien Holding (of which 2 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if HIAG Immobilien Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:HIAG

HIAG Immobilien Holding

Provides site and project development services in Switzerland.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.